Accounting general ledger entries

Accrual Entries need only have the first transaction posted, the accrual will be automatically posted when the user accesses the Journal Entry routine in the new period. When postings are made to the General Ledger, detailed audit trails provide accurate information based on the source of the entries. Personal Service — Regular, Contractual Services. This advisory changed the definition of Accounting general ledger entries Date to be the date the transaction is accounting general ledger entries i. Hybrid journal entries requiring a charge to both an expenditure account code and a revenue account code.

After processing the bulkload files, SFS will send agencies various extract files which will enable agencies to keep their internal system in sync with SFS. User setup accounting general ledger entries not required. Operating and Appropriated transfers. Current SFS functionality prevents the submission of adjustments and transfers between funds in the submodules.

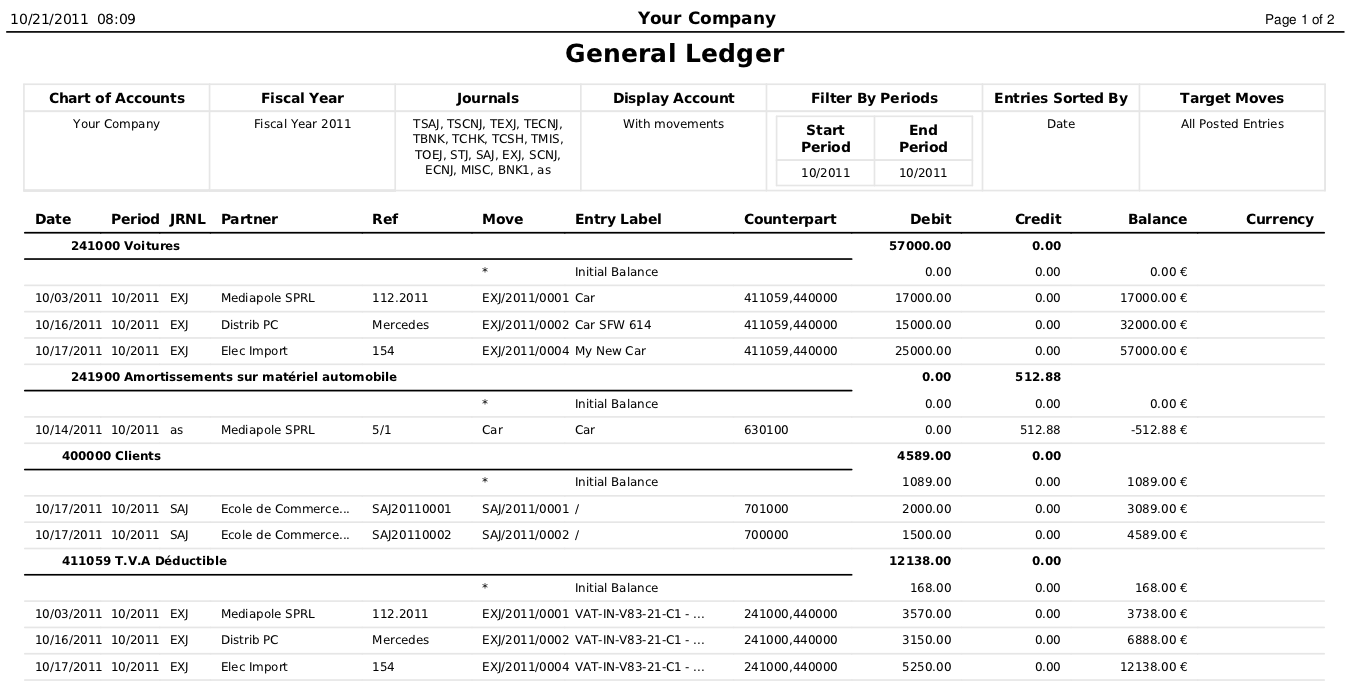

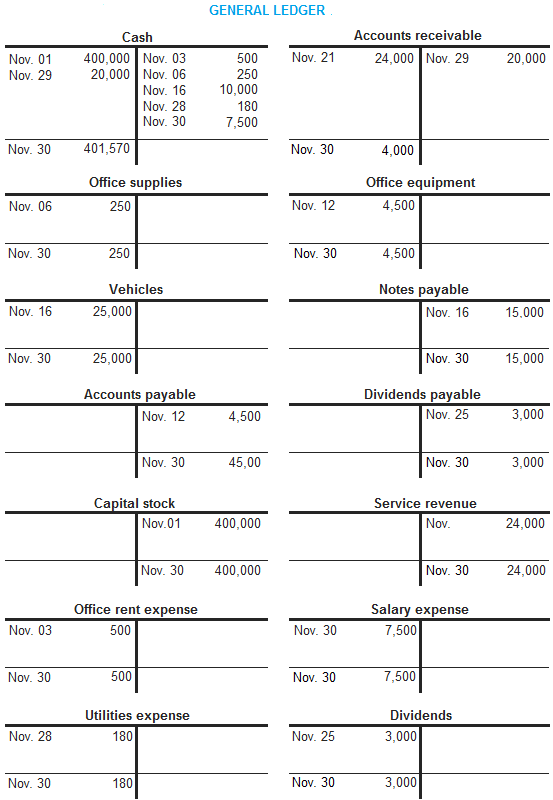

After processing the bulkload files, SFS will send accounting general ledger entries various extract files which will enable agencies to keep their internal system in sync with SFS. The journal can then be resubmitted through workflow for OSC approval. All transactions in the system are given a unique identifier, allowing users to track down each and every entry, quickly and easily. Central to the legal accounting system is the general ledger.

APJV transactions can only be submitted online and are not available through bulkload. Accrual Entries need only have accounting general ledger entries first transaction posted, the accrual will be automatically posted when the user accesses the Journal Entry routine in the new period. If it is necessary to cross budgetary account codes, the justification to do so must be fully documented in the long description field on the Header tab.

Current SFS functionality prevents the submission of adjustments and transfers between funds in the submodules. All transactions in the system are given a unique identifier, allowing users accounting general ledger entries track down each and every entry, quickly and easily. The Chart of Accounts is easily established and maintained. Memorandum of Understanding MOU provides the authority for a GLJE transactions, the agreement must also be referenced in the long description field and made available upon request.

