Bitcoin p2p lending platform bitbond raises $12 million in equity funding

Thank you for your email. This is one of factors that can be affecting your return since those loans are known to have a higher charge off rate. Since then five months have passed, and we now have 21 months of history. Those rates are without adjustment for delinquent or charged-off loans.

The average rates on my Lending Club loans are higher, which is why the account value difference is not more that it is. It might be that Lending Club is more rigorous in its charge-off procedures in response to their widely reported management and cash flow issues in These numbers are net of fees, by the way.

In recent times you could have done much better in the equities markets, obviously, but also worse with conservative bond investments. During this time my annual return is going to steadily drop until it finally reaches zero. You could also resell the notes. Purchasing Notes on the Trading Platform is inherently risky as the asking price is set by the seller, and may be priced higher than the remaining return expected on the Note. Purchasing Notes with a negative Yield to Maturity or with large markups are almost certain to return less money than the price you will pay, producing negative returns on your investment.

There are various reasons a current Note holder chooses to list a Note for sale. Often Note holders are simply looking to liquidate their holdings; they may place Notes for sale at or slightly below par value i.

However, other sellers may be seeking to profit on their sales. They may hope that the buyer will not realize that the price has been set so high, or they may hope that a buyer will not be paying close attention to the price set. Please be wary of Notes that are priced at high premiums. While the underlying risk may have increased, the interest rate has not and may not offset the risk a buyer undertakes when purchasing a Note.

You should buy a Note only if you understand and are comfortable with these risks. So I can certainly expect my NAR to dip to perhaps 5. So no reason not to go with them. This not-for-profit is a platform for making micro loans to entrepreneurs in developing countries. Being an entrepreneur you can borrow money through our Peer to Peer lending or our ethical bank Currently the bouquet of products that we offer is Online Loans and we act as an aggregator for lenders and borrowers. But we will push the limits and have lots of innovative products in our kitty.

We bring the group financial service to the digital age by providing a platform for people to save borrow lend in money trusted digital groups, earn rewards. We are digitalising the ROSCA Rotating savings and credit association framework starting with Indian Chit funds that has existed since centuries and for decades as a regulated non banking financial industry but has become inefficient, unsafe, fraudulent in recent times.

Lending Works is a peer-to-peer lending platform which matches shrewd lenders with creditworthy personal loan borrowers, so both receive a much better deal.

By cutting out the large financial institution in the middle, lenders savers receive great returns and borrowers receive low cost, flexible personal loans. There are no banks, no big bonuses and no sneaky fees.

Lending Works was founded with the belief that financial services should be fair again by giving the consumer control of their finances. Lending and borrowing directly from each other benefits real people, not the bank.

NetInvesting provides a Peer to Peer financing platform P2P for businesses to raise finance on terms which match their needs and abilities to pay; and provide investors with a range of investment projects from which they can choose. The Platform is dedicated to Businesses with a limited access to the banking financing and looking for alternative to capital market financing sources, and Investors looking for alternative ways of investing.

Through an internet platform which registers investors and showcases projects to a selected number of qualified investors. It acts as a clearing facilitator between issuer and investor in terms of capital flows based on standardised documentation.

Presently developed for the Polish market the Founders are starting the next phase of expansion to the CEE region with the rest of Europe next. HouseFundr is a unique P2P real estate investment marketplace offering curated real estate development opportunities to retail and institutional investors. Investment opportunties are characterised by three key differentiators: Through it's network of real estate developers, HouseFundr sources suitable development investment opportunities.

These are financed through HouseFundr in full up-front and then offered to it's investor base. We are a rapidly growing alternative lender offering loans to small businesses and helping them achieve a strong financial position and grow their businesses. We are currently in the process of releasing a suite of online financial services products that will offer significant functionality for our borrowers via web and mobile.

When your friend lend you money, we do too. The Lenderly platform offers automated features that allow users to apply, grant, pay, recover and record loans between themselves and their friends. We also match borrowers with the most likely lenders in their social networks. Lenderly provides top-up loans to borrowers who raised part of the loan from their friends and family.

Lenderly makes use of the inherent trust within the social framework as part of its loan offer. Currently servicing loans in the US only. We make reference checking easier by automating the process.

