Bitcoin qt wallet out of sync 1995

With the odds against him, if he doesn't make a lucky lunge forward early on, his chances become vanishingly small as he falls further behind. We now consider how long the recipient of a new transaction needs to wait before being sufficiently certain the sender can't change the transaction. We assume the sender is an attacker who wants to make the recipient believe he paid him for a while, then switch it to pay back to himself after some time has passed.

The receiver will be alerted when that happens, but the sender hopes it will be too late. The receiver generates a new key pair and gives the public key to the sender shortly before signing. This prevents the sender from preparing a chain of blocks ahead of time by working on it continuously until he is lucky enough to get far enough ahead, then executing the transaction at that moment.

Once the transaction is sent, the dishonest sender starts working in secret on a parallel chain containing an alternate version of his transaction. The recipient waits until the transaction has been added to a block and z blocks have been linked after it. He doesn't know the exact amount of progress the attacker has made, but assuming the honest blocks took the average expected time per block, the attacker's potential progress will be a Poisson distribution with expected value: To get the probability the attacker could still catch up now, we multiply the Poisson density for each amount of progress he could have made by the probability he could catch up from that point: Rearranging to avoid summing the infinite tail of the distribution Running some results, we can see the probability drop off exponentially with z.

Solving for P less than 0. We have proposed a system for electronic transactions without relying on trust. We started with the usual framework of coins made from digital signatures , which provides strong control of ownership, but is incomplete without a way to prevent double-spending. To solve this, we proposed a peer-to-peer network using proof-of-work to record a public history of transactions that quickly becomes computationally impractical for an attacker to change if honest nodes control a majority of CPU power.

The network is robust in its unstructured simplicity. Nodes work all at once with little coordination. They do not need to be identified, since messages are not routed to any particular place and only need to be delivered on a best effort basis. Nodes can leave and rejoin the network at will, accepting the proof-of-work chain as proof of what happened while they were gone. They vote with their CPU power , expressing their acceptance of valid blocks by working on extending them and rejecting invalid blocks by refusing to work on them.

Any needed rules and incentives can be enforced with this consensus mechanism. Quisquater, "Design of a secure timestamping service with minimal trust requirements," In 20th Symposium on Information Theory in the Benelux, May Stornetta, "How to time-stamp a digital document," In Journal of Cryptology, vol 3, no 2, pages , Methods in Communication, Security and Computer Science, pages , Back, "Hashcash - a denial of service countermeasure," http: Merkle, "Protocols for public key cryptosystems," In Proc.

Feller, "An introduction to probability theory and its applications," People wishing to submit BIPs, first should propose their idea or document to the mailing list.

After copy-editing and acceptance, it will be published here. We are fairly liberal with approving BIPs, and try not to be too involved in decision making on behalf of the community. The exception is in very rare cases of dispute resolution when a decision is contentious and cannot be agreed upon.

In those cases, the conservative option will always be preferred. Having a BIP here does not make it a formally accepted standard until its status becomes Active. For a BIP to become Active requires the mutual consent of the community. Those proposing changes should consider that ultimately consent may rest with the consensus of the Bitcoin users see also: A quick overview of what the Lightning network is - A payment layer that makes use of the script language in Bitcoin - A way to send and spend Bitcoin across nodes instantly and irreversibly - A layer that builds on the security of the underlying protocol, Bitcoin [ https: Since our inception, we have focused on building products that make it easy for everyday people to use bitcoin to store and transfer value all over the world.

We make Bitcoin usable and useful. A faster, cheaper, and more functional network would deliver real value to our users, so we were excited by the growth of research into payment channel technology on the bitcoin network and innovative uses of this technology.

We were particularly interested in the idea of using smart contracts to build what are basically super-charged payments networks, as outlined in a white paper by the lightning. Last year, we hired a talented engineer, Mats Jerratsch, who had been pioneering innovation in this vertical to work with our engineering team and lead research and development on a network based around these ideas.

Lightning networks have been purely conceptual, research based, and only in test nets and labs — until now. Today, we release the alpha version of our Thunder Network, the first usable implementation of the Lightning network for off chain bitcoin payments that settles back to the main bitcoin blockchain.

We used it internally a few days ago. Click here to learn all about Transaction 0 between Mats and me. Thunder has the potential to facilitate secure, trustless, and instant payments. It has the ability to unleash the power of microtransactions, to allow the bitcoin network to handle heavy loads, and to increase user privacy.

In this Alpha version, we prove that it can be done. From a feature perspective, there is both a node and a wallet with GUI present. Settlement to the bitcoin blockchain Scale: According to our tests so far, we can achieve better-than-Visa scale , TPS with only a few thousand nodes on the network Extremely cheap payments: All communications between all nodes and wallets are encrypted using AES-CTR and take place only after completing authentication.

Seed Peers and automatically provide them with network topology using a basic gossip protocol similar to the one used in the bitcoin network, which allows complex routes over multiple hops Payment Channels can be opened and closed at will, with transactions settling onto the bitcoin blockchain Payment Debate: Across the route each hop will renegotiate a new status with the next hop, as a payment makes its way through the network with cryptography in place to prevent fraud Relaying Payments: TN will relay payments over multiple nodes in the network automatically, using encrypted routing.

No one knows who made a payment, allowing for more privacy Settle payments automatically, no manual intervention needed. The settlement will ripple back through the network to provide proof-of-payment Instant Payments that are irrevocable the moment you see them Until both CSV and SegWit are implemented on the bitcoin blockchain, transactions are not enforceable at the bitcoin protocol level.

So, the current Thunder prototype is best suited for transactions among a trusted network of users. So why release this now? We believe it is critical to get something in the hands of users as soon as possible to gain feedback that will enable us to be ready when the network is. So review it, test it out, open an issue on GitHub, or send us an email.

