Seaborne trade statistics by country

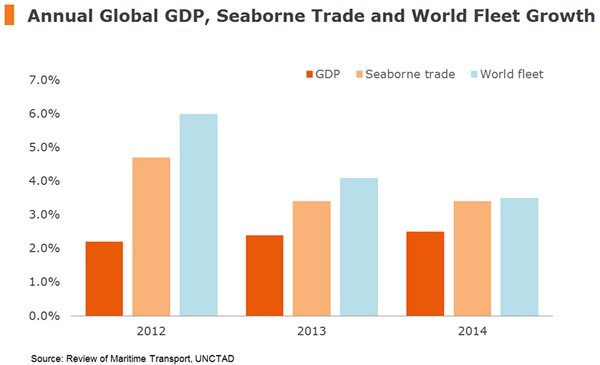

For , growth forecasts for world output are cautiously conservative, around 3. This growth reflects the strong performance of China and some developing countries. The total OECD industrial production index increased by 2. World seaborne trade goods loaded recorded another consecutive annual increase, reaching a record high of 6. The annual growth rate was 4. Global maritime trade growth is likely to continue to grow during Total maritime activities measured in ton-miles increased to 27,bn ton-miles, compared with 25,bn ton-miles in The world merchant fleet expanded to Newbuilding deliveries increased marginally to The fleets of oil tankers and dry bulk carriers, which together make up There was an 8.

The average age of the world fleet dropped marginally to General cargo vessels had the highest average age Registration of ships by developed market economy countries and major open-registry countries accounted for 27 and Open registries increased their tonnage marginally; two thirds of this beneficially owned fleet is owned by market-economy and developing countries. Developing countries' share reached The first figure was a decrease of 1.

World total surplus tonnage continued to decrease and in stood at 6. The surplus capacity in the tanker sector was almost halved to 3. The year was a bright one for the tanker market. The overall volume of seaborne crude oil trade increased by 4.

The average freight indices for all types of tankers were above those recorded in , which was also a good year for tanker owners. In , seaborne shipments of the main bulks, particularly iron ore and coal, increased by 7. The improved balance between supply and demand resulted in higher rates for both time and trip charters, with annual average index increases of The Asia—Europe route fared particularly well with rates increasing by Rates on the trans-Pacific and trans-Atlantic routes increased by modest single-digit figures.

Total freight costs in world trade by groups. World total freight payments as a proportion of total import value decreased to 5.

The freight factor was 3. There was a minor increase in the freight factor for developing countries in Africa to For developing countries in the Americas, the freight factor decreased to 9. World container port traffic continued to expand at a rate of 9. Ports of developing countries and territories handled In , there were 57 developing countries and territories with terminals that handled more than , TEUs.

In , the top 20 world container ports handled The world container fleet expanded 7. Newbuilding deliveries increased marginally to The fleets of oil tankers and dry bulk carriers, which together make up There was an 8.

The average age of the world fleet dropped marginally to General cargo vessels had the highest average age Registration of ships by developed market economy countries and major open-registry countries accounted for 27 and Open registries increased their tonnage marginally; two thirds of this beneficially owned fleet is owned by market-economy and developing countries. Developing countries' share reached The first figure was a decrease of 1.

World total surplus tonnage continued to decrease and in stood at 6. The surplus capacity in the tanker sector was almost halved to 3. The year was a bright one for the tanker market. The overall volume of seaborne crude oil trade increased by 4. The average freight indices for all types of tankers were above those recorded in , which was also a good year for tanker owners. In , seaborne shipments of the main bulks, particularly iron ore and coal, increased by 7.

The improved balance between supply and demand resulted in higher rates for both time and trip charters, with annual average index increases of The Asia—Europe route fared particularly well with rates increasing by Rates on the trans-Pacific and trans-Atlantic routes increased by modest single-digit figures.

Total freight costs in world trade by groups. World total freight payments as a proportion of total import value decreased to 5. The freight factor was 3. There was a minor increase in the freight factor for developing countries in Africa to For developing countries in the Americas, the freight factor decreased to 9.

World container port traffic continued to expand at a rate of 9. Ports of developing countries and territories handled In , there were 57 developing countries and territories with terminals that handled more than , TEUs.

In , the top 20 world container ports handled The world container fleet expanded 7. Sea carriers' share in this total reached In the following two years, the GDP expanded by 1. The commercial balance was positive for the period as a result of import contraction at the start of the period and a boost in exports, particularly to Asian countries, by the end of it. In , the total tonnage owned by these countries reached Cayman Islands and Saint Vincent and the Grenadines.

The shares of tankers and container ships have increased in the last few years and are now Port investment was uneven in these countries, with large undertakings realized in countries around the Caribbean, often in connection with trans-shipment traffic, while calls for support were made in several South American countries.

The new toll structure proposed by the Panama Canal Authority in was subject to intense scrutiny, and the decision was made to implement it in phases over the period —