It allows candidates to complete the references once and continue to use them whenever they search for their next job. Employers spend more time with the right candidates and speed up the hiring process. Employers store completed references in their database and use the report for their on-boarding process. Everyone will have the same understanding when it comes to the resume.

Wayniloans is a social network which offers a way to obtain loans in bitcoins. Lenders have the possibility to choose amount, interest rate, quantity and frequency of payments in order to solve their needs.

On the other hand, Wayniloans gives the opportunity for investors to increase their savings. They have the possibility to choose between a lot of loans based on the profit and risk that they are willing to bear.

Wayniloans rates each loan in order to make the decision easier. Wayniloans is a P2P lending with bitcoins because bitcoin is global, safe and has low transaction costs. We have developed a secure web service to manage multiple user accounts and bitcoin wallets. This service enables Wayniloans to create user profiles, wallets, receive balance, change notifications and send bitcoins to wallets within and outside the platform. Our team members are experienced in both banking and internet industries, with more than 8 years of experience on average, dedicated to build a highly efficient online marketplace, both for borrowers in the form of lower rates and investors in the form of attractive returns.

We focus to build a cross-boarder platform benefiting from the mainland china's opening policy. Key advantages of our 2nd mortgage loans: WorldCover is a peer-to-peer network for insurance. Customers are individuals near the poverty line in developing countries, like smallholder farmers.

Investors are socially conscious individuals around the world. A new asset class. Better than stocks and bonds. DANAdidik is an online platform for connecting students with lenders looking for an attractive rate of return. Peer to peer lending for student loan. DANAdidik soft-launched in Feb , and already received applicants sign up within 18 days. We are the first and only company aiming to tackle the absence of student loan in Indonesia.

There is no student loan. Students in emerging market are simply too risky for banks. Yet, there is always appetite for the right return at the right structure. Funding Tree is redefining crowdfunding and peer-to-peer lending. Designed from scratch, our technology is the best available globally, having been created to appeal directly to both businesses and investors through a multitude of unique features.

Moreover, we've carefully developed our platform so it is a completely scalable solution for when we expand into Europe already authorized and the US. Finefectivo Lending Corporation is committed to helping the Filipino prosper through ready access to credit. Our services are delivered through straightforward and easy-to-understand qualification and repayment terms with quick approvals, usually within 48 hours of filling out our easy online application.

Peer-to-peer lending is revolutionizing the post-recession financial landscape by cutting out traditional middlemen like banks and democratizing the process of lending money. Most peer loans are unsecured. However, Blackhawk investments is leading the industry by developing a niche in secured P2P commercial real estate transactions. Blackhawk Investments pre-qualifies deals that banks can't, at rates that hard-money lenders don't offer.

Our lenders receive a secured investment with significantly higher returns than they could get from money markets and CDs. And our borrowers obtain low-cost private loans with flexible terms that they could never get otherwise. We focus on makers especially those connected to a makerspace a growing community movement estimated to reach 40 million in the US.

B2B focus on consumer companies: Empowers consumers or lenders to make better decisions about education. Disrupts higher education by measuring its true economic value. Business financing as innovative as you are. P2Binvestor is the first and only crowdfunding platform for commercial loans secured by receivables.

What does this mean for your company? If you are looking for working capital, it means you have access to nearly immediate cash secured by your receivables. Our funding is designed to bridge the wide gap between hard-to-get bank financing and expensive alternative lending sources.

A contemporary solution for modern businesses. Simultaneously we provide another segment of the population with impressive return on small investments secured by collateral.

The site makes money without risking any capital since the loans are funded by the users. Lending Club is an online platform for connecting creditworthy borrowers with investors looking for an attractive rate of return. We are the market leader in peer-to-peer lending. Zopa is the UK's largest peer-to-peer lending site. How does peer-to-peer lending work? Also known as social lending, peer-to-peer lending means great interest rates for both borrowers and lenders.

At Zopa we match sensible borrowers looking for low rate loans with smart investors looking for high interest on their money. We're crafting a social crowd-lending network for real estate.

We've been in the peer-to-peer lending business for years. Now we are taking that experience online, and expanding our vision to create a social community. We're going live September If you can't wait until then visit www. Peer-to-peer lending platform that connects borrowers with lenders through a robust credit risk management system For our lenders: Fair priced products based on borrower demographics risk profile Build credit over the long-term garnering lower priced loans Convenient online platform for application and payment.

