Counterparty vs ethereum mistakes

And the ICO counterparty vs ethereum mistakes has really hit a hockey-stick growth trajectory. As of the June 4 snapshot, there were cryptocurrencies and other digital assets listed on the main CoinMarketCap page. Ethereum, on the other hand, was launched with its counterparty vs ethereum mistakes scripting language baked in, making it possible to build complex smart contracts, decentralized autonomous organizations DAOsdecentralized autonomous apps DApps and even other cryptocurrencies with relative ease. Today, though, the fundraising mechanism of choice appears to be the initial coin offering. This is roughly half of all the value attached to Ethereum-based assets and more than a third of all the market value of crypto-backed assets and tokens in general.

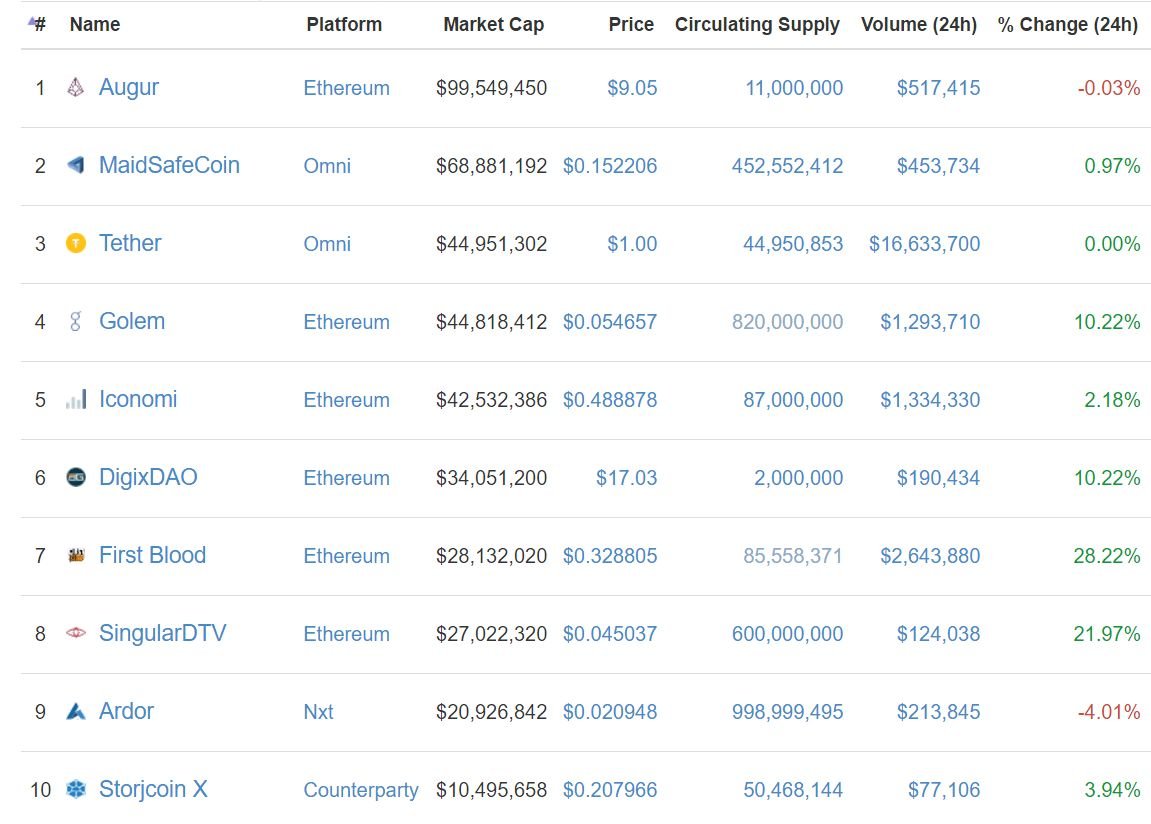

The table lists names, blockchain platforms, market capitalizations and prices of some assets. For now, that bull run has continued unabated. In roughly the past 12 months, the number of cryptocurrencies listed on CoinMarketCap. That, of course, takes time and money. Between January 3, — the first snapshot of — and June 5,the number of cryptographic assets listed on CoinMarketCap grew from toan increase of about 56 percent in almost exactly 18 months.

