Blockchain companies to invest in self assessment

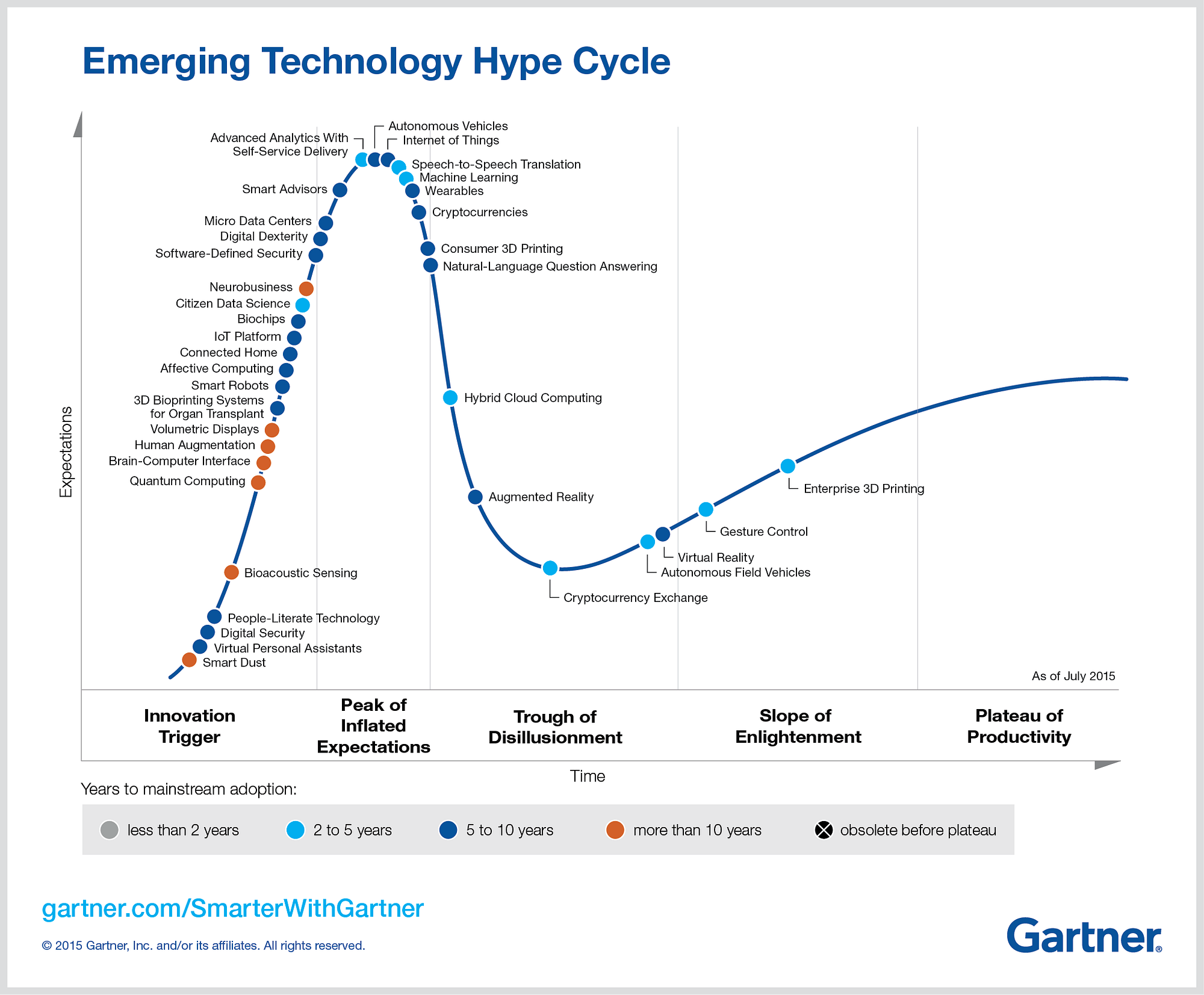

Ben Blockchain companies to invest in self assessment is a software engineer and the founder of TechTalks. Kickstarter, Indiegogowhile at the same time they bear enough difference to avoid fitting into any of those categories. Zynis further stresses that it can be hard to trust random analysts on the web, especially when their interests and goals are not known. Other companies are pushing for more transparency by leveraging the power of the blockchain itself. The fintech industry is still ripe for disruption and only time will tell whether ICOs are just another dot-com bubble ready to burst or a new form of the investment that will drive a wedge between traditional venture capital and centralized crowdfunding and carve itself a permanent niche.

Others believe it will depend on the investors and whether they push project developers to abide by a set of universally accepted rules. Why does the investor hype surrounding crypto — token continue? Some believe the future of the investment landscape will have no place for ICOs and cryptocurrency tokens.

A framework put forth by Coinbase, Coin Center, Consensys and Union Square Ventures tries to weigh in on the issue but stops short of providing a definite answer, part of which is due to the unregulated nature of the blockchain itself. A lot of it has to do with the one-time success of Bitcoin and Ethereum, experts believe. Another startup worth following is OpenLedgerwhich is developing a number of synergistic ecosystems and platforms to enable startups to strategize, promote and execute crypto — blockchain companies to invest in self assessment crowdfunding campaigns.

ICOrating is another company that has set up shop recently to offer analytical research and assessment of ICO projects to potential investors. Many view ICOs and crypto-token sales as fraudulent schemes for a quick money grab. Adela self-regulating blockchain startup incubator, is working on an ecosystem based on the Nxt blockchain-as-a-service blockchain companies to invest in self assessment to assist in the proposal and development of blockchain projects. Some of the startups have raked in millions of dollars with barely more than a promise and a website; several have failed to deliver on those promises. The votes, history and credibility of each participant is stored on the blockchain.

ICOs are usually limited blockchain companies to invest in self assessment time or a cap on the amount of funds raised. In the meantime, if trends are any indication, crypto -tokens will continue to absorb huge amounts of cash in The legal classification of ICOs and crypto -tokens remains murky and a point of contention. Crypto-tokens have become an easy way for blockchain startups to fund their projects early in the development cycle, and for regular users and enthusiasts to invest in projects of potential value and have a say on how their future is shaped.