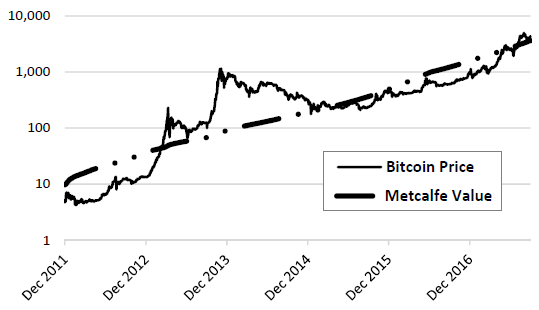

Fundamental interactions bitcoin price

Many people find it difficult to grasp how something which only exists digitally can have any value at all. The answer to this question is rather simple and it lies in basic economics: By definition, if something is both rare scarce and useful utility it must have value and demand a specific price, with all other things being equal. Take gold, for example. Why does gold cost as much as it does? Put simply, it is relatively expensive because it is rare, hard to find and limited in supply scarcity.

Gold also has some uses to which consumers derive satisfaction from utility. Like gold, Bitcoin is also scarce: There are currently just over This set cap is well known, making its scarcity transparent.

However, to have value, Bitcoin must also be useful. Bitcoin creates utility in a number of ways. Like gold, Bitcoin is perfectly fungible one Bitcoin is similar to another , it is divisible you can pay someone a small fraction of Bitcoin, should you want to and easily verifiable via the Blockchain.

Bitcoin also has other desirable properties. It is fast, borderless and decentralised with the potential to change the financial world for better. Not only does it currently have value as a payment system, but also as an asset class a store of wealth. It is also useful because it is built on open protocols, meaning, anyone can innovate on top of it and make the system better.

Bitcoin also has undeniable utility even when compared to other, newer cryptocurrencies. This unit is usually more convenient for pricing tips, goods and services. Bitcoin - with capitalization, is used when describing the concept of Bitcoin, or the entire network itself. A block is a record in the block chain that contains and confirms many waiting transactions. Roughly every 10 minutes, on average, a new block including transactions is appended to the block chain through mining.

The block chain is a public record of Bitcoin transactions in chronological order. The block chain is shared between all Bitcoin users. It is used to verify the permanence of Bitcoin transactions and to prevent double spending. Confirmation means that a transaction has been processed by the network and is highly unlikely to be reversed. Transactions receive a confirmation when they are included in a block and for each subsequent block.

Each confirmation exponentially decreases the risk of a reversed transaction. Cryptography is the branch of mathematics that lets us create mathematical proofs that provide high levels of security. Online commerce and banking already uses cryptography. In the case of Bitcoin, cryptography is used to make it impossible for anybody to spend funds from another user's wallet or to corrupt the block chain. It can also be used to encrypt a wallet, so that it cannot be used without a password.

That sounds like a lot. On the CIA figures, the value of bitcoins hashed into existence is similar to the broad money total for Uzbekistani soms. With apologies to Tashkent, the value of soms and bitcoins, and the number of people for whom they are relevant pieces of information in the world of modern finance, both round to zero. In fact, its rising price even hints at some of its troubles.

As the New York Times reported last year , a small band of Chinese companies have effectively gained control of the currency.

As domestic currency value has fallen, so demand for the digital currency has risen, driving up its value. But such centralization is unwelcome for many users of the currency outside of China. And change is what it probably needs. If the currency is to grow—which, as the Financial Times argues, it clearly needs to—it will need a technical redesign. Currently, Bitcoin can only tolerate up to 7 transactions per second, which is tiny compared to the many thousands that, say, Visa can handle.

The Chinese companies mining Bitcoin could, in theory, join forces to take advantage of the majority loophole. Given the country in which the most prolific miners operate, the news could raise fears about state control. The future of home movies is shooting them in 3-D and playing them back in VR. Men are less likely to do it than women, and mixed-sex pairs least likely of all. A new prototype gets at how—and why—manufacturers and product designers might benefit from a blockchain.