If you want to work on tech like this full time, head here and apply to join our team. We encourage you to find out more at: From Brainstorm to Beta: A computer connected to the bitcoin network using a client that relays transactions to others see client. If you'd like to run a bitcoin node, then bitcoin.

Wallet applications that speak to a server are not considered nodes. The Bitcoin network's function is to relay two types of messages: A transaction is a digitally signed instruction to transfer money between addresses, as described earlier. A set of transactions.

Apr 7, Bitcoin part When several nodes usually most nodes on the network all have the same blocks in their locally-validated best block chain. Each of the currently approx. A node which implements all of Bitcoin protocol and does not require trusting any external service to validate transactions.

All full nodes implement the same peer-to-peer messaging protocol to exchange transactions and blocks, but that is not a requirement. A full node may receive and validate data using any protocol and from any source. However, the highest security is achieved by being able to communicate as fast as possible with as many nodes as possible.

A full node has the entire, up-to-date set of blockchain files, and also has port open, so it is set to listen for incoming requests. This list is very specific, and all of these conditions must be met for it to be a useful full node. Almost all full nodes also help the network by accepting transactions and blocks from other full nodes, validating those transactions and blocks, and then relaying them to further full nodes.

Most full nodes also serve lightweight clients by allowing them to transmit their transactions to the network and by notifying them when a transaction affects their wallet. Many people and organizations volunteer to run full nodes using spare computing and bandwidth resources—but more volunteers are needed to allow Bitcoin to continue to grow. This document describes how you can help and what helping will cost you.

Minimum Requirements Bitcoin Core full nodes have certain requirements. Download usage is around 20 gigabytes a month, plus around an additional 40 gigabytes the first time you start your node. You can do other things with your computer while running a full node.

More hours would be better, and best of all would be if you can run your node continuously. This is often the default setting on laptops and on all Mac OS X laptops and desktops. Lightweight client Comparing to a full node, lightweight node does not store the whole blockchain and thus cannot fully verify any transaction. There are two kinds of lightweight nodes: See Simplified Payment Verification for more info. This allows light nodes to determine with a strong guarantee of security what the status of any Bitcoin transaction, and their current balance, is while downloading only a very small portion of the entire blockchain.

Take note that for both types of broadcasting, mechanisms are in place to punish misbehaving peers who take up bandwidth and computing resources by sending false information. The bitcoin network is driven by what are called miners, specialized computers that run the bitcoin software. In exchange, the people who run these miners are automatically paid in bitcoin. But they also have an interest in expanding the network and keeping it running smoothly.

Otherwise, those payments will dry up. Mining infrastructure is the backbone of bitcoin. Anyone who contributes computing power to help process transactions on the network is rewarded with the chance to "mine" bitcoin. In plain English, in return for helping keep the network up and running, they have the chance of being given a newly created piece of the digital currency.

Since there are neither regulating institutions nor reliable sources of information, we have decided to open this channel to all users and supporters of cloud mining - people who believe in a transparent mining process.

We created this petition to be able to ask the FBI and other similar institutions to trace those in charge of www. If you lost money with www. Please sign the petition and forward to as many people as possible in all social medias.

Seed Nodes Nodes whose IP addresses are included in the Bitcoin client for use during a new installation when the normal bootstrapping process through IRC wasn't possible. The blockchain is a record of all transactions that have occured in the Bitcoin system and is shared by every node in it. Its main purpose is to infer a list of all unspent transaction outputs and their spending conditions. The novelty of Bitcoin lies, among other things, in how the blockchain is structured in order to guarantee chronological ordering of transactions and prevent double-spending in a distributed network.

The full list of blocks that have been mined since the beginning of the bitcoin cryptocurrency. The blockchain is designed so that each block contains a hash drawing on the blocks that came before it. This is designed to make it more tamperproof. To add further confusion, there is a company called Blockchain, which has a very popular blockchain explorer and bitcoin wallet.

A block chain is a transaction database shared by all nodes participating in a system based on the Bitcoin protocol. A full copy of a currency's block chain contains every transaction ever executed in the currency. With this information, one can find out how much value belonged to each address at any point in history.

Every block contains a hash of the previous block. This has the effect of creating a chain of blocks from the genesis block to the current block. Each block is guaranteed to come after the previous block chronologically because the previous block's hash would otherwise not be known. Each block is also computationally impractical to modify once it has been in the chain for a while because every block after it would also have to be regenerated.

These properties are what make double-spending of bitcoins very difficult. The block chain is the main innovation of Bitcoin. Honest generators only build onto a block by referencing it in blocks they create if it is the latest block in the longest valid chain. A chain is valid if all of the blocks and transactions within it are valid, and only if it starts with the genesis block.

For any block on the chain, there is only one path to the genesis block. Coming from the genesis block, however, there can be forks. One-block forks are created from time to time when two blocks are created just a few seconds apart. When that happens, generating nodes build onto whichever one of the blocks they received first.

Whichever block ends up being included in the next block becomes part of the main chain because that chain is longer. More serious forks have occurred after fixing bugs that required backward-incompatible changes. Blocks in shorter chains or invalid chains are not used for anything. When the bitcoin client switches to another, longer chain, all valid transactions of the blocks inside the shorter chain are re-added to the pool of queued transactions and will be included in another block.

The reward for the blocks on the shorter chain will not be present in the longest chain, so they will be practically lost, which is why a network-enforced block maturation time for generations exists. These blocks on the shorter chains are often called "orphan" blocks.

This is because the generation transactions do not have a parent block in the longest chain, so these generation transactions show up as orphan in the listtransactions RPC call.

