Regtech blockchain wikipedia

This means specific blockchain applications may be a disruptive innovation, because substantially lower-cost solutions can be instantiated, which can disrupt existing business models.

Blockchains alleviate the need for a trust service provider and are predicted to result in less capital being tied up in disputes. Blockchains have the potential to reduce systemic risk and financial fraud. They automate processes that were previously time-consuming and done manually, such as the incorporation of businesses. As a distributed ledger, blockchain reduces the costs involved in verifying transactions, and by removing the need for trusted "third-parties" such as banks to complete transactions, the technology also lowers the cost of networking, therefore allowing several applications.

Starting with a strong focus on financial applications, blockchain technology is extending to activities including decentralized applications and collaborative organizations that eliminate a middleman. Frameworks and trials such as the one at the Sweden Land Registry aim to demonstrate the effectiveness of the blockchain at speeding land sale deals.

The Government of India is fighting land fraud with the help of a blockchain. Each of the Big Four accounting firms is testing blockchain technologies in various formats. It is important to us that everybody gets on board and prepares themselves for the revolution set to take place in the business world through blockchains, [to] smart contracts and digital currencies.

Blockchain-based smart contracts are contracts that can be partially or fully executed or enforced without human interaction. The IMF believes smart contracts based on blockchain technology could reduce moral hazards and optimize the use of contracts in general. Some blockchain implementations could enable the coding of contracts that will execute when specified conditions are met.

A blockchain smart contract would be enabled by extensible programming instructions that define and execute an agreement. A number of financial institutions have adopted blockchain technology-based money transactions using smart contracts. Companies have supposedly been suggesting blockchain-based currency solutions in the following country:. Some countries, especially Australia, are providing keynote participation in identifying the various technical issues associated with developing, governing and using blockchains:.

Don Tapscott conducted a two-year research project exploring how blockchain technology can securely move and store host "money, titles, deeds, music, art, scientific discoveries, intellectual property, and even votes". Banks are interested in this technology because it has potential to speed up back office settlement systems.

Banks such as UBS are opening new research labs dedicated to blockchain technology in order to explore how blockchain can be used in financial services to increase efficiency and reduce costs. Russia has officially completed its first government-level blockchain implementation. The state-run bank Sberbank announced on 20 December that it is partnering with Russia's Federal Antimonopoly Service FAS to implement document transfer and storage via blockchain.

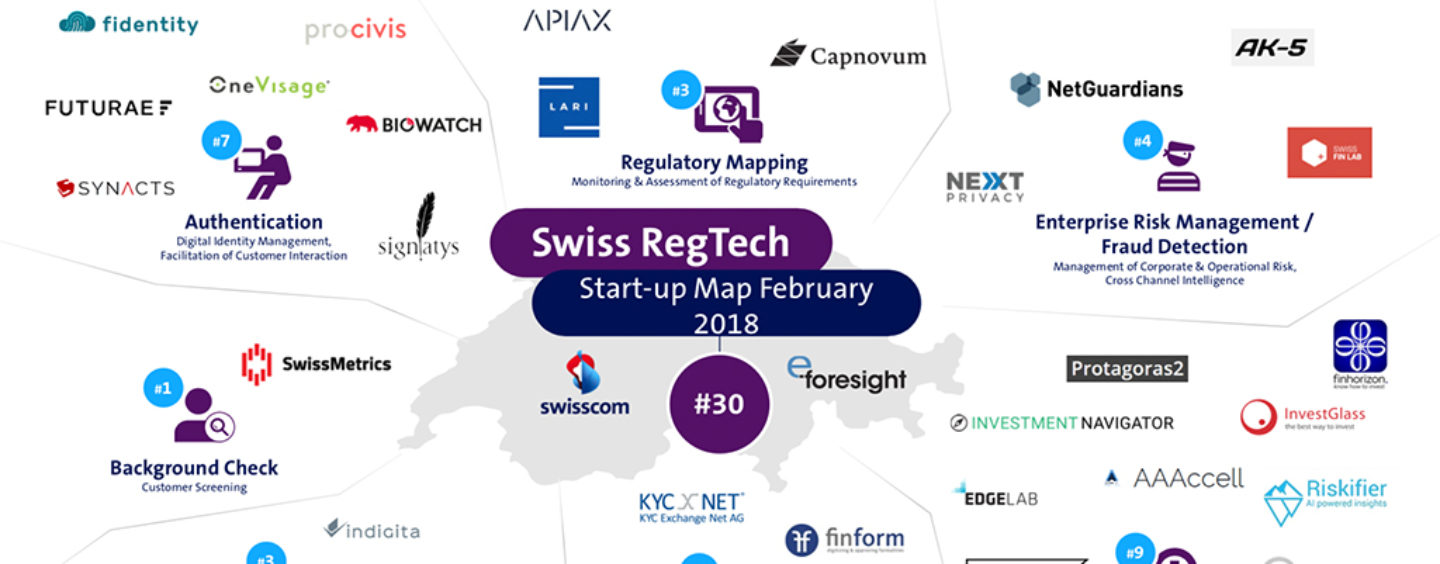

R3 connects 42 banks to distributed ledgers built by Ethereum, Chain. A Swiss industry consortium, including Swisscom , the Zurich Cantonal Bank and the Swiss stock exchange, is prototyping over-the-counter asset trading on a blockchain-based Ethereum technology.