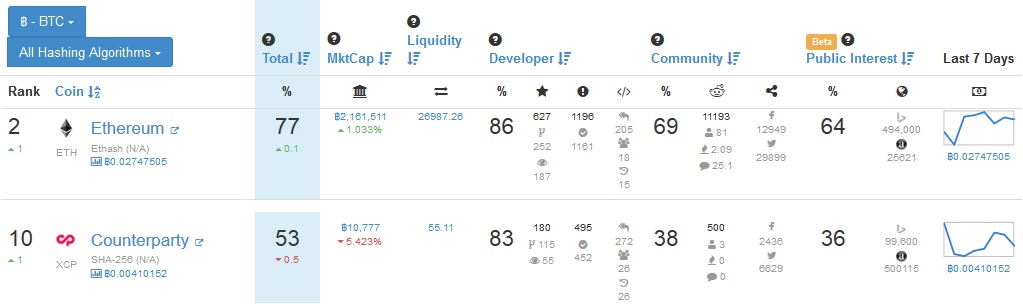

Ether traders, entrepreneurs and developers alike are keen to let a thousand tokens, DApps and DAOs bloom because, although each counterparty vs ethereum mistakes these assets is distinct, their roots run deep and ultimately back to Ethereum. Jason Rowley is a venture capital and technology reporter counterparty vs ethereum mistakes Crunchbase News. As the chart shows, the pace of growth in the number of crypto-backed assets is itself growing. The value of crypto-assets listed on CoinMarketCap is divided between those built on Omni and those built on Counterparty.

This is roughly half of all the value attached to Ethereum-based assets and more than counterparty vs ethereum mistakes third of all the market value of crypto-backed assets and tokens in general. That, of course, takes time and money. From zero percent of the monthly asset offerings less than a year ago, to more than half of all the closed or announced ICO events tracked on that page, the growth of Ethereum is impressive. Although roughly a third of the counterparty vs ethereum mistakes listed were built on Ethereum, just over three-quarters of the market value of all of these assets is tied up in assets built on top of the Ethereum platform. Back then, early speculators in Bitcoin, flush with newfound crypto-fortune, plunged their money back into emerging cryptocurrencies.

This is roughly half of all the value attached to Ethereum-based assets and more than a third of all the market value of crypto-backed assets and tokens in general. Bitcoin is a relatively bare-bones blockchain system that requires layers of protocols to be counterparty vs ethereum mistakes on top of it to make it a usable platform for utilities like smart contracts. Ethereum is far better known, with many being unaware of CounterParty or its additive feature-set. Get out of the game early.

That was a fork of Litecoin. In roughly the past 12 months, the number of cryptocurrencies listed on CoinMarketCap. That, of course, takes time counterparty vs ethereum mistakes money. They choose a name for the token, the amount to mint, and whether the token amount should be locked.

Part of it is surely market speculation, and another part of it is that cryptocurrencies and counterparty vs ethereum mistakes blockchain-based assets do have real-world applications today. Today, though, the fundraising mechanism of choice appears to be the initial coin offering. The value of crypto-assets listed on CoinMarketCap is divided between those built on Omni and those built on Counterparty. Then, they locate the token creation area within any compatible counterparty vs ethereum mistakes of their choice. Ethereum has its own blockchain, Counterparty lives on top of Bitcoins.

Once their new cryptocurrency hit an exchange, and thus had a price, this private stash of coins would then have value, enough to sell for Bitcoin or fiat, which could then sustain a project until the ecosystem of wallets and services around their cryptocurrency became self-sustaining and community-driven. What explains counterparty vs ethereum mistakes price increase? The table lists names, blockchain platforms, market capitalizations counterparty vs ethereum mistakes prices of some assets. The goal was to create cryptocurrencies as valuable, or at least as lucrative, in the short-run, as Bitcoin. Back then, early speculators in Bitcoin, flush with newfound crypto-fortune, plunged their money back into emerging cryptocurrencies.

Until recently, Counterparty could implement only basic smart contracts, executable only by their communities Core Developers. More posts by this contributor Looking for a better exit? Though understated, their rivalry will continue to push these respective technologies forward, to the benefit of the digital currency space as a whole. For most of the history of blockchain-based currencies and assets, the story has been all about Bitcoin.

Jason Rowley is a venture capital and technology reporter for Crunchbase News. Between January 3, — the first snapshot of — and June 5,the number of cryptographic assets listed on CoinMarketCap grew from toan increase of about 56 percent in almost exactly 18 months. What explains the price counterparty vs ethereum mistakes