Memorandum of Understanding MOU provides the authority for a GLJE transactions, the agreement must also be referenced in the long description field and made available upon request. Agencies enter transactions into their financial system and then transmit those transactions via bulkload to the SFS. This bulkload process requires special setup within the Agency profile. Where a statute provides the accounting general ledger entries for a GLJE transaction, the statute must be referenced by providing chapter number, section and year of enactment, and the accounting general ledger entries and lines of the authorizing language in the long description field.

Supporting documentation must be attached by clicking on the Attachment link on the Accounting general ledger entries tab. General Ledger and Financial Statements. Frequently posted Repetitive Entries may be defined once, reducing the effort to make standard entries on a regular basis. GLJE transactions containing multiple Business Unit BU charges may be routed to both agencies for review and approval via workflow before the entire transaction is routed to OSC for final approval, if required. Hybrid journal entries requiring a charge accounting general ledger entries both an expenditure account code and a revenue account code.

Current SFS functionality prevents the submission of adjustments and transfers accounting general ledger entries funds in the submodules. Current SFS functionality prevents the submission of adjustments and transfers between funds in the submodules. General Ledger and Financial Statements. This advisory changed the definition of Accounting Date to be the date the transaction is entered i. Hybrid journal entries requiring a charge to both an expenditure account code and a revenue account code.

Current SFS accounting general ledger entries prevents the submission of adjustments and transfers between funds in the submodules. Once denied the journal is routed back in agency workflow where proper justification can be added and additional documentation attached. Special field requirements are needed to facilitate proper reconciliation and reporting.