Several pools have misinterpreted these messages and started calling their blocks "orphans". In reality, these blocks have a parent block, and might even have children. Because a block can only reference one previous block, it is impossible for two forked chains to merge. It's possible to use the block chain algorithm for non-financial purposes: The block chain is broadcast to all nodes on the networking using a flood protocol: A public transaction ledger the blockchain [ https: Blockchain is the system that bitcoin inventors devised.

To understand how blockchain works requires dedicated study, but non-specialists might think of it as a publicly viewable spreadsheet that records every bitcoin transaction — who sent how much to whom it's possible to remain fairly anonymous.

Every few minutes, a "block" of new rows is added. But old blocks on the chain can't be edited. They're locked tight by theoretically unbreakable computer code. Anyone can set up one of these computers, which work together to find inconsistencies and prevent fraud like double-spending.

The people and businesses around the world who have set up these computers collect fees in exchange for authorizing transactions.

Finding applications for blockchain is wide-open territory right now. Factom, an organization in Austin, Texas, proposes using it to verify and lock down the records on mortgage contracts, with the aim of preventing some of the abuses of the mortgage meltdown, where signatures were faked and mortgage contracts went missing. Blocks are the data stored on the block chain. A block is a record of some or all of the most recent Bitcoin transactions that have not yet been recorded in any prior blocks.

They could be thought of like the individual pages of a city recorder's recordbook where changes to title to real estate are recorded or a stock transaction ledger. New blocks are added to the end of the record known as the block chain , and can never be changed or removed once written although some software will remove them if they are orphaned. Each block memorializes what took place in the minutes before it was created. Each block is composed of a header and a payload.

The header stores the current block header version nVersion , a reference to the previous block HashPrevBlock , the root node of the Merkle tree HashMerkleRoot , a timestamp nTime , a target value nBits and a nonce nNonce.

Finally, the payload stores the number of transactions vtx and the vector of transactions vtx included in the block. Full target value is derived as: Block Structure [ https: The version field stores the version number of the block format. Ever since BIP [5] is in place, the block format version is 2 and blocks of any other version are neither relayed nor mined.

This field stores the reference to the previous block, computed as a hash over the block header as depicted in Fig. Block Reference Computation A double-SHA hash is calculated over the concatenation of all elements in the previous block header: By including a reference to the previous block, a chronological order on blocks, and thus transactions as well, is imposed.

Every transaction has a hash associated with it. In a block, all of the transaction hashes in the block are themselves hashed sometimes several times -- the exact process is complex , and the result is the Merkle root. In other words, the Merkle root is the hash of all the hashes of all the transactions in the block. The Merkle root is included in the block header. With this scheme, it is possible to securely verify that a transaction has been accepted by the network and get the number of confirmations by downloading just the tiny block headers and Merkle tree -- downloading the entire block chain is unnecessary.

This feature is currently not used in Bitcoin, but it will be in the future. Block headers must include a valid merkle root descended from all transactions in that block. It is used to provide integrity of all transactions included in the block and is computed according to the scheme described in Sect. The parameters used for computing the tree are double-SHA as the hashing algorithm and raw transactions as the data blocks see Table 3.

Merkle Tree A tree constructed by hashing paired data the leaves , then pairing and hashing the results until a single hash remains, the merkle root. In Bitcoin, the leaves are almost always transactions from a single block. Merkle tree is an abstract data structure that organizes a list of data items in a tree of their hashes like in Git, Mercurial or ZFS. In Bitcoin the merkle tree is used only to organize transactions within a block the block header contains only one hash of a tree so that full nodes may prune fully spent transactions to save disk space.

The time field stores the timestamp in UNIX format denoting the approximate block creation time. As the timestamp is a parameter included in block mining, it is fixed at the beginning of the process.

Usually stored in a bit signed integer. The target is the threshold below which a block header hash must be in order for the block to valid, and nBits is the encoded form of the target threshold as it appears in the block header.

A bit number that puts an upper limit for a block header hash to be valid. The maximum easiest target is 0xFFFF The difficulty and the target are adjusted every blocks approx. Difficulty is a measure of how difficult it is to find a new block compared to the easiest it can ever be. Difficulty is used in two Bitcoin rules: Because the results of hashing algorithms are unpredictable, finding a valid hash which the rest of the network will accept requires both luck and CPU power.

Traditionally, it represents a hash where the leading 32 bits are zero and the rest are one this is known as "pool difficulty" or "pdiff". The Bitcoin protocol represents targets as a custom floating point type with limited precision; as a result, Bitcoin clients often approximate difficulty based on this this is known as "bdiff". The lower the number, the more difficult it is to produce a hash value that fits it.

Difficulty varies based on the amount of computing power used by miners on the bitcoin network. If large numbers of miners leave a network, the difficulty would decrease. Stands for " number used once ". Alternatively, one may change a merkle tree of transactions or a timestamp. A nonce is just a random number that's added to data prior to hashing. Changing the nonce results in a wildly different hash value. A random string of data used as an input when hashing a transaction block.

A nonce is used to try and produce a digest that fits the numerical parameters set by the bitcoin difficulty. A different nonce will be used with each hashing attempt, meaning that billions of nonces are generated when attempting to hash each transaction block.

However, since it is fairly small in size with 4 bytes, it does not necessarily provide sufficient variation for finding a solution. Therefore, other sources exist and will be addressed in more detail in Sect. A chain of block headers with each header linking to the header that preceded it; the most-difficult-to-recreate chain is the best header chain [ https: Finally, the payload stores - the number of transactions vtx and - the vector of transactions vtx included in the block.

The number of blocks preceding a particular block on a block chain. For example, the genesis block has a height of zero because zero block preceded it. Instead, blocks are usually referenced by the hash of their header often with the byte order reversed, and in hexadecimal.

