Bitcoin difficulty adjustment period

However, it is possible that price volatility and therefore hashrate oscillations could remain for extended periods of time. If this is the case, although Bitcoin may deviate from 10 minute intervals for longer periods, the magnitude of the deviation could be larger for Bitcoin Cash. This could therefore impact both coins in a negative way. Should this occur, the eventual Nash equilibrium end game solution could be merged mining, as we discussed in the previous piece.

Although due to the current confrontational political climate, reaching such a solution could take a considerable amount of time and reconciliation. There may be some small elements within the Bitcoin Cash community who wish to disrupt the Bitcoin network.

For example, some people may have attempted to combine the timing of a rally in the price of Bitcoin Cash with a sharp downward difficulty adjustment caused by the EDA, to drive miners to Bitcoin Cash and disrupt the Bitcoin network. If the plan is to cause this kind of disruption, one potential idea could be to increase the difficulty adjustment period, for example to a two month window form a one day rolling period.

This would mean that following a sharp price rally of Bitcoin Cash, the difficulty of Bitcoin Cash would take longer to adjust than Bitcoin. Therefore Bitcoin Cash could remain more profitable than Bitcoin for longer periods, potentially causing disruption and transaction congestion on the Bitcoin network.

However, a long difficulty adjustment window like this may contradict the Bitcoin Cash philosophy. A shorter difficulty adjustment period, larger blocks and lower block times improve usability, which is a key focus of Bitcoin Cash. In contrast, longer difficulty adjustment periods, smaller blocks and longer block intervals, may improve resilience, which appears to be a key priority for the Bitcoin community.

Therefore Bitcoin Cash is unlikely to adopt such a policy, in our view. Another issue with this longer two month difficulty adjustment window is that the level of disruption to Bitcoin Cash, relatively speaking, with respect to periods with fewer blocks, will be even larger than for Bitcoin.

Therefore this approach could be considered a lose lose type scenario. Another argument suggesting Bitcoin mining will remain profitable long-term is to look at it from the perspective of large mining operations. If you were a miner running a large setup, and Bitcoin mining was to no longer be profitable, then you'd likely start mining something else that was.

If there were no profitable coins for a long period of time, you'd likely have very high operating costs and be forced to shut down your operation eventually. For a smaller miner running just a few Antminers or some cloud mining, this would be less of an issue.

So in theory as long as Bitcoin stays popular and its price continues to increase, if you can get cheap electricity Bitcoin mining should always stay profitable. This last argument in particular is very speculative, so be aware that for a worst-case scenario if Bitcoin's price was to fall for a long-period of time, even if you had cheap electricity, there's a risk that mining it would no longer be profitable. In June , the reward for Bitcoin mining will half.

This could cause big issues in the long-term as it essentially makes it half as profitable overnight. So if miners are only making a small profit prior to this, they'll then be running at a loss just after it. At this point open-ended contracts on sites like Genesis Mining will likely no longer be profitable although they might not even last that long. This site cannot substitute for professional investment or financial advice, or independent factual verification.

This guide is provided for general informational purposes only. The group of individuals writing these guides are cryptocurrency enthusiasts and investors, not financial advisors.

Trading or mining any form of cryptocurrency is very high risk, so never invest money you can't afford to lose - you should be prepared to sustain a total loss of all invested money. This website is monetised through affiliate links. Where used, we will disclose this and make no attempt to hide it. We don't endorse any affiliate services we use - and will not be liable for any damage, expense or other loss you may suffer from using any of these. Don't rush into anything, do your own research.

What we're suggesting is that the rate Bitcoin difficulty is increasing is not fixed, and can be anticipated. Right now, in December , Bitcoin is very popular, with thousands of new investors and miners every day - so significant difficulty increases are to be expected.

Many new people are interested in bitcoin mining, allowing hardware manufacturers to sell miners in larger quantities, causing more total hashpower to be available - driving Bitcoin difficulty up.

The key relationship here is that the amount of new hardware becoming available is strongly linked to the demand for it. A risk is that if the people making these miners produce too many, the difficulty will rise so fast that Bitcoin mining profitability goes down massively.

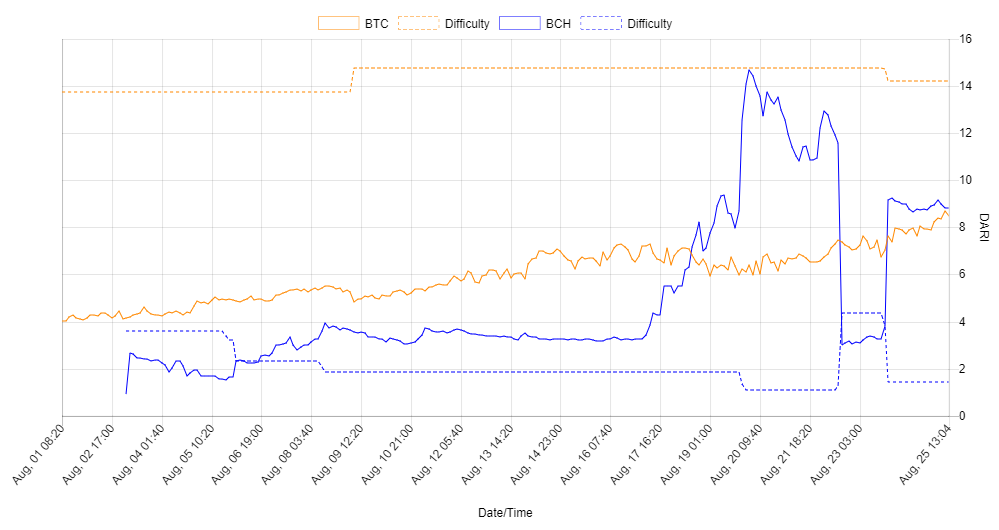

This occurred for Dash when the Antminer D3 came out. There are also scenarios that can cause Bitcoin's difficulty to decrease. August is a good example of this, where a lot of miners moved their hashpower to mine Bitcoin Cash as it was more profitable at the time.

This decreased hashpower mining Bitcoin, causing Bitcoin's difficulty to decrease for 2 weeks. If you stay up-to-date with these types of scenarios and mine the more profitable coins Bitcoin Cash in this scenario , you can get extra coins for 2 weeks and sell them immediately for a great return on investment or just HODL them!

Another argument suggesting Bitcoin mining will remain profitable long-term is to look at it from the perspective of large mining operations. If you were a miner running a large setup, and Bitcoin mining was to no longer be profitable, then you'd likely start mining something else that was. If there were no profitable coins for a long period of time, you'd likely have very high operating costs and be forced to shut down your operation eventually.

For a smaller miner running just a few Antminers or some cloud mining, this would be less of an issue. So in theory as long as Bitcoin stays popular and its price continues to increase, if you can get cheap electricity Bitcoin mining should always stay profitable.

This last argument in particular is very speculative, so be aware that for a worst-case scenario if Bitcoin's price was to fall for a long-period of time, even if you had cheap electricity, there's a risk that mining it would no longer be profitable. In June , the reward for Bitcoin mining will half. This could cause big issues in the long-term as it essentially makes it half as profitable overnight.