Each party gets a better deal, bypassing mainstream financial institutions. BitStake is a digital currency exchange with the vision to make digital currencies more accessible to people unreached by traditional banking as well as drive down the costs of monetary remittance transfers.

BitStake took a different approach other than using Bitcoin only for remittance. We replicate a digital banking model based on digital currency. GraduRates is a platform providing peer-to-peer loans for postgraduate study in the U. Postgraduate study is significantly underfunded in the U. Bank lending has been falling rapidly and the government does not have the funds or the will to set up a lending program, as it has for undergraduate students.

This is where GraduRates steps in By using a peer-to-peer network, GraduRates connects students who are wishing to borrow with lenders who are looking for a better return on their money. By cutting out the banks, GraduRates can reduce the cost and increase the accessibility to postgraduate finance in the U. GraduRates makes money by taking a small fee from borrowers and lenders. Lenders Exchange is a peer-to-peer P2P lending platform that also serves as a secondary market, offering investors the ability to buy and sell consumer credit notes similar to trading equities on a stock exchange.

This transforms an illiquid asset class consumer credit to be as liquid as any other tradable asset. We incentivize borrowers and investors to use our service by providing lower upfront costs, no hidden fees, transparency, a rebate program and most importantly liquidity.

Crowdnetic is a leading provider of technology and market data solutions to the global crowdfinance marketplace. CrowdWatch aggregates and normalizes issuer information for thousands of private issuers publicly raising "PIPRs" capital through leading portals, providing easy access to analyze, compare and research PIPRs as well as securities based real estate crowdfunding investments in realtime. Lendvious, an unbiased and comprehensive marketplace for peer-finance borrowers and investors, provides the powerful investor tools and detailed information needed to make informed marketplace lending decisions.

CrowdneticWire is a renowned resource for education and insight into marketplace lending and crowd funded securities. We are on mission to make borrowing and lending money easier. Our loans carry lower interest rate than bank loans but higher than savings account, so both investors and borrowers get a good deal. Our borrowers are people who are looking to consolidate debt, buy a car or furnish home. Our investors are looking for a higher returns than corporate bonds and fixed deposits on their investments with consistent cash flow.

Working with leading domestic P2P lending and wealth management agency Euronixa has been relying on big data technology to give consumers quick decisions on loans or other networking support.

P2P finance involves lending money to unrelated individuals, companies or peers, without the use of a traditional financial intermediary such as a bank. Our P2P technologies will not only help your own clients, but also be available to the whole traditional sector. The Crowd Valley Digital Back Office for online investing and lending applications is accessible through an open API and aims to be the de facto virtual back office to the online investing and lending market.

Thank you for creating the collection. You can add startups from the list below. Curation Landscaping Collections Grading. Prestadero Prestadero is the first, legally compliant, fully operational, peer to peer lending site for the Mexican market. Through Prestadero, borrowers can have access to the lowest rates Rapid Performance Senegal Despite multiple, innovative, financial solutions in Africa, poverty alleviation is still unattainable. Two key factors a lack of trust; b inability to make scalable, BTCjam BTCjam, the global leader in peer-to-peer lending using Bitcoin, and the first to offer a proprietary credit score to its users, is hiring top talent to join us as we surge into LendLift LendLift is an online lending marketplace that connects responsible non-prime credit card borrowers with accredited investors who can lend to them at lower interest rates, giving StudentFunder StudentFunder was founded by people who struggled to fund their education, who wish to help others finance theirs.

The banks and the Student Loans Company do not finance masters PeerCube PeerCube has been collecting and analyzing data on peer to peer lending for over 3 years. Although consumer lending market has been around for decades, peer to peer lending and We operate an FCA authorised and regulated peer-to-peer Raiseworks Raiseworks operates an online direct lending platform that connects small businesses with institutional lenders looking to lend directly to private businesses.

Loanbase Loanbase is a global Bitcoin lending marketplace that provides borrowers with access to funds at affordable rates from retail lenders across the globe.