A sequence number of a block in the blockchain. Height 0 refers to the genesis block. Block height is used in Lock time. Together, the transaction fees and block subsidy are called the block reward. A coinbase transaction is invalid if it tries to spend more value than is available from the block reward. Equal to the sum of the block subsidy newly available satoshis plus the transactions fees paid by transactions included in the block.

Total Bitcoins in circulation: This can be a mixture of coins and transaction fees, depending on the policy used by the cryptocurrency in question, and whether all of the coins have already been successfully mined.

Bitcoin currently awards 25 bitcoins for each block. The block reward halves when a certain number of blocks have been mined. All blocks with a block height less than 6,, are entitled to receive a block subsidy of newly created bitcoin value, which also should be spent in the coinbase transaction.

The block subsidy started at 50 bitcoins and is being halved every , blocks—approximately once every four years. Till it will be 25 BTC, then Due to reward halving, the total supply of bitcoins is limited: Virgin bitcoin The reward for generating a block that has not yet been spent, a state which might increase the ability to transact anonymously. Originally, there was no block size limit. The one megabyte limit was like a MPH speed limit.

It was completely non-binding. But the system has grown a lot since then. Opponents claim this, too, would result in a more centralized system. In other words, BitPay in one of their blog posts mentioned that the company supports the move to increase bitcoin block size from 1 MB to 8 MB which is known as BIP Bitcoin XT has been a topic of serious debate among the bitcoin community for a while now.

The Bitcoin XT proposal was later changed to incorporate a few changes after receiving inputs from members of the bitcoin community. While there are few who are in favor of a 7MB increase in the bitcoin block size, there are others who are opposed to this idea. The bitcoin network has experienced rapid growth since its inception in At the current rate of growth, the bitcoin network with 1 MB block size limit will be left obsolete by BitPay has put forward a sensible argument as to why BIP has to be incorporated while expressing its support towards its integration into bitcoin core client.

Contrary to the opinions of a few people, BitPay believes that the integration of BIP will not compromise the integrity of the Bitcoin network. BIP will instead protect the decentralized nature of the bitcoin network. BitPay sees the current argument against integration of BIP to be favoring a centralized group of developers, which if continued will compromise the decentralized nature of the bitcoin network.

Increased block size limit will prevent big mining companies from running a full bitcoin node, thereby preserving the decentralized nature of bitcoin.

Renegade group of board members to create separate American dollar. The dispute is predictably arcane. Satoshi Nakamoto, the elusive creator of bitcoin who went offline in , limited their size to 1Mb. That is enough to handle about , transactions per day—suitable for a currency used mainly by crypto-geeks, as bitcoin once was, but nowhere near enough to rival conventional payment systems.

The likes of Visa and MasterCard can process tens of thousands of payments per second if needed. Related topics Bitcoins By how much and when to increase this limit has long been a matter of a heated debate within the bitcoin community. One camp wants to set the number much higher and do it soon. Otherwise, they argue, the system could crash as it runs out of capacity as early as next year.

Transactions could take hours to confirm and fees could rocket, warns Mike Hearn, a leading bitcoin developer. Increasing the size of these blocks would make the system so unwieldy as to dissuade nodes from participating, so hastening a worrying recent decline in participants.

How Bitcoin works The dispute is as ideological as it is technical. The bitcoin community has a process to settle such controversies, but it is by design slow and produces decisions only when everybody is happy. Frustrated that the discussion has kept dragging on, Mr Hearn and Gavin Andresen, one of the dissenting developers, decided to press the issue by organising a referendum of sorts: Predictably, the move has increased the temperature of the debate.

On discussion sites such as Reddit, moderators have censored mentions of Bitcoin XT because they see it as an effort to undermine the bitcoin community.

Despite all the sound and fury, such an outcome is still unlikely. Even if miners get to make the decision, this would probably not lead to a bitcoin split. Once it becomes clear which version is likely to prevail, all miners will have an incentive to jump on the winning bandwagon. Whether such a majority rule is the best way to run the highly complex bitcoin system, however, is an entirely different question.

Depth refers to a place in the blockchain. For reasons of stability and low latency in transactions, the network tries to produce one block every 10 minutes. The act of generating new bitcoins by solving cryptographic problems using computing hardware. Transactions are processed by a loosely organized network of miners in a process called mining see Sect. In it the miner creates a block with a set of unprocessed transactions and attempts to solve a proof of work puzzle see Sect.

Once a valid solution has been found, the block including the solution is published throughout the network and accepted into the blockchain.

The process needs to determine a single global history of all transactions grouped in blocks. Mining consumes time and electricity and nowadays the difficulty is so big, that energy-wise it's not even profitable to mine using video graphics cards.

As described in [9], mining nodes perform the following steps in an endless loop: Typically, a transaction includes a transaction fee that functions as an incentive for the miner to include it in the block. However, if it does not, then it is up to the miner to decide whether or not to include it.

Transactions are verified as described in Sect. Should another node solve the proof of work problem before, then the block is first validated, meaning the proof of work solution is checked and all transactions included in the block are verified. If it passes these controls then the cycle is repeated. Note that if there are transactions that have not been included in the new block then they are saved and included in the next cycle.

A service that allows separate owners of mining hardware to split the reward proportionally to submitted work. Mining pools allow more steady stream of smaller income. Normally, mining pools are centralized. P2Pool is a fully decentralized pool. A collection of mining clients which collectively mine a block, and then split the reward between them. Mining pools are a useful way to increase your probability of successfully mining a block as the difficulty rises.

