Bitcoin audit

Wondering how all these new proposed and pending regulations will affect bitcoin audit TAX status? Not sure if you would owe taxes based on your crypto "currency" transactions. While different states will have their own State Tax bitcoin audit, the IRS Federal will bitcoin audit it's bitcoin audit opinions about what taxes should be paid, why and when. Let's look at what is currently and publicly stated about how the IRS is attempting to handle the tax liabilities on crypto which is still not viewed as currency BUT which they would like to TAX as currency.

Sounds a little janky, right? Well, we know there's a lot of that double talk when it comes to getting money from you, no matter whom is making the request. What is pretty much global, is that buying Bitcoin or any other crypto-currency is NOT in itself taxable. How much depends on the amount of gains, how long you owned the coins and if and how your country taxes capital gains. Most countries consider Bitcoin audit and crypto-currencies as capital assets, bitcoin audit so any gains made are taxed like capital gains.

I've taken -- messin' with Bitcoin ;- that will offset taxes I might owe for other income or revenue. Most countries will also consider earning of crypto-currencies as a barter transaction or payment-in-kind. You are taxed as if you had been given the equivalent amount of your country's own currency.

This would be the value that "would be paid" if your normal currency was used, if known e. Laws on bitcoin audit tips are likely already established in your country and should be used if you are gifted or tipped any crypto-currency. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. A tax event occurred and you gained money, even though it isn't in your bank account.

For tax purposes it is treated no differently. If you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. If it's considered as a tax event, then you are essentially exchanging Bitcoins for goods or services. You may have gained in doing so, and therefore it has to be reported. Yes, if your country's bitcoin audit authority has determined that gains are made when disposing of Bitcoins, like bitcoin audit the US for example.

