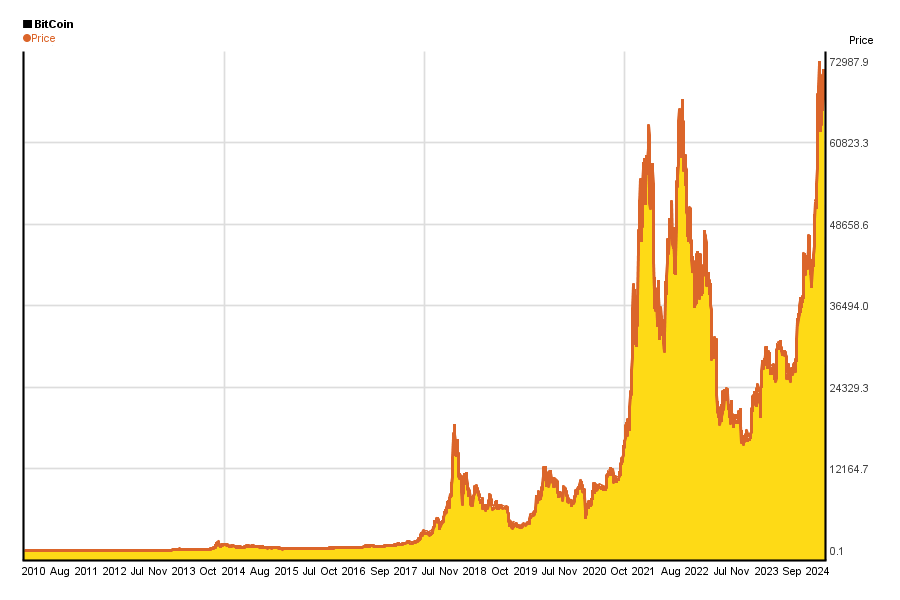

Peercoin bitcoin chart history

Payments in the Peercoin network are made to addresses , which are based on digital signatures. They are strings of 34 numbers and letters which always begin with the letter P. One can create as many addresses as needed without spending any Peercoins.

It is quite common to use one address for one purpose only which makes it easy to see who actually sent the Peercoins. Transactions are recorded in the Peercoin blockchain a ledger held by most clients , a new block is added to the blockchain with a targeted time of 10 minutes whenever a small enough hash value is found for the proof-of-work scheme , a transaction is usually considered complete after 6 blocks, or 60 minutes, though for smaller transactions, fewer than 6 blocks may be needed for adequate security.

New coins can be created in two different ways; mining and minting. Mining uses the SHA algorithm to directly secure the network. There are long term plans to reduce gradually the amount of mining and to rely more on minting. This is to create a fair distribution and could lead to an increase in the reward from minting. The proof-of-stake system was designed to address vulnerabilities that could occur in a pure proof-of-work system.

With bitcoin , for example, there is a risk of attacks resulting from a monopoly on mining share. This is because rewards from mining are programmed to decline exponentially, which may decrease the incentive to mine. This has the effect of making a monopoly more costly, and separates the risk of a monopoly from proof-of-work mining shares.

The whole network uses the SHA Algorithm. For each 16 times increase in the network, the proof-of-work block reward is halved. In July the Bitcoin mining reward halved causing a notable minority of miners to switch to mining Peercoin for better profitability.

Peercoin's proof-of-stake system was developed to address the high energy consumption of bitcoin. This is a combined result of the proof-of-stake minting process, and scaling of mining difficulty with popularity. Peercoin is designed so that variable and optional transaction fees are removed in favor of a protocol defined transaction fee currently 0.

This is intended to offset inflation by deflating the money supply and serves to self-regulate transaction volume, and stop network spam. One issue with a protocol defined transaction fee is that it does not evolve with the value of currency units, and requires a hardfork of the protocol to adjust transaction fees. PeerAssets is a simple, blockchain agnostic protocol which enables peers to issue and transact with assets. PeerAsset protocol based assets can be utilized to represent any type of asset like bonds or equity.

This allows the creation of DAOs and DACs on the Peercoin blockchain, complete with dividend functionality as well as shareholder voting. It will form algorithmically chosen indices and baskets of cryptocurrencies and issue assets corresponding to the value of these baskets. A federated approach will be taken, where a group of founders or a board of directors will perform managerial duties to facilitate operation. According to the original paper, Peercoin uses a centrally broadcast checkpoint mechanism.

From Wikipedia, the free encyclopedia. This article contains content that is written like an advertisement. Please help improve it by removing promotional content and inappropriate external links , and by adding encyclopedic content written from a neutral point of view. November Learn how and when to remove this template message.

This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. This is to create a fair distribution and could lead to an increase in the reward from minting. The proof-of-stake system was designed to address vulnerabilities that could occur in a pure proof-of-work system. With bitcoin , for example, there is a risk of attacks resulting from a monopoly on mining share.

This is because rewards from mining are programmed to decline exponentially, which may decrease the incentive to mine. This has the effect of making a monopoly more costly, and separates the risk of a monopoly from proof-of-work mining shares. The whole network uses the SHA Algorithm. For each 16 times increase in the network, the proof-of-work block reward is halved.

In July the Bitcoin mining reward halved causing a notable minority of miners to switch to mining Peercoin for better profitability. Peercoin's proof-of-stake system was developed to address the high energy consumption of bitcoin. This is a combined result of the proof-of-stake minting process, and scaling of mining difficulty with popularity. Peercoin is designed so that variable and optional transaction fees are removed in favor of a protocol defined transaction fee currently 0.

This is intended to offset inflation by deflating the money supply and serves to self-regulate transaction volume, and stop network spam.

One issue with a protocol defined transaction fee is that it does not evolve with the value of currency units, and requires a hardfork of the protocol to adjust transaction fees. PeerAssets is a simple, blockchain agnostic protocol which enables peers to issue and transact with assets.

PeerAsset protocol based assets can be utilized to represent any type of asset like bonds or equity. This allows the creation of DAOs and DACs on the Peercoin blockchain, complete with dividend functionality as well as shareholder voting.

It will form algorithmically chosen indices and baskets of cryptocurrencies and issue assets corresponding to the value of these baskets. A federated approach will be taken, where a group of founders or a board of directors will perform managerial duties to facilitate operation. According to the original paper, Peercoin uses a centrally broadcast checkpoint mechanism. From Wikipedia, the free encyclopedia.

This article contains content that is written like an advertisement. Please help improve it by removing promotional content and inappropriate external links , and by adding encyclopedic content written from a neutral point of view. November Learn how and when to remove this template message.

This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. February Learn how and when to remove this template message. The topic of this article may not meet Wikipedia's general notability guideline.

Please help to establish notability by citing reliable secondary sources that are independent of the topic and provide significant coverage of it beyond its mere trivial mention. If notability cannot be established, the article is likely to be merged , redirected , or deleted.

Peer-to-peer crypto-currency with proof-of-stake" PDF. Retrieved 19 July A guide to some other cryptocurrencies".