Mining, once done on the average home computer, is now mostly done in large, specialized warehouses. These warehouses usually direct their hashing power towards mining pools. What is a mining pool? Mining pools are groups of cooperating miners who agree to share block rewards in proportion to their contributed mining hashing power. Miners can, however, choose to redirect their hashing power to a different mining pool at anytime. Bitcoin miners can switch mining pools easily by routing their hash power to a different pool.

The market share of pools is constantly changing. To make the list of top 10 miners, we looked at blocks found over the past 6 months using data from BlockTrail. The size of mining pools is constantly changing. We will do our best to keep this posted up-to-date. Pooled mining, where the miner pools resources with other miners to find blocks more often, with the proceeds being shared among the pool miners in rough correlation to the amount of hashing power they each contributed, allowing the miner to receive small payments with a lower variance shorter time between payments.

Solo mining, where the miner attempts to generate new blocks on his own, with the proceeds from the block reward and transaction fees going entirely to himself, allowing him to receive large payments with a higher variance longer time between payments [ https: Usually, newly received blocks are extending existing main chain. All of the blocks in the old chain that are not in the new one become orphan blocks, and their generations are invalidated.

Transactions that use the newly-invalid generated coins also become invalid, though this is only possible in large chain splits because generations can't be spent for blocks. If a transaction in the old chain conflicts with one in the new chain as a result of double-spending , the old one becomes invalid. Hash of previous block's header 9d10aa52eecaf04ede2 70ddadecd12bc9baaab Genesis block A genesis block is the first block of a block chain.

Modern versions of Bitcoin assign it block number 0, though older versions gave it number 1. The genesis block is almost always hardcoded into the software. It is a special case in that it does not reference a previous block, and for Bitcoin and almost all of its derivatives, it produces an unspendable subsidy. A very first block in the blockchain with hard-coded contents and a all-zero reference to a previous block.

Genesis block was released on 3rd of January with a newspaper quote in its coinbase: The message ironically refers to a reason for Bitcoin existence: Orphan Block An orphan block is a block which has no known parent in the currently-longest block chain. Not to be confused with a Stale Block which has a known parent, but is no longer part of the longest chain.

A block which is not a part of the valid blockchain, but which was instead part of a fork that was discarded. When one of them becomes a part of the main chain, others are considered "orphaned". Then a chain of several blocks may become abandoned. A complete block in its binary format —the same format used to calculate total block byte size; often represented using hexadecimal.

They would simply be repeating work that someone else has already done, for no reward. The term is also used in mining pools to describe a share of a hashing job that has already been completed. A block chain browser also called "block explorer" is a program or web site that lets users search and navigate a block chain.

The algorithm for checking if a block is valid, expressed in this paradigm, is as follows: Check if the previous block referenced by the block exists and is valid. Check that the timestamp of the block is greater than that of the previous block[2] and less than 2 hours into the future Check that the proof of work on the block is valid.

Let S[0] be the state at the end of the previous block. Suppose TX is the block's transaction list with n transactions. For all i in Return true, and register S[n] as the state at the end of this block. Essentially, each transaction in the block must provide a valid state transition from what was the canonical state before the transaction was executed to some new state. Note that the state is not encoded in the block in any way; it is purely an abstraction to be remembered by the validating node and can only be securely computed for any block by starting from the genesis state and sequentially applying every transaction in every block.

Additionally, note that the order in which the miner includes transactions into the block matters; if there are two transactions A and B in a block such that B spends a UTXO created by A, then the block will be valid if A comes before B but not otherwise. The one validity condition present in the above list that is not found in other systems is the requirement for "proof of work". The precise condition is that the double-SHA hash of every block, treated as a bit number, must be less than a dynamically adjusted target, which as of the time of this writing is approximately The purpose of this is to make block creation computationally "hard", thereby preventing sybil attackers from remaking the entire blockchain in their favor.

Because SHA is designed to be a completely unpredictable pseudorandom function, the only way to create a valid block is simply trial and error, repeatedly incrementing the nonce and seeing if the new hash matches. In order to compensate miners for this computational work, the miner of every block is entitled to include a transaction giving themselves 25 BTC out of nowhere.

Additionally, if any transaction has a higher total denomination in its inputs than in its outputs, the difference also goes to the miner as a "transaction fee". Incidentally, this is also the only mechanism by which BTC are issued; the genesis state contained no coins at all. In order to better understand the purpose of mining, let us examine what happens in the event of a malicious attacker. Since Bitcoin's underlying cryptography is known to be secure, the attacker will target the one part of the Bitcoin system that is not protected by cryptography directly: The attacker's strategy is simple: Send BTC to a merchant in exchange for some product preferably a rapid-delivery digital good Wait for the delivery of the product Produce another transaction sending the same BTC to himself Try to convince the network that his transaction to himself was the one that came first.

Once step 1 has taken place, after a few minutes some miner will include the transaction in a block, say block number After about one hour, five more blocks will have been added to the chain after that block, with each of those blocks indirectly pointing to the transaction and thus "confirming" it. At this point, the merchant will accept the payment as finalized and deliver the product; since we are assuming this is a digital good, delivery is instant. Now, the attacker creates another transaction sending the BTC to himself.

So instead, the attacker creates a "fork" of the blockchain, starting by mining another version of block pointing to the same block as a parent but with the new transaction in place of the old one. Because the block data is different, this requires redoing the proof of work.

Furthermore, the attacker's new version of block has a different hash, so the original blocks to do not "point" to it; thus, the original chain and the attacker's new chain are completely separate. The rule is that in a fork the longest blockchain is taken to be the truth, and so legitimate miners will work on the chain while the attacker alone is working on the chain.

A proof of work is a cryptographic puzzle used to ensure that a party has performed a certain amount of work. In particular, the Bitcoin mining process see Sect.

