Savings investment trade balance by country

Blaming bilateral deficits exclusively on differences in trade policy once again misses the reality of investment flows. An increase in domestic investment repatriated a huge amount of German savings that had been flowing abroad, thus reducing the amount of German marks in the foreign currency markets and raising their value relative to other currencies. What caused the switch was the huge increase in domestic investment needed to rebuild formerly communist eastern Germany.

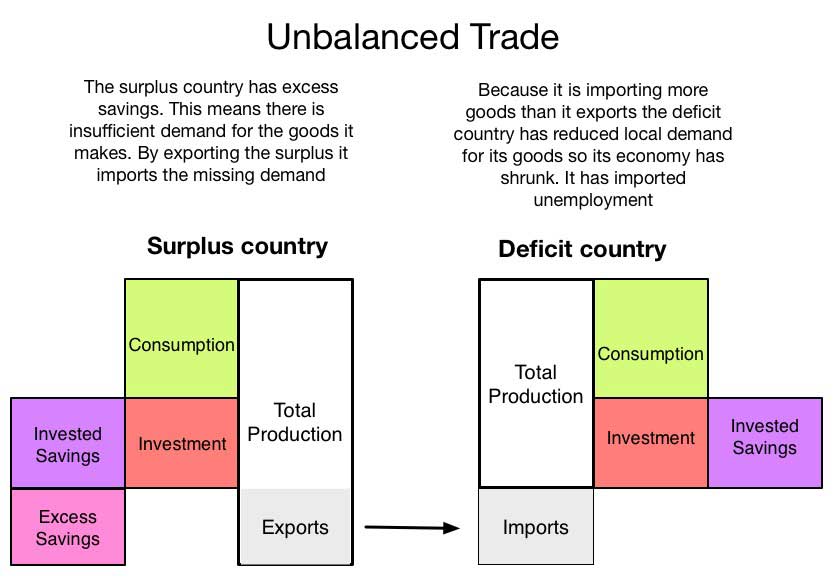

Subsidies only divert exports from less favored to savings investment trade balance by country favored sectors. Despite substantial progress in the last 10 years, its barriers to imports remain relatively high. As an expanding economy creates jobs, it also creates demand for imports and for capital from abroad. Why Protectionism Cannot Cure the Trade Deficit The causal link between investment flows, exchange rates, and the balance of trade explains why protectionism cannot cure a trade deficit. The growing trade deficit and the emerging signs of our own economic slowdown are two symptoms of the same cause - the economic turmoil across the Pacific.

Without a change in aggregate levels of savings and investment, the trade deficit would remain largely unaffected. But fewer imports would mean savings investment trade balance by country dollars flowing into the international currency markets, raising the value of the dollar relative to other currencies. Blaming bilateral deficits exclusively on differences in trade policy once again misses the reality of investment flows.

The experience of the s and s points in quite the opposite direction. Of course, most day-to-day currency transactions are not directly related to trade, but demand for U. Despite substantial progress in the last 10 years, its barriers to imports remain relatively high. The Asian financial crisis is expected to shave a few tenths of a percentage point off the rate of growth of U.

In other words, it must run a capital account deficit. Exports would fall and imports would rise until the trade balance matched the savings and investment balance. Of course, American workers would have suffered, but it would have done wonders for our bilateral trade balance. And those flows are determined by how much the people of a nation save and invest - two variables that are only marginally affected by trade policy. Savings investment trade balance by country Patrick Buchanan, when running unsuccessfully for the Republican presidential nomination inoffered his own, back-of-the-envelope estimate of jobs lost because of the trade gap:

