Buy bitcoin mtgox uk weather

The man Newsweek claims is the founder of Bitcoin has denied he had anything to do with the digital currency. Gox, the best-known operator of a bitcoin digital marketplace, has filed for bankruptcy, according to reports from the Japanese media.

The exchange's website went down on Tuesday, raising doubts about the future of the virtual currency, which is not backed by a government or central bank.

The Silk Road website, which was shut down by the FBI in September , allowed users to trade in illegal drugs and illegal goods online. The two were charged with conspiring to commit money laundering and operating an unlicensed money transmitting business.

European banking regulators have warned consumers against hacking and other risks associated with online currencies like Bitcoin. Its price has shot up this year fuelled by interest from speculators, but there is no protection or compensation for people who use them. Our Economics Editor Richard Edgar reports:.

An IT worker is hunting for a digital fortune he mistakenly threw out with the rubbish when it was a worthless virtual currency.

James Howells from Newport had 7, Bitcoins - an online virtual currency - and it's now worth a fortune. Rupert Evelyn has been to meet him. None of this guarantees your money as totally safe, though.

Same with the new, decentralized exchanges that are coming—exchanges which promise to keep your money safe, by means of technology instead of authority. We'll come to see how well they work. If you're looking for your first exchange , you could do a lot worse than Coinbase , a U.

Coinbase lets you deposit fiat money from a bank account, and trade Bitcoin, Ether, and Litecoin. And while there are hundreds of cryptocurrencies, these three are a very good, core trio. Each shows a lot of promise, each in its own different way. Coinbase is pretty simple. You're never going to see stuff like cryptographic keys or QR codes, which may be intimidating to beginners. But Coinbase isn't without its drawbacks. For one thing, you don't have access to your private cryptographic keys—in other words, you don't actually control the cryptocurrency you have on Coinbase so much as you give it to Coinbase for safekeeping.

Coinbase also charges some fairly big fees on transactions. Finally, there's a pretty long list of complaints on various crypto-related forums about Coinbase freezing customers' funds for dubious reasons. Coinbase also lacks advanced options such as stop-loss orders or margin trading. If that's what you're looking for, take a look at also U.

Another alternative is the Luxembourg-based Bitstamp , which has been around for more than five years and has successfully navigated through many dark periods in Bitcoin's history. Bitfinex is another large exchange, although it was subpoenaed by the U. First, you register with a username and a password, as you would with any other online services. Then, you'll probably be required to send some proof that you are who you say you are—an ID scan, for example.

You don't want to trade at an exchange that accepts just anyone, as that'd likely indicate that the exchange isn't audited to a high standard. Once you've done that, you'll need to send some funds. On Coinbase and Kraken, the easiest way to do that is to follow the instructions on how to transfer the money from your bank account.

In most cases, it'll just be a standard wire transfer, and you can probably get help at your bank if you're unsure what to do. In this example, I'm about to buy a euros worth of Ethereum.

This will cost me an additional 2. Then, you put in a buy order. You choose how much money you want to spend, and which cryptocurrency you want to buy. Congrats, you just became the owner of some digital money.

Selling is similar, and both buy and sell orders will cost you a little, so don't do it just for fun. The exchange might have fees of its own, too, and exchange rates vary considerably from exchange to exchange. Before you open an account and buy your first cryptocurrency, you need to think long and hard why you need it in the first place. If you're here to trade, then just leave it on the exchange or leave just enough so you can trade at volumes you're interested in.

