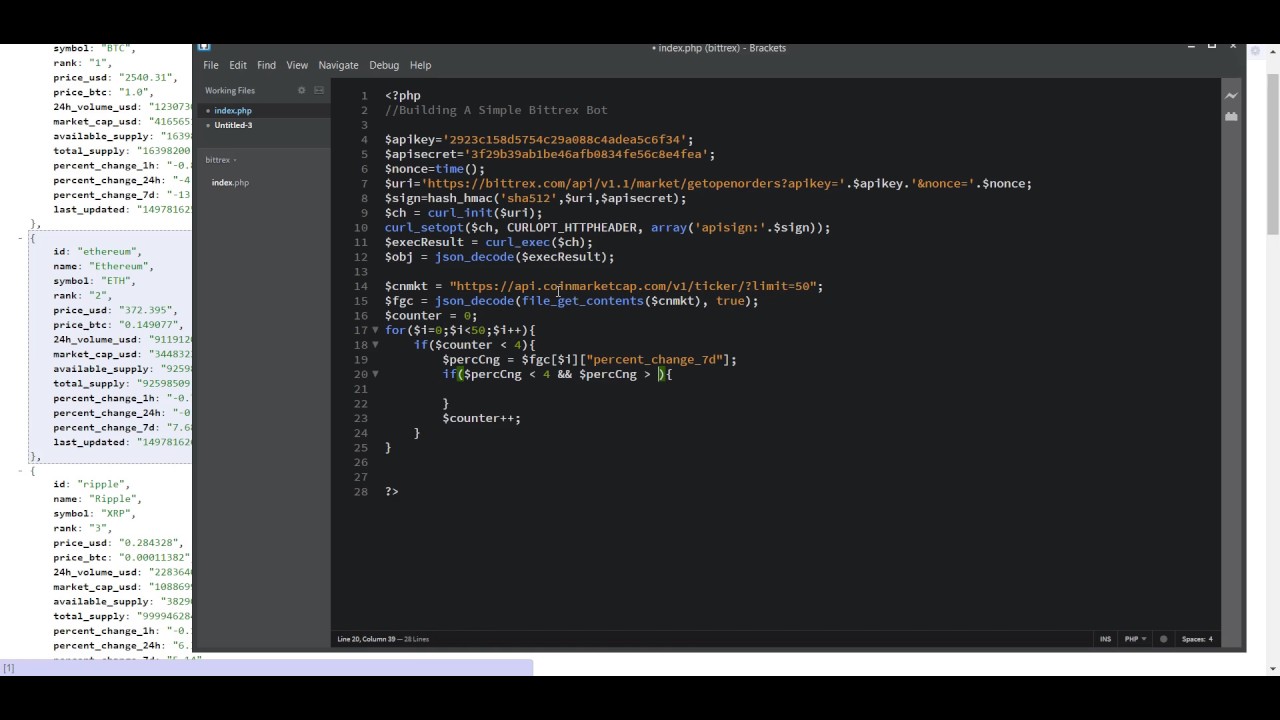

I will be your cryptocurrency trading bot developer

However, some jurisdictions such as Argentina and Russia severely restrict or ban foreign currencies. Other jurisdictions such as Thailand may limit the licensing of certain entities such as Bitcoin exchanges. Bitcoin is money, and money has always been used both for legal and illegal purposes. For instance, bitcoins are completely impossible to counterfeit.

Users are in full control of their payments and cannot receive unapproved charges such as with credit card fraud. Bitcoin transactions are irreversible and immune to fraudulent chargebacks. Bitcoin allows money to be secured against theft and loss using very strong and useful mechanisms such as backups, encryption, and multiple signatures. Some concerns have been raised that Bitcoin could be more attractive to criminals because it can be used to make private and irreversible payments.

However, these features already exist with cash and wire transfer, which are widely used and well-established. The Internet is a good example among many others to illustrate this. Attempting to assign special rights to a local authority in the rules of the global Bitcoin network is not a practical possibility.

Any rich organization could choose to invest in mining hardware to control half of the computing power of the network and become able to block or reverse recent transactions. However, there is no guarantee that they could retain this power since this requires to invest as much than all other miners in the world.

It is however possible to regulate the use of Bitcoin in a similar way to any other instrument. Just like the dollar, Bitcoin can be used for a wide variety of purposes, some of which can be considered legitimate or not as per each jurisdiction's laws. In this regard, Bitcoin is no different than any other tool or resource and can be subjected to different regulations in each country. A government that chooses to ban Bitcoin would prevent domestic businesses and markets from developing, shifting innovation to other countries.