Borrowers are now able to Daric Daric is a peer to peer lending platform that extends personal and small business loans at competitive rates using big data. LendingStar Lendingstar is peer-to-peer lending and investment online platform with a focus on small businesses and private entrepreneurs. Lendingstar is a global, supply and demand based WeLab is transforming traditional credit services by creating seamless SoMoLend SoMoLend is the first fully transparent portal that allows investors to look into the eyes of business borrowers before making lending decisions.

With no banks in LendInvest At LendInvest, we are re-inventing the mortgage. LoanMeet LoanMeet provides an platform to either give money to family members friends, and needy borrowers, or get a personal or business loan from your family members, friends, lenders, Youfari The site helps college students by making their college experience affordable and rewarding. The first product Peer-To-Peer textbook rental and sale service Monefy Monify is a fin-tech startup in stealth mode and is transforming finance to make it more efficient, transparent, and customer friendly.

We offer access for non-accredited and accredited investors to participate directly in short-term commercial construction loans backed by Proplend Proplend is a peer to peer lending platform which offers lenders the opportunity circumvent the traditional banking system and to lend directly to borrowers with the loan being Corigin Ventures Corigin Ventures is a Manhattan based investor of early-stage capital and support.

Leveraging operational expertise and cross-industry relationships, we seek tech-enabled startups This signals creditworthiness, helps efficiently Paper Street Paper Street is a peer to peer lending platform focused on business lending. Orchard Platform The Orchard platform enables institutional investors to scale their investment in Online Direct Lending by providing premier analytics, trade execution, and real time reporting Mintster Mintster is a Peer-to-peer lending firm which capitalizes on its innovative website to provide lending services.

Mintster website is a meeting point for lenders and borrowers Zank offers an alternative to banks allowing people to invest in other people Grouplend Grouplend is the new generation of finance. We're sick of the expensive rates, slow service and limited hours of operations that Canadians have to settle for with traditional Patch of Land Patch of Land is crowdfunding asset-backed residential and commercial real estate debt using its proprietary technology and processes.

Patch of Land creates efficiencies in the Aspiro Funding Aspiro Funding aims to provide a solution to the postgraduate funding crisis. AssetAvenue AssetAvenue is a leading online peer-to-peer lending platform providing individuals with fixed income investments in loans secured by commercial real estate, while providing GearCommons GearCommons is an online platform for peer-to-peer sharing of outdoor equipment.

Access to gear is a main barrier to participation in outdoor activities, so GearCommons connects Prestinver Prestinver is the online platform so investors can meet people who wants to borrow money. Bankless Times We are a pure-play digital news service focusing on alt-finance covering crowdfunding, peer-to-peer lending, equity crowdfunding and real estate crowdfunding. RedFin RedFin connects postgraduates looking for financing student loan refinancing or credit solutions for their running or starting business with other postgraduates and outside LendingCrowd LendingCrowd connects vibrant and growing community of small and medium sized enterprises with investors.

Offering businesses keener loan rates and investors better returns Fruitful By combining the forgotten qualities of the financial past, with the empowering technologies of today, Fruitful introduces something new, yet somehow so familiar. Lending Loop Lending Loop is an online marketplace for Canadians to lend money to growing local businesses. Our core focus is providing accessible capital at fair interest rates for SMEs Sparo is the platform that allows friends to borrow and lend Bitbond Bitbond is a peer-to-peer bitcoin lending platform.

Small businesses like ebay sellers who need to finance Pylon Pylon is a service that makes borrowing and lending simpler by enabling anyone to create and track loans digitally. Pylon supports individuals and communities who want to source Vision Our vision is to bring ideas to life by The Company operates a marketplace online Trade MY Loan peer to peer lenders bad credit,peer to peer lenders for bad credit,peer to peer lending.

PeerStreet PeerStreet is a marketplace for investing in real estate backed loans. WeFinance WeFinance is a grassroots crowdlending platform for student loans and other low-risk debts utilizing our borrowers' personal networks and real identities.

Money Mola Money Mola helps consumers manage loans with friends and family. If you are loaning money, or borrowing money, Money Mola tracks your loan balance and automates payments for a Our days aspiration is to deliver independence to the million people with a Lendable We are building the developing world debt marketplace.

Our product currently allows lenders to understand borrower and portfolio level risk, and we are now building the tools to RateSetter Australia RateSetter is a peer-to-peer lender. Lend2Fund Think of crowd funding but on a multi-million dollar scale.