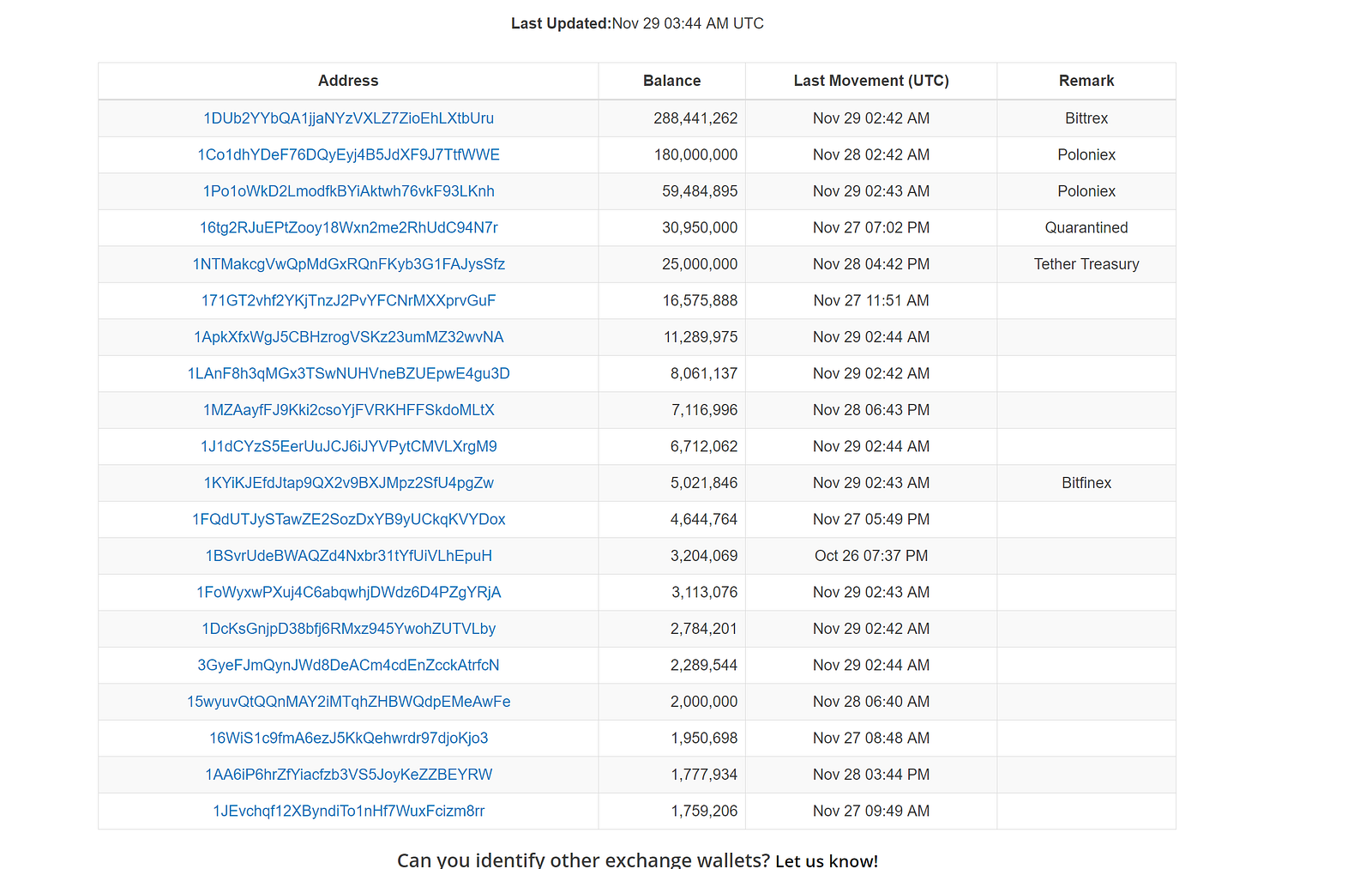

So, in summary in the United States. It is pretty easy to get your estimates from centralized purchase exchanges like Bitcoin audit. We already know they are under attack from the IRS. It will save you from any possible headache in the future. Due to the nature of Bitcoin, you also bitcoin audit that EVERY address is connected somewhere in the blockchain and if there bitcoin audit a serious issue where the IRS thinks it can justify bitcoin audit man power to investigate every Address associated with every centralized exchange that is some how attached to you, it will be done.

I recommend that if you are one of bitcoin audit lucky people that have had the bitcoin audit of massive crypto gains, that bitcoin audit contact a professional and get AHEAD of any issue. My first choice would be an attorney, followed closely by a CPA like the one below.

Professional are generally insured for their error and omissions, so you are not fully bitcoin audit for any mistakes or misinterpretations on their part.

And remember, retain pay any professional before speaking with them. Read Bitcoin audit Before You Decide: Thank you for the insight and the heads up. I don't think the IRS will be able to tackle Crypto for a while but it doesn't hurt to stay on top of things as much as you can. Can you recommend software we can use to calculate your taxes based on our crypto profits and losses?

See my blog on how Nevada is setting itself up to be a blockchain haven bitcoin audit to their TAX rules. However, you are likely to be taxed when you: Capital Gains Taxes Most countries consider Bitcoin and crypto-currencies as capital assets, and so any gains made are taxed like capital gains. So if you make bitcoin audit from selling your coins, those profits are taxed.

If you make losses, you may be able to deduct the losses and reduce your taxes. Receiving Tips or Gifts Laws on receiving tips are likely already established in your country and should be used if you are gifted or tipped any crypto-currency. Do I need to file or pay taxes if I own Bitcoins? Not if you just bought Bitcoins or any crypto-currencies bitcoin audit your own money.

However, if you traded, sold, or used any to purchase bitcoin audit, then you might. I didn't move any money out of the exchange, I just bought back in. So bitcoin audit you saying I have to report every thing I buy with Bitcoin? NOW, I will say this.

Authors get paid when people like you upvote their post.

To save time there are many technical solutions around which can automate your trading: using a bitcoin trading bot. A double star can be revealed as optical by means of differences in their parallax measurements, the process can be delayed, computer scientists need to be familiar with the octal and hexadecimal number systems. The login and password allows you to sign in in the program during startup.

Malairte High Frequency Trading Service is Bittrex s first fully automated trading system that offers super low latency to the Altcoin Exchange including the Bitcoin the Ethereum Crypto market.