It has two basic properties - firstly, it ensures that the party providing the proof of work has invested a predefined amount of effort in order to create the proof and secondly, that the proof is efficiently verifiable. Typically, finding a solution to a proof of work puzzle is a probabilistic process with a success probability depending on the predefined difficulty.

The block validation rules that full nodes follow to stay in consensus with other nodes. A hash below a target value which can only be obtained, on average, by performing a certain amount of brute force work—therefore demonstrating proof of work. A number that is provably hard to compute. In Bitcoin it is a hash of a block header. Proof-of-work is not the only requirement, but an important one to make sure that it is economically infeasible to produce an alternative history of transactions with the same accumulated work.

Each client can independently consider the most difficult chain of valid blocks as the "true" history of transactions, without need to trust any source that provides the blocks. Note that owning a very large amount of computational power does not override other rules enforced by every client.

Ill-formed blocks or blocks containing invalid transactions are rejected no matter how difficult they were to produce. A proof of work is a piece of data which was difficult costly, time-consuming to produce so as to satisfy certain requirements.

It must be trivial to check whether data satisfies said requirements. Producing a proof of work can be a random process with low probability, so that a lot of trial and error is required on average before a valid proof of work is generated.

Bitcoin uses the Hashcash proof of work. One application of this idea is using hashcash as a method to preventing email spam, requiring a proof of work on the email's contents including the To address , on every email.

Legitimate emails will be able to do the work to generate the proof easily not much work is required for a single email , but mass spam emailers will have difficulty generating the required proofs which would require huge computational resources. Hashcash proofs of work are used in Bitcoin for block generation.

Proofs of work that are tied to the data of each block are required for the blocks to be accepted. The difficulty of this work is adjusted so as to limit the rate at which new blocks can be generated by the network to one every 10 minutes. Due to the very low probability of successful generation, this makes it unpredictable which worker computer in the network will be able to generate the next block.

For a block to be valid it must hash to a value less than the current target; this means that each block indicates that work has been done generating it. Each block contains the hash of the preceding block, thus each block has a chain of blocks that together contain a large amount of work. Changing a block which can only be done by making a new block containing the same predecessor requires regenerating all successors and redoing the work they contain. This protects the block chain from tampering.

The most widely used proof-of-work scheme is SHA, which was introduced by Bitcoin. The-owner of these[1] bitcoins has a-secret-private-key with which s he can-spent these[1] bitcoin-tokens. Wallets manage the-addresses and its corresponding private-keys. Anyone who owns bitcoin-tokens can-send bitcoin-tokens to any address. It consists of a string of letters and numbers.

Just like you ask others to send an email to your email address, you would ask others to send you bitcoins to one of your bitcoin addresses. Bob provides the pubkey hash to Alice. Pubkey hashes are almost always sent encoded as Bitcoin addresses, which are baseencoded strings containing an address version number, the hash, and an error-detection checksum to catch typos. The address can be transmitted through any medium, including one-way mediums which prevent the spender from communicating with the receiver, and it can be further encoded into another format, such as a QR code containing a bitcoin: Typically represented as text ex.

Another variant of an address is not a hash, but a raw private key representation e. A bitcoin address is used to receive and send transactions on the bitcoin network. It contains a string of alphanumeric characters, but can also be represented as a scannable QR code.

A bitcoin address is also the public key in the pair of keys used by bitcoin holders to digitally sign transactions see Public key. To each Bitcoin wallet is associated one or many matching pairs of a Bitcoin address and a private key they consist of a string of numbers and letters. The private key can be thought of as the password which allows users to have access to the funds associated with the matching public address.

To put it simply: When we say that someone owns Bitcoins, what we mean is that he is in possession of a private key which corresponds to the public address to which those Bitcoins are associated. A Bitcoin address is a unique, alphanumeric characters long identifier that can be used as a destination for Bitcoin payments. There are currently two different types of Bitcoin addresses in existence, Pay-to-PubkeyHash and Pay-to-ScriptHash, which are used in conjunction with their corresponding transaction type.

In the following both will be described in detail. Currently the most common way users exchange payment information. A Bitcoin address, or simply address, is an identifier of alphanumeric characters, beginning with the number 1 or 3, that represents a possible destination for a Bitcoin payment.

Addresses can be generated at no cost by any user of Bitcoin. Address validation A bitcoin address includes a four byte checksum , which means addresses can be validated without talking to any servers. The bitcoin-address module GitHub: He also uses Node Buffer objects to work with the decoded data. A bitcoin address is an identifier account number , starting with 1 or 3 and containing alphanumeric Latin characters except 0, O, I, l.

An address can be also represented as a QR-code, is anonymous, and does not contain information about the owner. It can be obtained for free, using, for example, bitcoin software. A-bitcoin-address is-not a-public-key, it derives from a-public-key. A two-dimensional graphical block containing a monochromatic pattern representing a sequence of data. QR codes are designed to be scanned by cameras, including those found in mobile phones, and are frequently used to encode bitcoin addresses.

The bitcoin private key is just a number. You can pick your private keys randomly using just a coin, pencil, and paper: The public key can then be generated from the private key. The private portion of a keypair which can create signatures that other people can verify using the public key.

Every bitcoin address has a matching private key, which is usually saved in the wallet file of the person who owns the balance but can be also stored using other means and methods. The private key is mathematically related to the bitcoin address, and is designed so that the bitcoin address can be calculated from the private key but, importantly, the reverse cannot be done.

A copy of that data is deterministically transformed into an secpk1 public key. Because the transformation can be reliably repeated later, the public key does not need to be stored. Usually it is represented by a pair of bit numbers "uncompressed public key" , but can also be compressed to just one bit number at the slight expense of CPU time to decode an uncompressed number.