There is a wide variety of legislation in many different jurisdictions which could cause income, sales, payroll, capital gains, or some other form of tax liability to arise with Bitcoin. Bitcoin is freeing people to transact on their own terms. Each user can send and receive payments in a similar way to cash but they can also take part in more complex contracts.

This allows innovative dispute mediation services to be developed in the future. Such services could allow a third party to approve or reject a transaction in case of disagreement between the other parties without having control on their money. As opposed to cash and other payment methods, Bitcoin always leaves a public proof that a transaction did take place, which can potentially be used in a recourse against businesses with fraudulent practices.

It is also worth noting that while merchants usually depend on their public reputation to remain in business and pay their employees, they don't have access to the same level of information when dealing with new consumers. The way Bitcoin works allows both individuals and businesses to be protected against fraudulent chargebacks while giving the choice to the consumer to ask for more protection when they are not willing to trust a particular merchant.

The Bitcoin technology - the protocol and the cryptography - has a strong security track record, and the Bitcoin network is probably the biggest distributed computing project in the world. Bitcoin's most common vulnerability is in user error. This is pretty similar to physical cash stored in a digital form.

Fortunately, users can employ sound security practices to protect their money or use service providers that offer good levels of security and insurance against theft or loss. The rules of the protocol and the cryptography used for Bitcoin are still working years after its inception, which is a good indication that the concept is well designed. The more such issues are discovered, the more Bitcoin is gaining maturity.

There are often misconceptions about thefts and security breaches that happened on diverse exchanges and businesses. However, it is accurate to say that a complete set of good practices and intuitive security solutions is needed to give users better protection of their money, and to reduce the general risk of theft and loss.

It is not possible to change the Bitcoin protocol that easily. Any Bitcoin client that doesn't comply with the same rules cannot enforce their own rules on other users. Therefore, It is not possible to generate uncontrolled amounts of bitcoins out of thin air, spend other users' funds, corrupt the network, or anything similar.

However, powerful miners could arbitrarily choose to block or reverse recent transactions. A majority of users can also put pressure for some changes to be adopted. As a general rule, it is hard to imagine why any Bitcoin user would choose to adopt any change that could compromise their own money. Yes, most systems relying on cryptography in general are, including traditional banking systems. However, quantum computers don't yet exist and probably won't for a while.

In the event that quantum computing could be an imminent threat to Bitcoin, the protocol could be upgraded to use post-quantum algorithms. This bot acts with pre defined.

The ever increasing number of crypto platforms on the market today combined with the vast amount of time it takes to keep on top of the day to day price movements of volatile cryptocurrencies leaves many traders frustrated and time poor. Other benefits of using MT4 as opposed to.

Photo courtesy of John Reinstra. How much of that is designed to appeal to the millennial market and how much appeals to everyone across any age group.

Cortex7 Bitcoin Trading App. Gox s automated trading bot which has been dubbedWilly algorithmic trading is getting a bad rap. Bitcoin Trading Bot reviews scams Bitcoin Chaser With any new technology online there is always the promise of a way to beat the system make money quickly. The most valuable commodity I know of is information Gordon Gekko. ZeroBlock is a very simple and powerful app that allows you to see a simple price chart for Bitcoin.

Check out the Gekko code from Github: We will attempt to inform readers which bots are the best to use. We looked through them to see which are your worth your time. This software helps you open and cancel orders very fast. If you did not already know, CryptoTrader software is an app designed to allow people to easily trade crypto currencies such as Bitcoin. A bitcoin trading bot written in node https. Android app on Google Play.

Bitcoin Trading Bots Reviews information and features analysis of the best bitcoin trading bots. Those sly, sly bots. This review aims to bring real live research to conclude once for all if purchasing BTC Robot is worth your money not. We are told that this allegedly awesome program. Gimmer Bitcoin bot Gimmer is an algorithmic trading platform for Bitcoin and other cryptocurrencies. These are supplied as a. This is not investment advice, im not responsible for your actions.

Waiting for you to place a trade, baiting you by seemingly good Bitcoin prices. Cryptohustlin63 in bitcoin last year. Interestingly enough most people don t realize that many cryptocurrency traders use trading bots to execute trades faster , more efficiently sometimes even in their. Save time on bitcoin altcoin market follow ups , compare prices on different exchanges, get Cexy to show you new coins introductions, list pumping dumping market. Cortex7 is a cryptocoin trading client, compatible with various bitcoin exchanges.