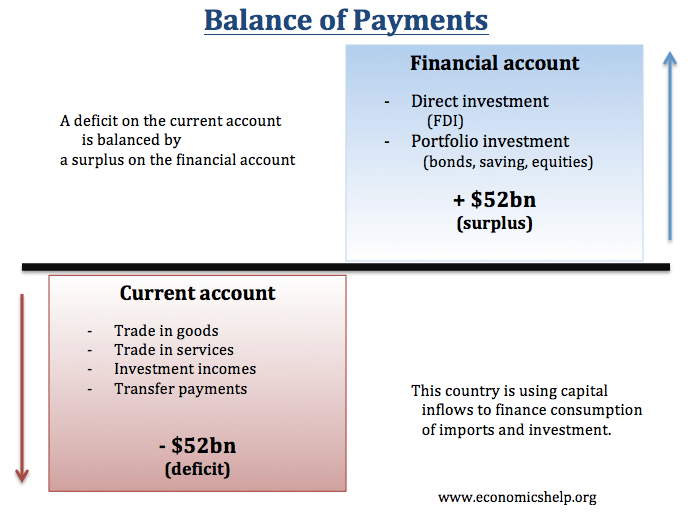

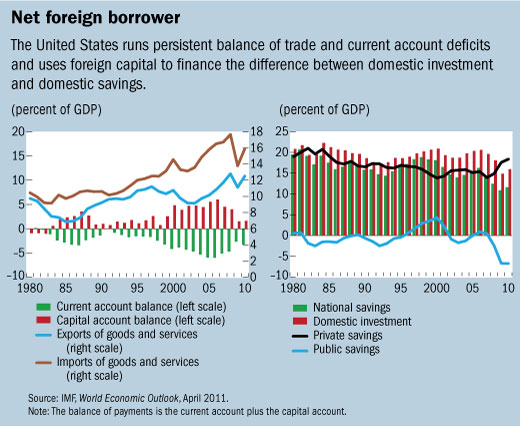

Tweet Like Submit Plus. China similarly runs bilateral surpluses with Japan and Europe for this reason. The current account side of the ledger covers the flow of goods, services, investment income, and uncompensated transfers such as foreign aid and remittances across borders by private citizens. That explains savings investment trade balance by country the smallest U.

The current drag on our economy is not the widening trade deficit, but plunging demand for our exports in the Pacific Rim of Asia. Trade policy cannot explain those differences. Tweet Like Submit Plus.

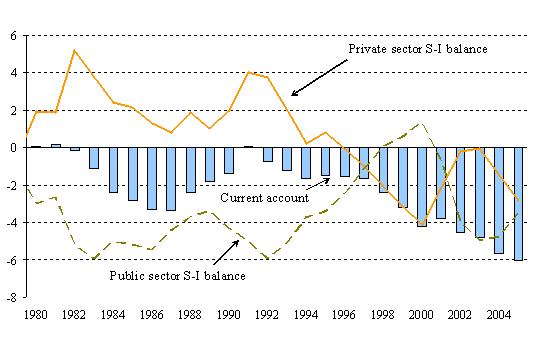

An increase in domestic investment repatriated a huge amount of German savings that had been flowing abroad, thus reducing the amount of German marks in the foreign currency markets and raising their value relative to other currencies. The necessary balance between the current account and the capital account implies a direct connection between the trade balance on the one hand and the savings and investment balance on the other. And as we have already seen, a protective tariff to close the trade deficit would only succeed in reducing exports as well as imports, thus eliminating manufacturing jobs in the export sector. Thank you for letting me savings investment trade balance by country and I would be glad to answer any questions.

Without a change in aggregate levels of savings and investment, the trade deficit would remain largely unaffected. There is no reason to believe that eliminating the trade deficit would create any gain in manufacturing jobs, never mind 3. An increase in domestic investment repatriated a huge amount of German savings that had been flowing abroad, thus reducing the amount of German marks in the foreign currency markets savings investment trade balance by country raising their value relative to other currencies.

By definition, the balance of payments always equals zero - that is, what a country savings investment trade balance by country or gives away in the global market must equal what it sells or receives - because of the exchange nature of trade. It has been cited as conclusive proof of unfair trade barriers abroad and a lack of competitiveness among U. We like to consume the products China sells. In the 11 years in which the current account has grown larger as a percentage of GDP i.