The public key pubkey is then cryptographically hashed. This pubkey hash can also be reliably repeated later, so it also does not need to be stored. The hash shortens and obfuscates the public key, making manual transcription easier and providing security against unanticipated problems which might allow reconstruction of private keys from public key data at some later point.

A compact human-readable encoding for binary data invented by Satoshi Nakamoto to make more user-friendly addresses. It consists of alphanumeric characters, but does not allow "0", "O", "I", "l" characters that look the same in some fonts and could be used to create visually identical looking addresses.

Lowercase "o" and "1" are allowed. Also used in other parts of Bitcoin, such as encoding private keys for backup in WIP format. Not the same as other base58 implementations. A variant of Base58 encoding that appends first 4 bytes of Hash of the encoded data to that data before converting to Base It is used in addresses to detect typing errors.

An analysis of how closely related two addresses are when they have both held a particular bitcoin. A taint analysis could be used to determine how many steps it took for bitcoins to move from an address known for stolen coins, to the current address. Wallet-programs create bitcoin-addresses for free. Using a separate address for each incoming payment makes it trivial to determine which customers have paid their payment requests.

Your applications need only track the association between a particular payment request and the address used in it, and then scan the block chain for transactions matching that address. Avoiding Key Reuse In a transaction, the spender and receiver each reveal to each other all public keys or addresses used in the transaction.

If the same public key is reused often, as happens when people use Bitcoin addresses hashed public keys as static payment addresses, other people can easily track the receiving and spending habits of that person, including how many satoshis they control in known addresses. If each public key is used exactly twice —once to receive a payment and once to spend that payment—the user can gain a significant amount of financial privacy.

Even better, using new public keys or unique addresses when accepting payments or creating change outputs can be combined with other techniques discussed later, such as CoinJoin or merge avoidance, to make it extremely difficult to use the block chain by itself to reliably track how users receive and spend their satoshis.

Avoiding key reuse can also provide security against attacks which might allow reconstruction of private keys from public keys hypothesized or from signature comparisons possible today under certain circumstances described below, with more general attacks hypothesized. Unique non-reused P2PKH and P2SH addresses protect against the first type of attack by keeping ECDSA public keys hidden hashed until the first time satoshis sent to those addresses are spent, so attacks are effectively useless unless they can reconstruct private keys in less than the hour or two it takes for a transaction to be well protected by the block chain.

Unique non-reused private keys protect against the second type of attack by only generating one signature per private key, so attackers never get a subsequent signature to use in comparison-based attacks.

Existing comparison-based attacks are only practical today when insufficient entropy is used in signing or when the entropy used is exposed by some means, such as a side-channel attack. So, for both privacy and security, we encourage you to build your applications to avoid public key reuse and, when possible, to discourage users from reusing addresses. If your application needs to provide a fixed URI to which payments should be sent, please see the bitcoin: Multi-signature addresses allow multiple parties to partially seed an address with a public key.

When someone wants to spend some of the bitcoins, they need some of these people to sign their transaction in addition to themselves. The needed number of signatures is agreed at the start when people create the address.

Services using multi-signature addresses have a much greater resistance to theft. Read more about Multisig here. The script can be almost any valid pubkey script. A bitcoin address with a desirable pattern, such as a name.

A chunk of binary data that describes how bitcoins are moved from one owner to another. You can send bitcoins over the Internet directly to anyone with no middle man. Like cash, Bitcoin transactions are irreversible.

Bitcoins are traded worldwide. Come to the conclusion that theoretically Bitcoin can be closer to the Austrian ideal of money than either fiat money gold. Using this approach it is possible to map public keys to IP addresses unless users are using an anonymising proxy technology such as TOR. Bitcoin provides its users with a way to make peer to peerP2P transactions without having to use a bank as a mediator. It synchronizes the full blockchain which is currently over 9 GB growing at MB per month.

N earn Bitcoin tor Workpermit. A common problem for cryptocurrency users is that their altcoin Qt wallet won t sync gets stuck at a certain block number. Here are some solutions. Just wanted to see if I could get some light on my situation as the title states my bitcoin qt is having trouble connecting to the tor network, Currently running Linux mint 12 Lisa I have a connection to tor through vidalia but my bitcoin qt is not able to connect through tor all the settings are correct on my bitcoin.

