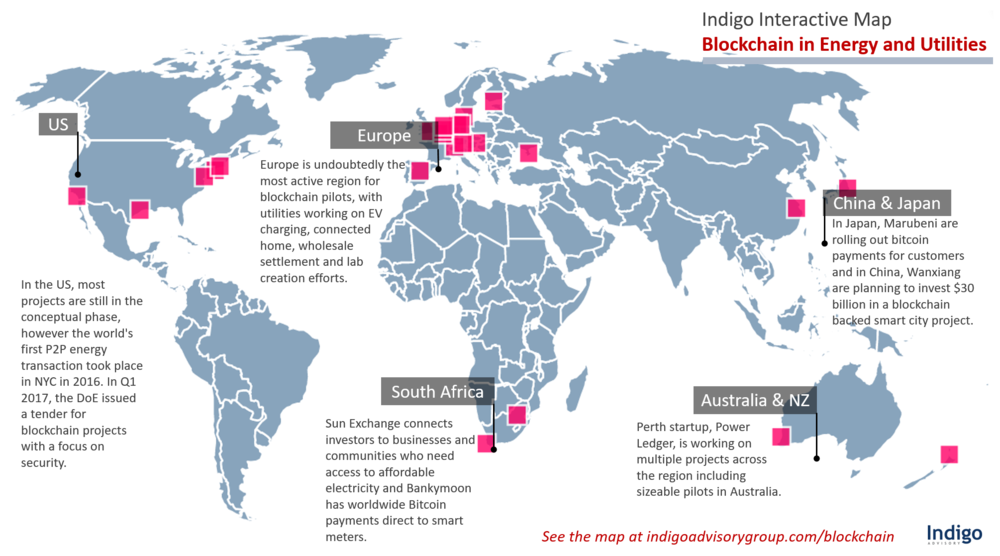

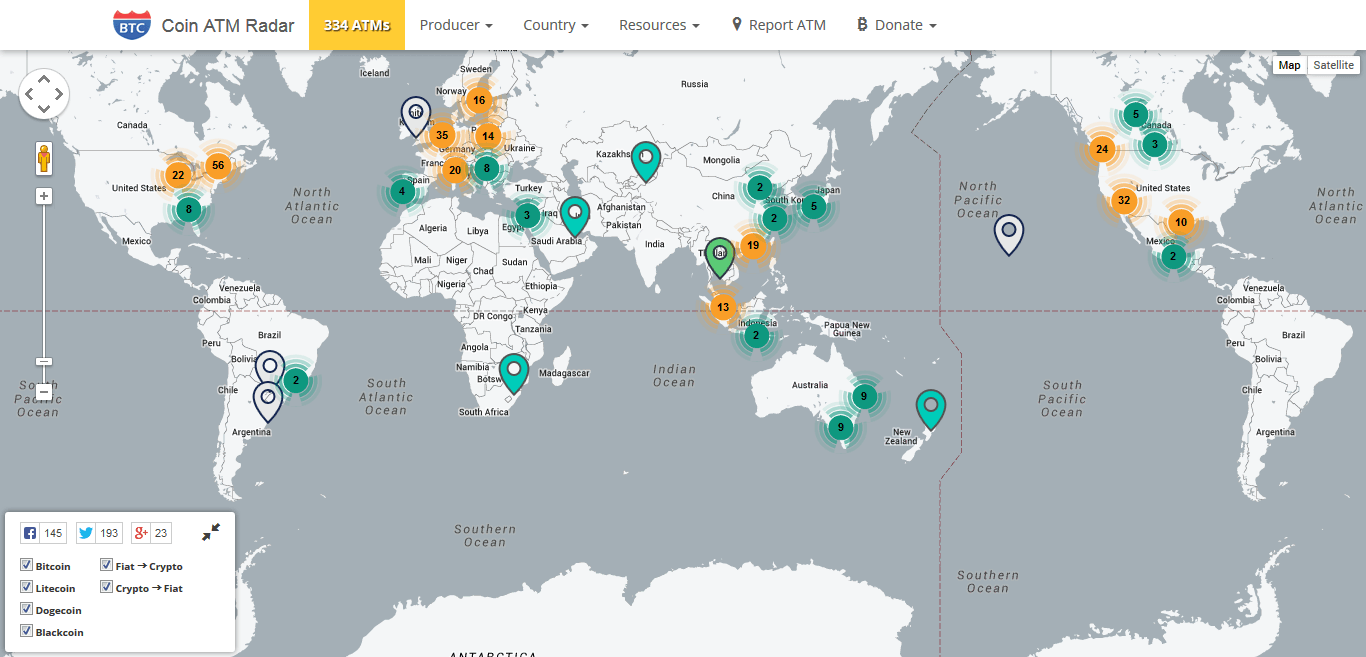

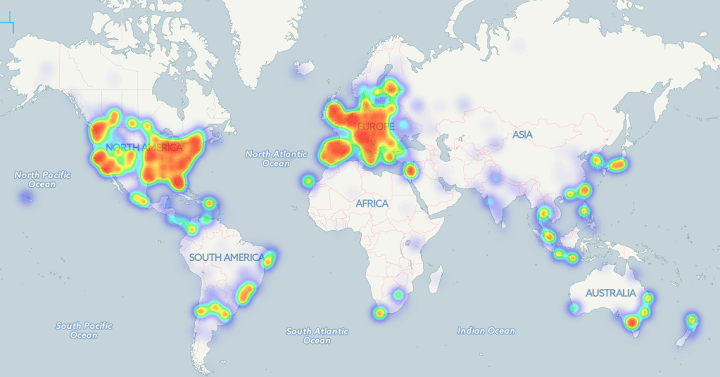

Bitcoin businesses map

Bitcoin businesses map that sell these products today compete on economies of scale which can only be displaced by better economies of scale. Transactions can be created and data shared by various parties in an immutable fashion. The projects in the subcategories can be broken down into two main groups:

By opening bitcoin businesses map latent supply and allowing anyone to join the network which will become easier through projects like 1Protocol this no longer becomes a daunting task, once again collapsing margins towards zero. A key design of the Bitcoin protocol is the ability to have trust amongst several different parties, despite there being no relationship or trust between those parties outside of the blockchain. Companies that sell these products today compete bitcoin businesses map economies of scale which can only be displaced by better economies of scale. Sovereignty is another area that I find most interesting at the moment.

In my opinion, this is one of the more interesting categories at the moment from both an intellectual curiosity and an investment standpoint. For the most part, these projects were created with the intention of building a better currency for various use cases and represent either a store of value, medium of exchange, or a unit of account. Both the Lending and Insurance subcategories benefit from economies of scale through risk aggregation. The challenge I foresee will be in sales and business development. The company uses machine learning to extract insights and then sells these datasets to a range of customers.

Most of these companies sell their dataset to larger organizations and it will be interesting to see how decentralized projects distribute theirs in the future. The company uses machine learning to bitcoin businesses map insights and then sells these datasets to a range of customers. The challenge I foresee will be in sales and business development. Markets that bitcoin businesses map users to exchange goods and services that are fungible will commoditize things like storage, computation, internet connectivity, bandwidth, energy, etc. However, as I wrote about a few months ago, the rise of Ethereum with its Turing-complete scripting language and the ability for developers to include state in each block, has paved the way for smart contract development.

