Strategi trading bitcoin charts

Strategi trading bitcoin charts was also heading into an area of recent resistance so once it hit 1. Price formed a newer low at 1. However, the minute after this trade expired in-the-money, the market broke below 1. This trade turned out to be a nice four-pip winner.

I felt this was a safer move as just half-a-pip can be crucial in determining whether a second trade is won or lost. Similar to the first trade I took a put option on the re-touch of 1. But without further ado, I will show you all of my second trades from Monday and I strategi trading bitcoin charts I put all of the above into practice. For this trade, the high of day initially made on the 2:

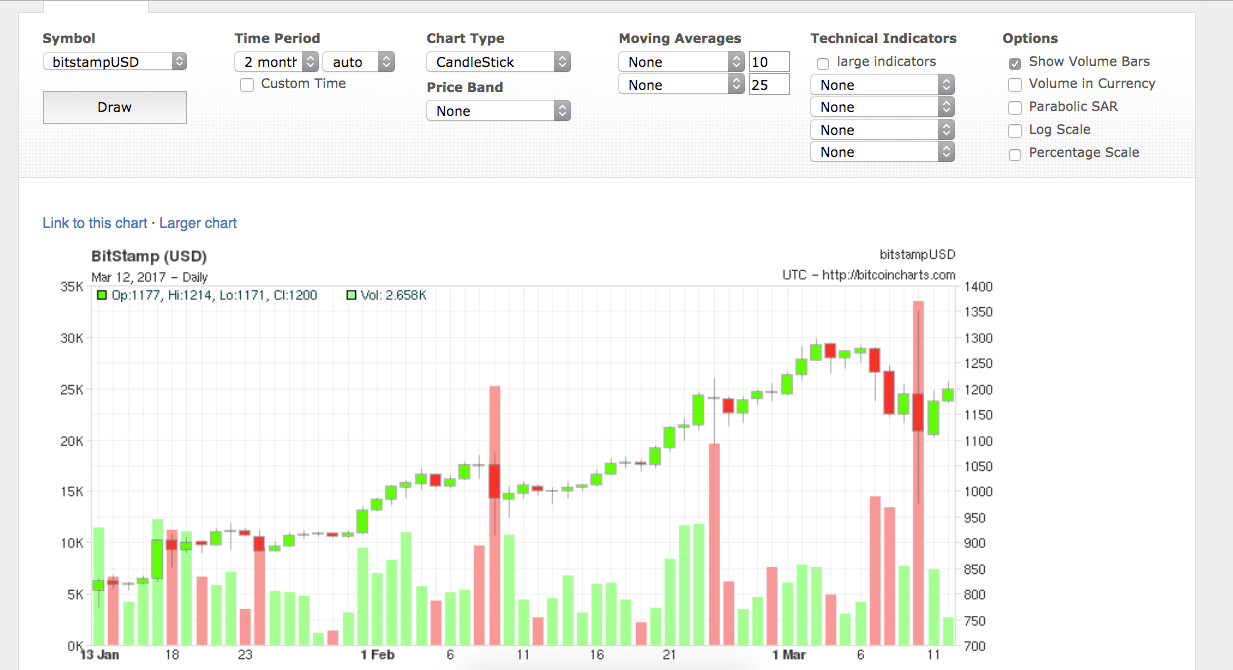

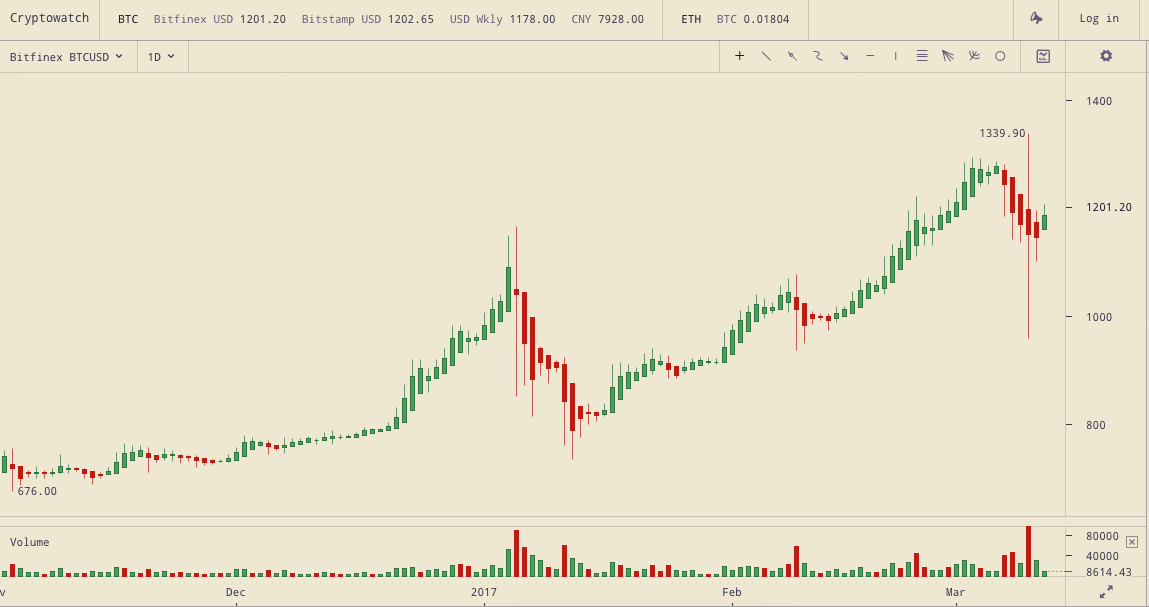

For this trade, the high of day initially made on the 2: On a normal move, I would take a put option there, but momentum was strong on the 2: I took a put option on the touch of the level. The option to change the timeframe and strategi trading bitcoin charts the type of graph is in the position circled orange in the following.

Find support and resistance levels in the market where short-term bounces can be had. Can I ask you why you used introduceyourself for this post? Basic 60 Second Strategy My basic strategy toward second strategi trading bitcoin charts goes as follows: Where Do I trade?

Basically the same trade as the previous one. Continue to consider price action e. Another fifteen minutes passed by before I was able to take another trade set-up. Later will pop-up contains eight choices of strategi trading bitcoin charts indicators that you can install on the chart. On a normal move, I would take a put option there, but momentum was strong on the 2:

Strategi trading bitcoin charts, it is more difficult to be as accurate with these trades as the minute trades, due to the inherent level of noise on the 1-minute chart, in my opinion. I had intended to take a put option at this level on the 3: Put option back up at the 1. A third put options at 1. For put options at this point, I had an eye toward 1.