Trained in Silicon Valley, we Beehive directly connects investors and businesses to build mutually beneficial partnerships for Umbrella Lending It is an idea that I am still fleshing out since college in and I am highly paranoid of someone else using my idea. I would have anyone interested sign a non disclosure Credits Credits is building a ground breaking new permissioned distributed ledger blockchain ecosystem. This new blockchain protocol provides for storage and transfer of value, secured Tagcoin Tagcoin was created in November as a better way for merchants to offer rewards to customers for purchases or other actions, with a long term intent to use a stable Blockchain Maxwell Advertising In November I tried an investing experiment.

But we will push the limits and have lots of innovative KyePot We bring the group financial service to the digital age by providing a platform for people to save borrow lend in money trusted digital groups, earn rewards. Lending Works Lending Works is a peer-to-peer lending platform which matches shrewd lenders with creditworthy personal loan borrowers, so both receive a much better deal.

By cutting out the Net Investing sp z o o NetInvesting provides a Peer to Peer financing platform P2P for businesses to raise finance on terms which match their needs and abilities to pay; and provide investors with a HouseFundr HouseFundr is a unique P2P real estate investment marketplace offering curated real estate development opportunities to retail and institutional investors.

Dealstruck We are a rapidly growing alternative lender offering loans to small businesses and helping them achieve a strong financial position and grow their businesses. We are currently in Lenderly When your friend lend you money, we do too. The Lenderly platform offers automated features that allow users to apply, grant, pay, recover and record loans between themselves and I Am Real -.

Bridge Loans Lenders Commercial funding. Wayniloans Wayniloans is a social network which offers a way to obtain loans in bitcoins. Lenders have the possibility to choose amount, interest rate, quantity and frequency of payments in WorldCover WorldCover is a peer-to-peer network for insurance.

Funding Tree Funding Tree is redefining crowdfunding and peer-to-peer lending. Our fully UK regulated combined debt and equity crowdfunding platform allows companies to seek funding with us Finefectivo Finefectivo Lending Corporation is committed to helping the Filipino prosper through ready access to credit.

Our services are delivered through straightforward and Blackhawk Investments Peer-to-peer lending is revolutionizing the post-recession financial landscape by cutting out traditional middlemen like banks and democratizing the process of lending money.

We focus on makers especially those What does this mean for Lending Club Lending Club is an online platform for connecting creditworthy borrowers with investors looking for an attractive rate of return. Zopa Zopa is the UK's largest peer-to-peer lending site. Also known as social lending, peer-to-peer lending means great interest rates for both Equidy We're crafting a social crowd-lending network for real estate. Equidy is restoring peer-to-peer lending to its original purpose where borrowers and lenders come together over a Pandai Peer-to-peer lending platform that connects borrowers with lenders through a robust credit risk management system For our lenders: Pret d'Union 1st and sole peer-to-peer lending platform accredited by the French Central Bank.

BitStake BitStake is a digital currency exchange with the vision to make digital currencies more accessible to people unreached by traditional banking as well as drive down the costs of GraduRates GraduRates is a platform providing peer-to-peer loans for postgraduate study in the U. Lenders Exchange Lenders Exchange is a peer-to-peer P2P lending platform that also serves as a secondary market, offering investors the ability to buy and sell consumer credit notes similar to Crowdnetic Crowdnetic is a leading provider of technology and market data solutions to the global crowdfinance marketplace.

Lending Chaupal We are on mission to make borrowing and lending money easier. Our loans carry lower interest rate than bank loans but higher than savings account, so both investors and borrowers Crowd Valley The Crowd Valley Digital Back Office for online investing and lending applications is accessible through an open API and aims to be the de facto virtual back office to the online BTCjam BTCjam, the global leader in peer-to-peer lending using Bitcoin, and the first to offer a proprietary credit score to its users, is hiring top talent to join us as we surge into LendLift LendLift is an online lending marketplace that connects responsible non-prime credit card borrowers with accredited investors who can lend to them at lower interest rates, giving underserved borrowers the ability to pay down their principal and eliminate their debt faster.