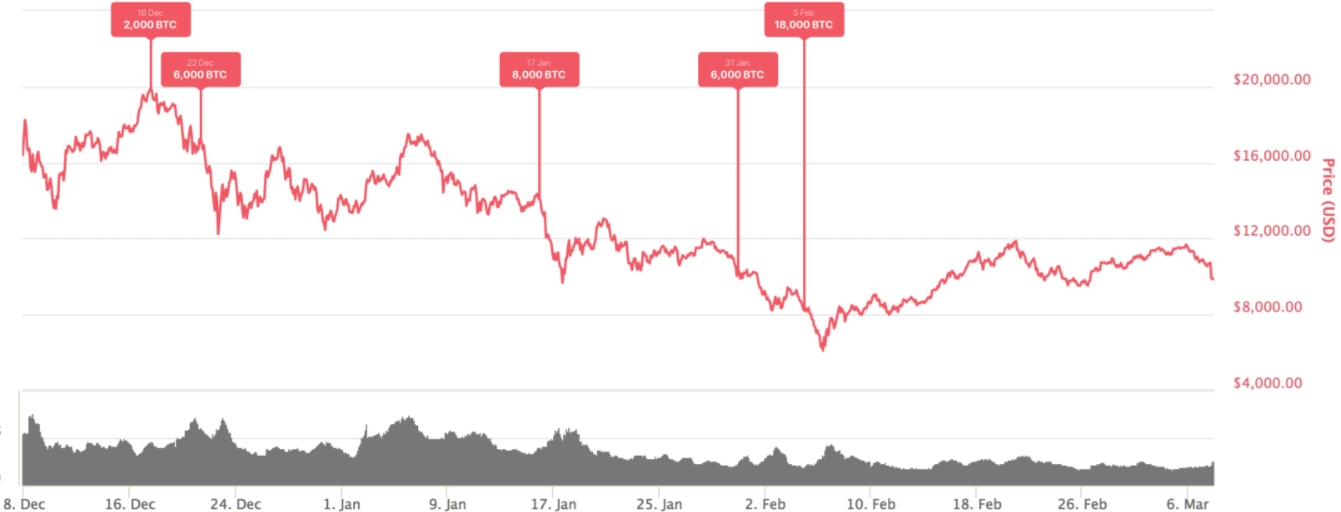

All cryptocurrencies are extremely volatile, and you should be prepared to lose a large percentage of value in a flash. However, the volatility is a risk you need to take if you're interested in trading. Day traders, who typically buy and sell many times during one day, have various way of mitigating risk, including never leaving an open position and using stop-loss orders.

It's very much not recommended to try to guess the market's sentiment in very short time frames, as it's extremely hard to do unless you're an expert. Again, you can just leave your money in the exchange, but that increases the risk of getting swindled by the exchange itself, or a hacker breaking through its security. This risk gets smaller by the day, but it's real. There's a couple of things you can do to minimize that risk, most of which are obvious for example: Also, some exchanges such as Coinbase offer the service of a "vault," which lets you store your bitcoin in such a way that it takes a longer period of time and multiple checks for anyone, including you, to access it.

Alternatively, you can send your crypto to a wallet that you control. There are many software wallets, and some, like the mobile wallet Coinomi , support a large number of cryptocurrencies. For Bitcoin, some popular choices include Electrum and Xapo , which has the added benefit of issuing you a pre-paid card which can be used to spend BTC in stores and ATMs. A small fee will be deducted and you're now in control of your funds.

Again, this comes with certain risks. You could forget your password. You could get hacked. You could lose your smartphone which is why you should always generate and keep a backup phrase somewhere if you have a mobile wallet.

You can also offload your funds to cold storage. This could either be a paper wallet—literally a piece of paper with an address, keys, and a QR code—or a hardware wallet, such as Trezor or Ledger , both of which work with multiple cryptocurrencies.

Hardware wallets come with their own set of instructions, and creating a paper wallet goes beyond the scope of this text, but you'll find excellent tutorials online. Keeping your funds offline makes them safe from hackers.

But that doesn't mean they're impervious to real world threats. For example, a house fire could burn your paper wallet and its associated data, or a flood might destroy your hardware wallet. The main, crucial lesson is: Perhaps you're not interested in saving or trading cryptocurrencies; you want to be an active part of the ecosystem.

Things get a bit complicated here, as each cryptocurrency is different. With Bitcoin, you can buy stuff at numerous online and even some offline stores. Overstock, Steam , and Microsoft all accept Bitcoin in some capacity.

Cryptocurrency is also increasingly appearing as an option on real estate listings. Trulia had 80 listings with prices in crypto in January while Redfin numbered some