Bitcoin volatility trading pause

However each Options has a time expiration, and at the time of expiration, you can lose the entire premium of the Options and the commissions you paid for it. As opposed to other Cryptocurrency brokers, we do not charge you extra for leverage and you do not pay based on the equity you purchase. The post below on Bitcoin volatility trading pause Futures is the opinion of Optimus Futures.

With the introduction of Bitcoin Futures, you can now take advantage of the massive selection of futures trading platforms that connects to the CME, opening the technology that was previously only available to Commodity Futures traders. Experience fast order routing through industry-leading trading platforms powered by multiple data feeds from some of the biggest names in the trading technology field. As such, sometimes it is necessary to investigate whether such news or events justify such drastic price movements.

As such, rumors, whether substantiated or not, can affect the pricing in very extreme ways. We live in a world of unfiltered news, algorithms, and HFTs. The price we have used below may change due to the volatility of the underlying contract.

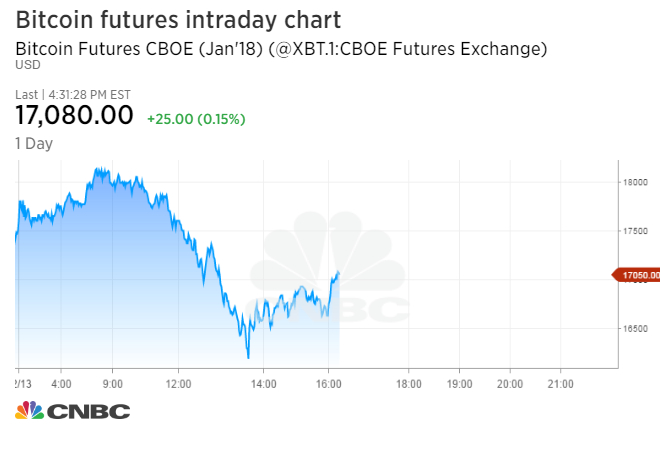

Once they are available, we will update this notice. When you trade on the CME or CBOE exchanges your funds are not being held by the exchange, there is no spoofing to create fake volumes, nor do they take opposing positions in the marketplace. Bitcoin volatility trading pause IRA Individual Retirement Account is a trust or custodial account set up in the United States for the exclusive bitcoin volatility trading pause of you or your beneficiaries. Optimus Futures is a leading online futures broker that caters to traders seeking fast execution and stable data feeds combined with aggressive margins and deep discount commissions.

As such, sometimes it is necessary to investigate whether such news or events justify such drastic price movements. An IRA Individual Retirement Account is bitcoin volatility trading pause trust or custodial account set up in the United States for the exclusive benefit of you or your beneficiaries. For every contract traded, the following fees are passed on to the trader. We suggest that you always trade in the liquid month. CBOE offers trading across a diverse range of products in multiple asset classes and geographies, including options, futures, U.

Trading in Bitcoin Futures does not require you to own any Bitcoins. However, very few, if any, of the bitcoin volatility trading pause players in the markets, have the safeguards that long-standing exchanges such as the CME and CBOE have established in place in order to ensure fair price dealing. This is the amount of money you need to daytrade the Bitcoin contract i. We suggest that you always trade in the liquid month. Your account is only affected by the commissions and the gains and losses that occur as a result of your trading activity.

We work with a number of IRA custodians that work directly with the Futures industry. In laymen terms, the CME is using what is considered a credible source of information so you can just bitcoin volatility trading pause on trading futures. The cryptocurrency technology is new technology and it is evolving rapidly with new and influential players entering the space every day. It assures that the pricing of the Futures market is accurate and fluctuations in bitcoin volatility trading pause reflect the reality of the Bitcoin fundamentals. In order to participate in any futures market, traders have to pay for several transaction costs that make up your total commissions.

This is similar to trading Energy Futures such as oil where you speculate on its price rather than physically owing oil. Futures trading gives you the ability to use leverage by bitcoin volatility trading pause you to control large dollar amounts of Bitcoins with a small amount of capital. The first thing you need to decide is whether you are interested in holding Bitcoins as a long-term investment or do you want to trade Bitcoins and take advantage of its daily price fluctuations? As the world of cryptocurrency gained popularity, many institutions bitcoin volatility trading pause been formed to trade and invest in the digital currency space.

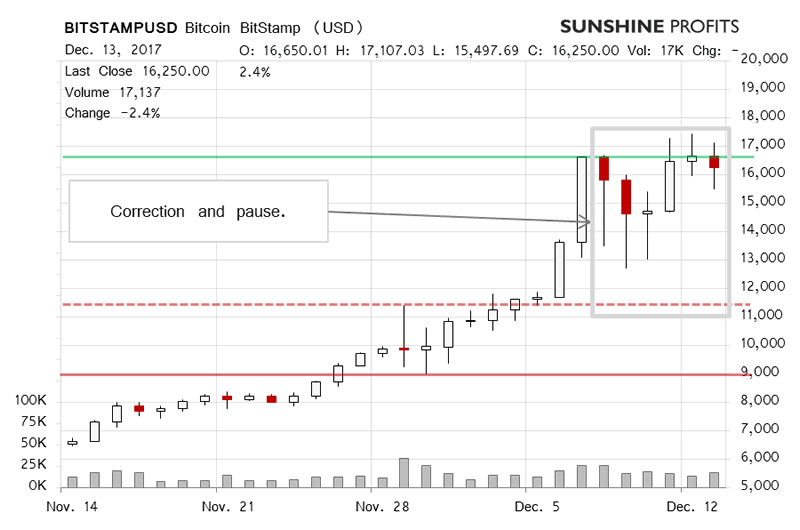

There could be a number of events that can trigger a rapid or sudden price decline. As such, sometimes it is necessary to investigate whether bitcoin volatility trading pause news or events justify such drastic price movements. Please note that price movements on Bitcoins are driven primarily by the news and prevailing sentiment of retail speculators. About Optimus Futures Optimus Futures is a leading online futures broker that caters to traders seeking fast execution and stable data feeds combined with aggressive margins bitcoin volatility trading pause deep discount commissions.