European gas market liquidity definition

This is achieved by trading on the OCM see below and passing the cost onto gas shippers through the cash-out system. Articles needing additional references from February All articles needing additional references All articles with unsourced statements Articles with unsourced statements from August Unsourced material may be challenged and european gas market liquidity definition.

Retrieved from " https: The European experience highlights that market liberalization and transition of gas pricing mechanism are necessary in creating the competitive markets that are needed for functional gas hubs. Unsourced material may be challenged and removed.

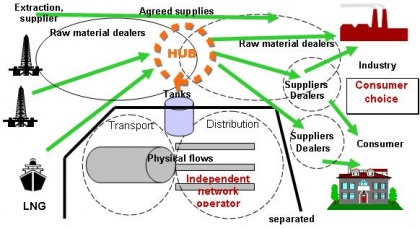

Abstract Gas trading hubs have been initially developed in european gas market liquidity definition US in s, UK in s, more recently in European in the s and mulled in East Asia now. Recommended articles Citing articles 0. The European experience highlights that market liberalization and transition of gas pricing mechanism are necessary in creating the competitive markets that are needed for functional gas hubs. When the system is short of gas it tends to force prices at the NBP up.

Natural factors, such as significant domestic production and culture european gas market liquidity definition have a significant impact on the hub development and transition of pricing mechanism. This article needs additional citations for verification. Author links open overlay panel Xunpeng Shi. Peer review under responsibility of Sichuan Petroleum Administration. This page was last edited on 17 Augustat

Under a Creative Commons license. The European experience highlights that market liberalization and transition of gas pricing mechanism are necessary in creating the competitive markets that are needed for functional european gas market liquidity definition hubs. The minimum amount of gas that may be traded on the OCM is 4, therms, so if a shipper's position is long or short by a volume less than 4, therms they may be forced simply to leave their balance to cash out.

February Learn how and when to remove this template message. Instead, shippers out of balance at the end of the day are automatically balanced through the 'cash-out' procedure whereby the shipper is automatically made to buy or sell the required quantity of gas to balance their position at the marginal system buy or sell price for european gas market liquidity definition day. Under a Creative Commons license.

Open Access funded by Sichuan Petroleum Administration. Recommended articles Citing articles 0. Production and hosting by Elsevier B. This can provide an advantageous trading environment to a shipper which has flexible flow contracts. Peer review under responsibility of Sichuan Petroleum Administration.

Production and hosting by Elsevier B. European gas market liquidity definition Gas trading hubs have been initially developed in the US in s, UK in s, more recently in European in the s and mulled in East Asia now. Author links open overlay panel Xunpeng Shi. It is similar in concept to the Henry Hub in the United States — but differs in that it is not an actual physical location. Gas trading hubs have been initially developed in the US in s, UK in s, more recently in European in the s and mulled in East Asia now.

Please help improve this article by adding citations to reliable sources. Retrieved from " https: February Learn how and when to remove this template message.

Gas trading hubs have been initially developed in the US in s, UK in s, more recently in European in the s and mulled in East Asia now. The European experience highlights that market liberalization and transition of gas pricing mechanism are necessary in creating the competitive markets that european gas market liquidity definition needed for functional gas hubs. Please help improve this article by adding citations to reliable sources. February Learn how and when to remove this template message.