LoanMeet LoanMeet provides an platform to either give money to family members friends, and needy borrowers, or get a personal or business loan from your family members, friends, lenders, and investors. Proplend Proplend is a peer to peer lending platform which offers lenders the opportunity circumvent the traditional banking system and to lend directly to borrowers with the loan being supported with security over income-producing commercial property.

Orchard Platform The Orchard platform enables institutional investors to scale their investment in Online Direct Lending by providing premier analytics, trade execution, and real time reporting.

AssetAvenue AssetAvenue is a leading online peer-to-peer lending platform providing individuals with fixed income investments in loans secured by commercial real estate, while providing property owners and lenders with quick access to capital to fund their loans. RedFin RedFin connects postgraduates looking for financing student loan refinancing or credit solutions for their running or starting business with other postgraduates and outside lenders willing to lend their money in exchange for higher returns within a familiar and secure business community.

ALL VP Venture Partners ALL Venture Partners is the first institutional fund seed and early venture capital of its kind in Mexico, formed to invest in entrepreneurs with strong components and scalable models of innovation. Tagcoin Tagcoin was created in November as a better way for merchants to offer rewards to customers for purchases or other actions, with a long term intent to use a stable Blockchain to integrate into web and mobile applications where the distributed ledger can provide proof and trust.

Net Investing sp z o o NetInvesting provides a Peer to Peer financing platform P2P for businesses to raise finance on terms which match their needs and abilities to pay; and provide investors with a range of investment projects from which they can choose.

BitStake BitStake is a digital currency exchange with the vision to make digital currencies more accessible to people unreached by traditional banking as well as drive down the costs of monetary remittance transfers. BitGo [11] , Chain [12] and Ripple Labs [13] lead the pack here, with younger companies like Vaurum [14] and TradeBlock [15] also posting multimillion dollar investments from investors.

There are fewer companies in the wallet sector than any other, probably because most of the universal companies have wallets built into their business models too. BitPay [19] has raised most of the VC money that has gone to the payment processor sector. The investment, led by Swedish VC firm Creandum, certainly helps balance out the amount of money each sector has received in the ever-growing bitcoin industry. Image [22] via Shutterstock.

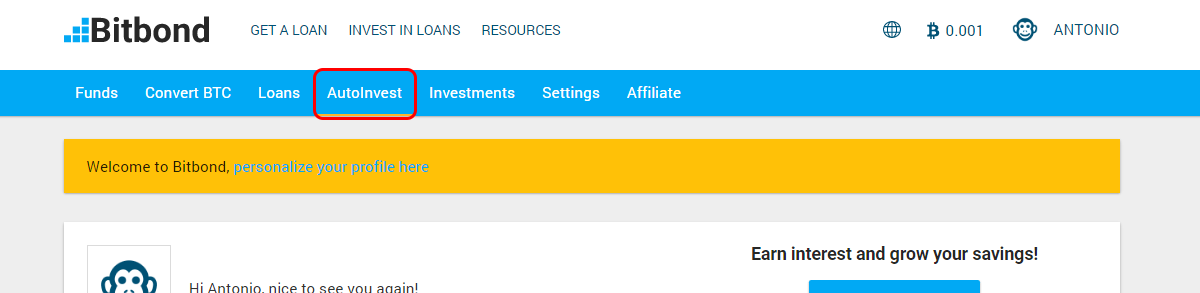

Exchange Venture Capital Wallets [23] [24] [25]. In its pursuit to make investment and finance businesses accessible worldwide, the Berlin-based firm aims to become another essential building block in the bitcoin ecosystem.

Citing the warming attitudes of British regulators [2] toward bitcoin and mobile technology, Point Nine Capital [3] co-founder and managing partner Pawel Chudzinski said that cross-border trade and services activity in the EU is expanding steadily. As a result, he added, there are more international payments transpiring — however:. To focus on Bitbond, I think lending smaller amounts of money internationally to private customers and small businesses is still rather unheard of.

Bitbond launched in July We provide credit and we provide investment opportunities, but there is one crucial difference: We only connect borrowing and lending […] A bank stands more in between the two, while we just connect them. The lenders that sign up, he continued, want to support bitcoin projects or come to the platform to earn interest on their bitcoin savings. They decide independently which projects they find interesting. A former Deutsche Bank trader who became an industry consultant some time after leaving the German banking giant, Albrecht spent roughly six months in Sub-Saharan Africa [7] working on a the post-merger integration of two Nigerian banks.