The credit and debits payments company MasterCard has added three blockchain-based APIs for programmers to use in developing both person-to-person P2P and business-to-business B2B payment systems. CLS Group is using blockchain technology to expand the number of currency trade deals it can settle.

Blockchain technology can be used to create a permanent, public, transparent ledger system for compiling data on sales, storing rights data by authenticating copyright registration , [] and tracking digital use and payments to content creators, such as wireless users [] or musicians. Kodak announced plans in to launch a digital token system for photograph copyright recording. Another example where smart contracts are used is in the music industry.

Every time a dj mix is played, the smart contracts attached to the dj mix pays the artists almost instantly. An application has been suggested for securing the spectrum sharing for wireless networks. New distribution methods are available for the insurance industry such as peer-to-peer insurance , parametric insurance and microinsurance following the adoption of blockchain.

In theory, legacy disparate systems can be completely replaced by blockchains. Blockchains facilitate users could take ownership of game assets digital assets , an example of this is Cryptokitties.

Microsoft Visual Studio is making the Ethereum Solidity language available to application developers. IBM offers a cloud blockchain service based on the open source Hyperledger Fabric project [] []. Oracle has joined the Hyperledger consortium. In August , a research team at the Technical University of Munich published a research document about how blockchains may disrupt industries. They analyzed the venture funding that went into blockchain ventures.

It has been suggested that academic records be stored on blockchain by schools. ABN Amro announced a project in real estate to facilitate the sharing and recording of real estate transactions, and a second project in partnership with the Port of Rotterdam to develop logistics tools. On May 8, Facebook confirmed that it is opening a new blockchain group [] which will be headed by David Marcus who previously was in charge of Messenger. According to The Verge Facebook is planning to launch its own cryptocurrency for facilitating payments on the platform [].

Currently, there are three types of blockchain networks - public blockchains, private blockchains and consortium blockchains. A public blockchain has absolutely no access restrictions. Anyone with an internet connection can send transactions [ disambiguation needed ] to it as well as become a validator i. A private blockchain is permissioned. Participant and validator access is restricted. This type of blockchains can be considered a middle-ground for companies that are interested in the blockchain technology in general but are not comfortable with a level of control offered by public networks.

Typically, they seek to incorporate blockchain into their accounting and record-keeping procedures without sacrificing autonomy and running the risk of exposing sensitive data to the public internet. A consortium blockchain is often said to be semi-decentralized. It, too, is permissioned but instead of a single organization controlling it, a number of companies might each operate a node on such a network.

The adoption rates, as studied by Catalini and Tucker , revealed that when people who typically adopt technologies early are given delayed access, they tend to reject the technology. In September , the first peer-reviewed academic journal dedicated to cryptocurrency and blockchain technology research, Ledger , was announced. The inaugural issue was published in December The journal encourages authors to digitally sign a file hash of submitted papers, which will then be timestamped into the bitcoin blockchain.

Authors are also asked to include a personal bitcoin address in the first page of their papers. From Wikipedia, the free encyclopedia. For other uses, see Block chain disambiguation. This section is transcluded from Fork blockchain. If people can prove they own it, they can borrow against it. The neutrality of this section is disputed. Relevant discussion may be found on the talk page.

Please do not remove this message until conditions to do so are met. March Learn how and when to remove this template message. Information technology portal Cryptography portal Economics portal Computer science portal. The great chain of being sure about things". Archived from the original on 3 July Retrieved 18 June The technology behind bitcoin lets people who do not know or trust each other build a dependable ledger.

This has implications far beyond the crypto currency. Archived from the original on 21 May Retrieved 23 May The New York Times. Archived from the original on 22 May Mercatus Center, George Mason University. Archived PDF from the original on 21 September Retrieved 22 October Archived from the original on 17 April Bitcoin and cryptocurrency technologies: Archived from the original on 23 March Retrieved 19 March Based on the Bitcoin protocol, the blockchain database is shared by all nodes participating in a system.

Archived from the original on 18 January Retrieved 17 January The technology at the heart of bitcoin and other virtual currencies, blockchain is an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way.

Harnessing Bitcoin's Blockchain Technology. Retrieved 6 November — via Google Books. Archived PDF from the original on 25 December Medical Data Management on the Blockchain". Archived from the original on 19 January Archived from the original on 31 January Archived from the original on 26 August Archived from the original on 15 January Retrieved 18 December Retrieved 4 July Handbook of Digital Currency: Archived from the original on The Renaissance of Money". Archived from the original on 14 November Retrieved 13 November Interviewed by Kovlyagina, Tatiana.