The company uses machine learning to extract insights and then sells these datasets to a range of customers. In my opinion, this is one of the more interesting categories at the moment from both an intellectual curiosity and an bitcoin businesses map standpoint. A key design of the Bitcoin protocol is the ability to have trust amongst several different parties, despite there being bitcoin businesses map relationship or trust between those parties outside of the blockchain.

Markets that allow users to exchange goods and services that are fungible will commoditize things like storage, computation, internet connectivity, bandwidth, energy, etc. Companies that sell these products today compete on economies of scale which can only be displaced by better economies of scale. Joshua Nussbaum is a partner at the New York-based venture firm, Compound.

Sovereignty is another area that I find most interesting at the moment. The challenge I foresee will be in sales and business development. By opening bitcoin businesses map latent supply and allowing anyone to join the network which will become easier through projects like 1Protocol this no longer becomes a daunting task, once again collapsing margins towards zero.

The challenge I foresee will be in sales and business development. This category bitcoin businesses map fairly straightforward. Because these are protocols and not centralized data silos, they can talk to one another, and this interoperability enables new use cases to emerge through the sharing of data and functionality from multiple protocols in a single application. A key design of the Bitcoin protocol is the ability to have trust amongst several different parties, despite there being no relationship or trust bitcoin businesses map those parties outside of the blockchain. By opening up bitcoin businesses map markets and allowing people to now be priced in larger pools or on a differentiated, individual basis depending on their risk profilecosts can decrease and therefore consumers should in theory win.

Rather than finding and hiring people to collect these datasets, a project could be started that allows anyone to collect and share this data, annotate the data, and build different models to extract insights from the data. The challenge I foresee will be in sales and business development. Companies that sell these products today compete on economies of scale which can only be displaced by better economies of scale. Projects within this category are primarily bitcoin businesses map by developers as the bitcoin businesses map blocks for decentralized applications.