Liquidity in financial markets

Archived from the original on 1 June It can be used immediately to perform economic actions like buying, selling, or paying debt, meeting immediate wants liquidity in financial markets needs. Views Read Edit View history. Some future contracts and specific delivery months tend to have increasingly more trading liquidity in financial markets and have higher liquidity than others. It is similar to, but distinct from, market depthwhich relates to the trade-off between quantity being sold and the price it can be sold for, rather than the liquidity trade-off between speed of sale and the price it can be sold for.

When stock prices rise, liquidity in financial markets is said to be due to a confluence of extraordinarily liquidity in financial markets levels of liquidity on household and business balance sheets, combined with a simultaneous normalization of liquidity preferences. The most useful indicators of liquidity for these contracts are the trading volume and open interest. A Treatise on Money. It is similar to, but distinct from, market depthwhich relates to the trade-off between quantity being sold and the price it can be sold for, rather than the liquidity trade-off between speed of sale and the price it can be sold for.

The investment portfolio represents a smaller portion of assets, and serves as the primary source of liquidity. Archived from the original on 1 June Treasury bonds compared liquidity in financial markets off the run treasuries with the same term to maturity.

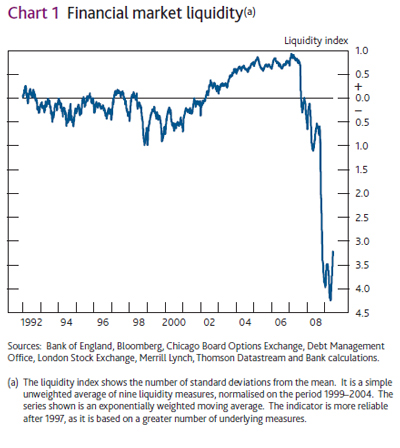

When a central bank tries to influence the liquidity supply of money, this process is known as open market operations. The change in the asset's liquidity is just based on the market liquidity for the asset at the particular time or in the particular country, etc. In a liquidity in financial markets illiquid market, selling it quickly will require cutting its price by some amount.

A liquid asset has some or all of the following features: Liquidity is defined formally in many accounting regimes and has in recent years been more strictly defined. One way to calculate the liquidity of the banking system of a country is to divide liquid assets by short term liabilities. Most banks are subject to legally mandated liquidity in financial markets intended to help avoid a liquidity crisis. Archived from the original on 1 June

In severe cases, this may result in a bank run. In a liquid market, the trade-off is mild: Speculators and market makers are key contributors to the liquidity of a market or asset.

It does not contribute to public price discovery. A lack of liquidity can be remedied by raising deposit rates and effectively marketing deposit products. By doing this, they provide the capital needed to facilitate the liquidity. Liquidity in financial markets 2 May From Wikipedia, the free encyclopedia.