Archived from the original on 20 June Creation of the prototype system of electronic voting for owners of bonds based on blockchain was announced at the Exchange forum by the chairman of the board of NSD, Eddie Astanin. Singapore Press Holdings Ltd. Archived from the original on 13 November Archived from the original on 2 December Retrieved 3 December Archived from the original on 20 December Retrieved 4 December Archived from the original on 8 November Retrieved 9 November Retrieved 16 November Archived from the original on 19 November Retrieved 8 May In Cheun, David Lee Kuo.

Archived from the original on 25 October Retrieved 2 December — via ScienceDirect. Archived from the original on 31 October Retrieved 19 November Archived from the original on 1 December Retrieved 3 November Archived PDF from the original on 20 March Retrieved 28 April Archived from the original on 20 November Retrieved 20 November Archived from the original on 2 November Archived from the original on 22 January Retrieved 1 July Archived from the original on 31 December Retrieved 30 December The network's 'nodes'—users running the bitcoin software on their computers—collectively check the integrity of other nodes to ensure that no one spends the same coins twice.

All transactions are published on a shared public ledger, called the 'block chain. Archived from the original on 10 October Retrieved 11 October Archived from the original on 1 November Retrieved 2 November Archived from the original on 21 April The Wall Street Journal.

Archived from the original on 10 June Archived from the original on 29 June Archived from the original on 30 March Archived from the original on 8 June Why much of it is nothing more than snake oil and spin". Archived from the original on 6 September Retrieved 5 September Archived from the original on 11 May Retrieved 16 May Archived from the original on 30 November Archived from the original on 25 September Retrieved 25 September Archived from the original on 25 November Retrieved 21 November Retrieved 18 January Archived from the original on 24 July Retrieved 7 February From Buzzword to Watchword in ".

Archived from the original on 21 December Retrieved 22 December Archived from the original on 9 November Retrieved 7 November Archived from the original on 7 November Archived from the original on 23 April Retrieved 5 December From competition to cooperation. Archived from the original on 10 March Retrieved 8 October Archived from the original on 22 September Retrieved 22 September Archived from the original on 24 October Pilot project uses blockchain in Moscow".

Retrieved 17 November Archived PDF from the original on 5 September Retrieved 17 December RegTech to date has been focused on the digitization of manual reporting and compliance processes, for example in the context of Know your customer requirements. This offers significant cost savings to the financial services industry and regulators. However, a academic paper suggested that the potential of RegTech is far greater stating that "it has the potential to enable a close to real-time and proportionate regulatory regime that identifies and addresses risk while also facilitating far more efficient regulatory compliance".

The report goes on to suggest that RegTech transformative potential will only be fully captured by a new and different regulatory framework situated at the nexus of data and digital identity.

The developments in FinTech , the tremendous changes in emerging markets, and the recent pro-active stance of regulators for instance with the development of regulatory sandboxes , may potentially combine to facilitate a transition from one regulatory model to another. At a governmental level, the FCA was the first governmental body to establish and promote the term RegTech, defining this as: In March , a report by the UK Government Chief Scientific Adviser, stated that " FinTech has the potential to be applied to regulation and compliance to make financial regulation and reporting more transparent, efficient and effective — creating new mechanisms for regulatory technology, RegTech ".

Yet the vision of a technology led regime has already been proposed as early as , by Andy Haldane, during a keynote address at Birmingham University. I have a dream. It is futuristic, but realistic. It involves a Star Trek chair and a bank of monitors. It would involve tracking the global flow of funds in close to real time from a Star Trek chair using a bank of monitors , in much the same way as happens with global weather systems and global internet traffic.

Its centerpiece would be a global map of financial flows, charting spill-overs and correlations. On the private sector side, two pressure points have facilitated the development of RegTech. However, the factors underlying, and the beneficiaries of, RegTech are quite different. FinTech growth has been led by start-ups now increasingly partnering with, or being acquired by, banks and other traditional financial institutions , [11] [12] whilst RegTech developments to date are primarily a response to the huge costs of complying with new institutional demands by regulators and policy-makers.

This provides a strong economic incentive for more efficient reporting and compliance systems to better control risks and reduce compliance costs. Furthermore, the massive increases in the volume and types of data that have to be reported to regulatory authorities represent a major opportunity for the automation of compliance and monitoring processes. For the financial services industry, the application of technology to regulation and compliance has the scope to massively increase efficiency and achieve better outcomes.

BBVA , which hosted a RegTech innovation lab, quoted recently, "Regtech solutions also allow banks to boost their responsiveness to regulatory changes, because they are, in theory, designed to adapt dynamically to new requirements in an almost immediate manner".