After losing some money on Bitcoin exchanges, I decided to develop my own Trading bot helper. Others like Zebpay Unocoin they are just merchant they charge you higher price they decide what should be the buyi. BitCoin Trader Unbiased Review. We re ecstatic to announce that AlgoTrader 4. Set up trading parameters to your liking in the web UI. Bot shall check the follo. First install the system level dependency Node.

Lurking in the shadows. At least this one is open source which basically means that its worthless probably not malicious. Square has begun selling Bitcoins to ordinary consumers, the fast growing payments company run by the Twitter co founder Jack Dorsey the Chicago Mercantile Exchange will soon allow. With bitcoin counterparty risk with exchanges is a very real thing an added risk beyond what would be consideredmarket risk i. That s exactly what happened on Thursday when Coinbase, the1.

Unlike other algorithmic trading platforms it has a robust open source. Trade Bots handeln im Sinne vieler verschiedener technischen Analysen, Sicherheiten und Absicherungen. Exchange your Bitcoin or other assets to Rupiah instantly only with a few clicks. Find out what bitcoin trading bots are recommended and which are not.

Nucleus Coin is a Custom Application Tokens for short CATs a digital token which is cryptographically secured by the Waves open source blockchain platform. Haasbot supports over 60 candlestick pattern indicators, which execute trades based on. Open Octopocket in Telegram. Recently in one of the previous articles we have covered about bitcoin trading bots and how useful they are when it comes to automating your bitcoin trading process. I had a solid understanding of the fundamentals of trading but not much beyond that.

The first one is probably the best piece on finance I've ever read. It literally answers all those questions any curious person who has ever made a trade might ask. On the other hand, John Hull's book gave me a fantastic introduction on mathematical finance from an applied point of view. I highly recommend both if you are just getting started with trading.

I believe we've reached a peak in the field of AI. We now have both powerful machines and enough data to process. With this in mind, my inner engineer got excited at the possibilities of tackling the market with today's advancement in technology. Besides that, I have an addiction for creating fascinating projects and this was no exception. The huge advantage is that you are not necessarily starting with a handicap against the big trading firms.

That's because when it comes to stock trading, even microseconds could make trades go wrong — such as your bot falling victim of a faster bot's bait offer. And guess who owns the faster servers and bots? With cryptocurrencies however, these small time increments are not nearly as important. Although I believe it's the golden age to be in the Bitcoin market because it's imperfect , I quickly abandoned the idea maybe too quickly? Without boring you with technical details any longer, the solid trading APIs were mostly based on REST, which is not fast enough for what I was aiming for.

For proprietary reasons I will abstain from publicly discussing a lot of details about the technical implementation. Although I get many requests to open-source the project, I believe that disclosing deep details of the models or prediction approach would hurt the advantages that this solutions has over the other existing bots.

However, for anyone willing to learn more about that, I would be more than happy to discuss in private, to some extent. Long story short, I ultimately ended up going for the stock market, but not into high frequency trading in its real meaning.

My bot holds a single position from seconds to minutes sometimes even hours , which makes it more of an automated trader than a high frequency trader. The reason behind this is that being an individual trader makes it extremely hard to compete with the big guys, as you're lacking perks such as very powerful hardware, advance trained software, and great locations for your servers. The closer to the stock exchange you are, the faster you receive the information. Large investment servers are literally paying millions to get their servers a few miles closer to the exchanges.

Their limitation is 3 requests per second, and this was more than enough for my new strategy. Getting solid historical financial data isn't cheap, and with so many people hitting the providers to scrape and download data, I don't blame them for limiting the offered information.

Intrinio is a good provider for real-time stock quotes at very inexpensive prices. However, getting access to more in-depth data would always yield better results. I built the first prototype in a little under a month. I was working late hours, trying to find time around my daily job as a freelancer. At this point the bot wasn't very smart. It took me about 2 more weeks to feed it with data until my error rate was satisfactory, and another 2 weeks to test it before putting it in production.

Summed up, the technical implementation of the current version took about 4 months, with some more improvements along the way. Since I publicly announced it , I've been receiving dozens of offers from trading companies. At the moment the system gives me an edge over other traders. If I sold it, I'd be giving this advantage to other traders and, subsequently, losing my lead.