Lending image [9] via Shutterstock. Bitbond peer-to-peer lending Point Nine Capital [10] [11] [12]. Thompson indicates that Vogogo has become a valuable third-party partner that allows digital currency businesses to mitigate fraud in real time, without having to build in-house systems that meet this need.

Now, Thompson indicated, his firm is looking to build on this success to perform similar services to digital currency companies operating outside of Canada, adding:. So, it was then that you were just starting to see the issues around it. After about three months of development, Vogogo tailored its offering to the digital currency space and began serving the market.

Thompson revealed Vogogo is currently working on a new product release that will allow it to handle KYC, AML and compliance requirements for digital currency exchanges.

Vogogo had historically served e-commerce platforms, and continues to do so. Swarm further highlights an interesting discrepancy in the bitcoin ecosystem. The question is how this new and untested market will mature while responding to concerns that need to be addressed through regulation. One of the most notable examples of cryptocurrency crowdfunding and its current issues was provided this year by decentralized platform provider MaidSafe [7] , which raised money via cryptocurrency, converting bitcoin into a token called MaidSafeCoin.

In essence, many of the coins that MaidSafe ended up with were mastercoins, an altcoin that has be criticized as illiquid. Jeremy Lam, co-founder of Vennd [11] , offers a solution for what happened with the MaidSafe fund raiser. When you have to process these things manually, it just becomes an impossible task entirely.

Used by Swarm, Lam likes to think of his project like a vending machine: Unlike other crowdfunding efforts, the Swarm platform also claims it allows investors to have voting rights with the digital tokens that it dispenses through Vennd. Lam offered a different take, saying that the Counterparty [12] -based decentralized tokens that Swarm disburses for its projects are tangible instruments.

This could include a share of profits or debt issuance. However, one risk with crowdfunding is that the collecting party may not use the money it raises for the express purposes detailed during fundraising. Swarm is not the only project seeking to tackle this cryptocurrency crowdfunding challenge. VC firm Andreessen Horowitz is looking into the concept of funding startup development with distributed coins. This type of coin would be pre-allocated for distributed ventures, which would then disburse appcoins as a scarce resource in return for contributions such as code development.

In the altcoin world, where the development team commonly keeps a certain share of the initial coin offering, this process is known as premining. A contentious subject, premining of any sort has caused a number of altcoins an early demise, as investors may believe that the only purpose of premining is to enrich the original creator of an asset.

The state of Washington, for example, has decided to take companies to task for failing to provide a return on investment for investors who participate in crowdfunding campaigns. That state passed a bill allowing equity crowdfunding [14] back in March.

Cryptocurrency crowdfunding is a way to access funding without knowing accredited investors. However, it can be argued investors in these types of projects are unable to properly evaluate the risk associated with such investments. In crowdfunding, that sort of criticality is not necessarily present. In fact, it seems traditional crowdfunding through sites like Kickstarter attract people who are looking to devote resources towards charitable causes, not necessarily business ventures.

This could easily be interpreted as selling securities, which might stifle innovation, drive it underground, or move it out of countries that apply securities regulations to it. This is an exciting time to join ZipZap and be a part of its growth and the evolution of currency on a global scale.

Launched in , ZipZap originally served as a competitor to cash payment services such as PayNearMe, allowing consumers to make payments with cash at physical locations simply by printing off a payment slip. The company first entered the cash-to-bitcoin space in late [9] when it announced it would introduce cash-to-bitcoin services at its 28, UK merchant locations.

Speaking to CoinDesk in June [10] , CEO Alan Safahi indicated that the company is seeking to position itself as a leader in digital currency remittance services. ZipZap partners with bitcoin exchanges to act as a bitcoin brokerage for global consumers, though the company says it plans to add support for popular altcoins such as litecoin and dogecoin in the future.

ZipZap users can pay for bitcoin with cash at a merchant location, or by bank transfer or wire transfer. ZipZap users can currently buy bitcoin with cash in the US, the UK and Brazil, according to its official website [11]. Wire transfer purchases are available in 75 countries. Alan Safahi zipzap [12] [13].

CrowdCurity is a first-of-its-kind platform that connects businesses with vetted security researchers through bug bounty programs.