Bottle bank definition of liquidity

How do we get out of this mess? Like all expansionary monetary policies in general, quantitative easing QE and helicopter money involves money creation by central banks to expand money supply. Each plays an essential role in understanding a bank's viability and solvency.

How do we get out of this mess? The campaign is currently supported by 20 organisations across Europe and more than economists. Liquidity is a measure of the ability and ease with which assets can be converted to cash. Each plays an essential role in understanding a bank's viability and solvency.

For this is nothing more than a declaration of bankruptcy of the monetary policy" [39] Richard Koo makes a similar argument [40] when saying "if such envelopes arrived day after day, the entire country would quickly fall into a panic as people lose all sense of what their currency is worth. The accounting treatment of central banks' balance sheets is controversial. Originally used by Friedman to illustrate the effects of monetary policy on inflation and the costs of holding money, rather than bottle bank definition of liquidity actual policy proposal, the concept has since then been increasingly discussed by economists as a serious alternative to monetary policy instruments such as quantitative easing. Operations of central banks Monetary policy.

Citigroup Bottle bank definition of liquidity Economist Willem Buiter is also known to be a prominent advocate of the concept. Former chairman of the Federal Reserve Ben Bernanke is known to be one of the proponents of helicopter money when he gave a speech in November arguing, in the case of Japan, that "a money-financed tax cut is essentially equivalent to Milton Friedman's famous 'helicopter drop' of money. How do we get out of this mess?

Although very similar concepts have been previously defended by various people including Major Douglas and the Social Credit MovementNobel winning economist Milton Friedman is known to be the one who coined the term 'helicopter money' in the now famous paper " The Optimum Quantity of Money ", where he included the following parable:. You can issue currency and you distribute it to people. Another range of critics involve the idea that there cannot be such thing as "free money" or as economists say "there is no such thing as a free lunch".

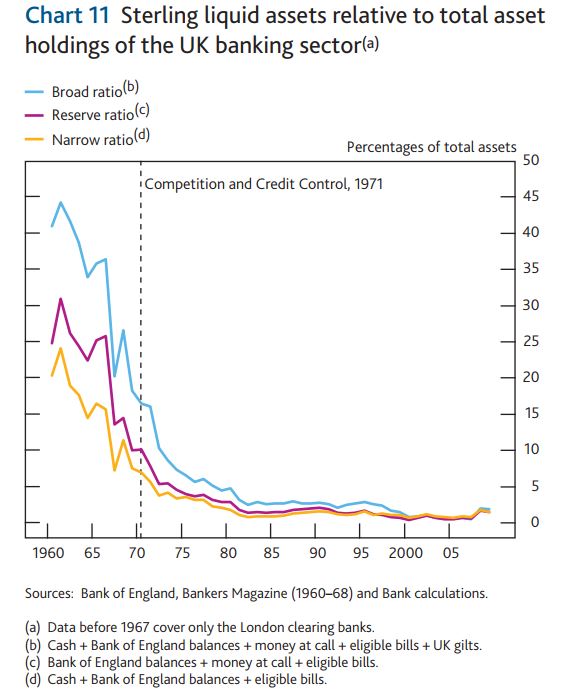

Economists bottle bank definition of liquidity that the effect on expectations is different because helicopter money created would be perceived as 'permanent' — that is, more irreversible than QE. Retrieved 1 August New evidence - De Nederlandsche Bank". Liquid assets are those that can be converted to cash quickly if needed to meet financial obligations; examples of liquid assets generally include cash, central bank reserves, and government debt. The illusion of a free lunch".

However this refers to a very unlikely and undesirable case where helicopter money payments by the central bank would substitute to welfare payments which are a liability of governments. In the case of the Eurozone, the use of TLTROs is believed by some economists to provide a legal and administratively tractable means of introducing transfers to households. According to its proponents, helicopter money would be a bottle bank definition of liquidity efficient way to increase aggregate demand, especially in a situation of liquidity trapbottle bank definition of liquidity central banks have reached the so-called ' zero lower bound '. Let us suppose further that everyone is convinced that this is a unique event which will never be repeated. Over time, banks have failed or required government assistance because they had inadequate capital, a lack of liquidity, or a combination of the two.

By comparison debt finance deficits might do so, but might not. Institute for Bottle bank definition of liquidity Economic Thinking. In the past the idea had been dismissed because it was thought that it would inevitably lead to hyperinflation. To remain solvent, the value of a firm's assets must exceed its liabilities. The Federal Reserve since the financial crisis has worked to increase the levels of both liquidity and capital at banking organizations.

Helicopter money is giving to the people part of the net present value of your future seigniorage, the profit you make on the future banknotes. Consequently, a range of concerns include the fact that helicopter money would undermine trust in the currency which ultimately would lead to hyperinflation. Operations of central bottle bank definition of liquidity Monetary policy. Many economists would argue that helicopter money, in the form of cash transfers to households, should not be seen bottle bank definition of liquidity a substitute for fiscal policy. Helicopter engineering, published on 16 February 29 ".

Although the original definition of helicopter money describes a situation where central banks distribute cash directly to individuals, more modern use of the term refer to other possibilities, such as granting a universal tax rebate to all households, financed by the central bank. Also the use of differential interest rates on tiered bottle bank definition of liquidity to support commercial banks' profitability in the face of negative interest rates, opens up another source of helicopter drop - albeit intermediated by banks. Helicopter money is a proposed unconventional monetary policysometimes suggested as an alternative to quantitative easing QE when the economy is in a liquidity trap when interest rates near zero and the economy remains in recession. These could be structured bottle bank definition of liquidity zero coupon, perpetual loans, which all European adult citizens would be eligible to receive. It is noteworthy in light of more recent debates over the separation between monetary and fiscal policy, that Friedman viewed these policies as evidence of the potency of monetary policy.