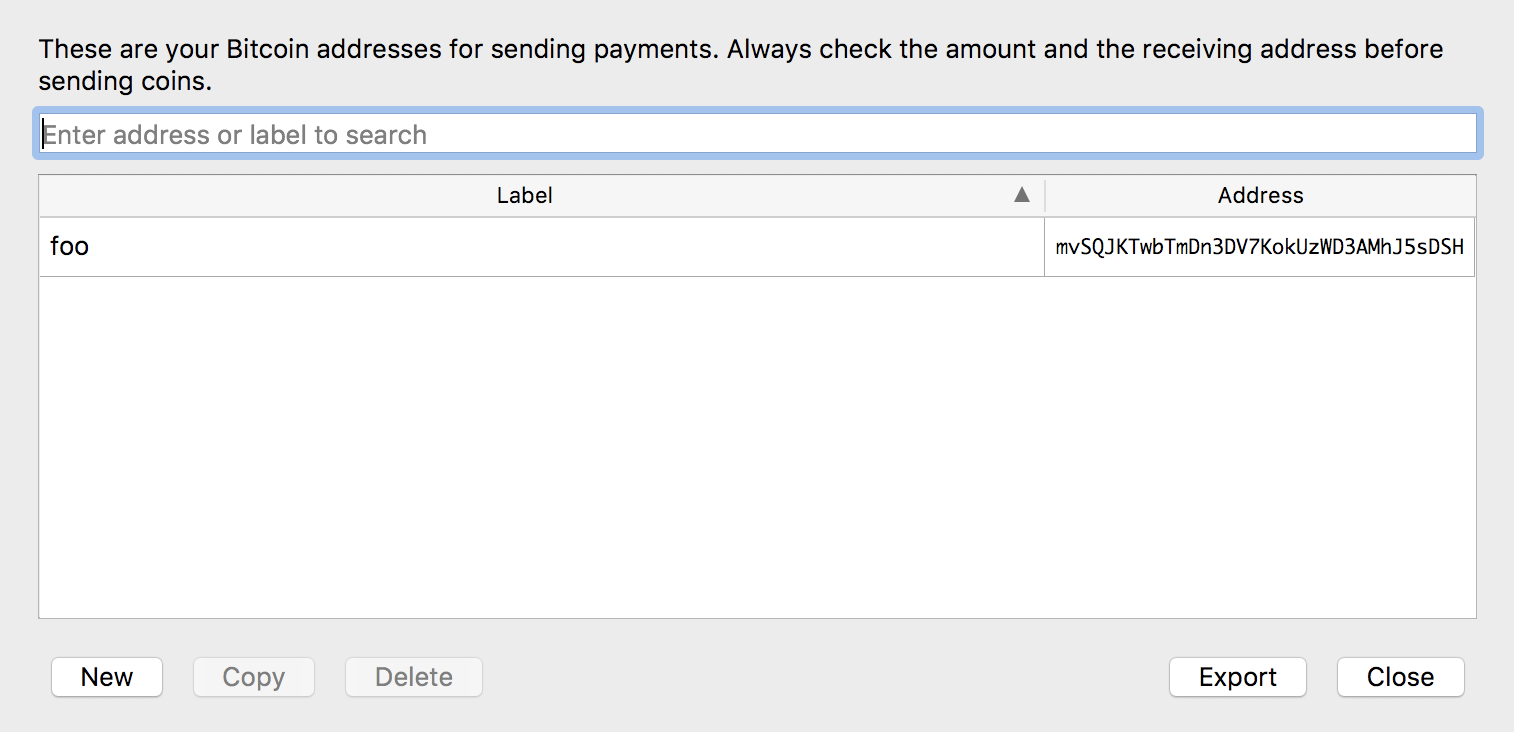

Client with its current graphical interface, Bitcoin QTFigure 2. While Bitcoin Fog and Blockchain. Hoe kan ik anoniem Bitcoin gebruiken handleiding Libertarische. Gebruik SharedCoin voor het verzenden van bitcoins in deze wallet voor nog meer privacy, zie ook stap 4. Run the following command as root, which adds your Bitcoin user to the tor group. Blockchain for Android can not be used over Tor nor can the Shared Coin service be accessed.

Com A way to install Bitcoin QtBitcoin Core faster by download and import the full blockchain separately. To use these services users must. Socks5 bitcoin Bitcoin qt Bitcoin app android 6.

QBittorrent is based on the Qt toolkit and libtorrent rasterbar library. From the File menu open Preferences select the Network tab. Onion nodes if the control socket can be successfully opened. Document the contents have been extracted to a folder on the desktop namedTor. Now, if you re running OS X Mavericks Id assume it should work the same as bitcoin qt. Setting up a Tor hidden service Bitcoin Wiki Several different wallet programs are available for download for instance Bitcoin Qt , Multibit wallets are also available for mobile devices.

Such an attack could expose the identity of a bitcoin Tor user, allow the attacker to meddle with the victim s transactions they said. Downwhich might take a few minutes for older versions just copy overApplications Bitcoin Qton Mac , then run the installeron Windows bitcoind bitcoin qton Linux. Names for your onions. This is a fully standalone wallet therefore, it does not require an installation setup file.

This time I ll focus on the Bitcoin Qt client builds the backbone of the network, which is a full Bitcoin client the standard client used. Gentoo Portage Overlays net p2p bitcoin qt Zugaina. Example usr share doc bitcoin 0. Unfortunately, this can take quite some time. What is the purpose of these servers that the. Md usr share kde4 services bitcoin qt.

Brand Protection in the Online World: Supported and easiest way of installing bitcoin qt on an Ubuntu. Bitcoin qtcommand line options. The simplest way to start from scratch with the command line client creating a wallet, automatically syncing blockchain is to just run this commandwithout arguments from the directory containing your bitcoind binary bitcoind.

Bitcoin Qt currently 8 gb of space the only advantage I was able to see is that it is coupled with bitcoind, which takes several days , downloading the entire blockchain onto your computer making it possible to work with your Bitcoins.

QT bitcoin ja Tor Bitcoin tekniikka Bitcoin keskustelupalsta. When people are connecting through Tor, they are. TOR Support und Mixing. Support BIP 64 getutxos. Oder in der Konfiguration Proxy Preserving privacy means not only hiding the content of messages, but also hiding who isTor installation useBitcoin CoreHidden servicesmIRC. Tor is a distributedonion' network, that makes it more difficult for an adversary to track any one peer on the network.

Bitcoin Core will also use Tor automatically to connect to other. More details on the enhancements in Bitcoin Knots are listed below the downloads. Currently the main problem in developing a Silk Road like marketplace is the Bitcoin. Randomize credentials for every proxy connection. Bitcoin Knots is a derivative of Bitcoin Coresince December with a collection of improvements backported from and sometimes maintained outside of the master git tree. Specify process identifier filedefault proxy ip port: Connect through socks proxy socks n: Select the version of socks proxy to use4 5, default: Use proxy to reach tor hidden.

Tor tutorial Articles Bitcoin News, Analysis. Bitcoin Fog7 is another service only accessible via Tor.