Post trade distributed ledger working group list

FinTech and market electronification. The Corporate Issuer Forum CIF gathers senior representatives of major corporate issuers and focuses on discussing market practice and regulatory topics related to the debt capital markets. Repo and post trade distributed ledger working group list markets: The future of electronic trading of cash bonds in Europe October In light of the shift towards electronification, ICMA conducted a mapping exercise of electronic trading platforms ETPs and information networks.

This initiative resulted in the ETP Mapping Directory, a single source of information on currently over 30 infrastructure providers, which is updated on a regular basis and covers all cash bond classes.

The directory is divided into 10 categories including collateral management, exposure agreements and reconciliations. It provides information on how each solution can be used, for example at which stage of the trade lifecycle, whether for cleared or uncleared transactions and where the solution sits within the IT infrastructure.

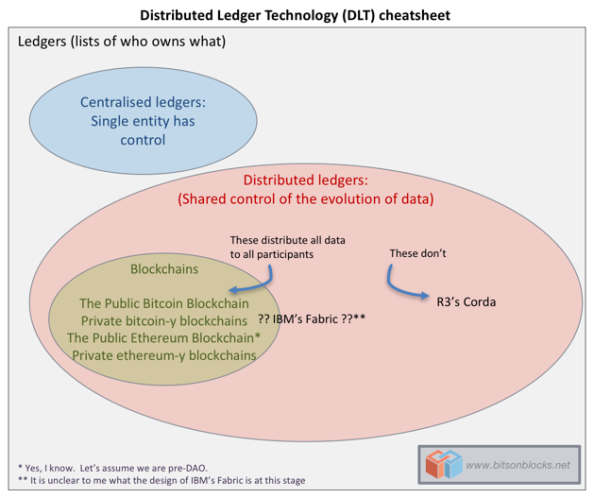

The directory is intended to be a living document and will be updated on a regular basis. Distributed Ledger Technology DLToften referred to as Blockchain, has stirred a lot of interest and enthusiasm across the financial industry. Although discussions are still at a very early stage, DLT is believed to have the potential to substantially change the way financial markets are operating today, promising important cost savings and efficiency gains in particular in the post-trade space.

Regulators and law makers around the post trade distributed ledger working group list, concerned with the regulatory implications of the technology, are increasingly joining the debate. This webpage aims to provide an overview of the most important contributions, focusing on key early regulatory initiatives in this space but also referencing some of the most important industry initiatives and selected other research on DLT.

The aim is not to offer a comprehensive list of available sources on DLT but to limit the overview to the key initiatives. The list will be updated on an ongoing basis as the discussions on DLT are evolving and the impacts are becoming more clear. This follows up on an earlier Call for evidence on Investment using virtual currency or distributed ledger technology published on 22 April and the responses received to that consultation.

Distributed ledger technologies in securities post-trading Revolution or evolution? Distributed ledger technology — panacea or flash in the pan? Post trade distributed ledger working group list Paper on distributed ledger technology April UK Government Office for Science: The Impact and Potential of Blockchain on the Securities Transaction Lifecycle 9 May Some key post trade distributed ledger working group list initiatives A multitude of industry initiatives are under way to develop use cases on DLT, among which several important collaborative cross-industry initiatives, including: PTDL is a London-based industry group that aims to provide a forum where financial institutions can explore and share ideas about how DLT can transform the post-trade space.

The membership is diverse and includes nearly 40 financial institutions and prominent market infrastructures. The Hyperledger initiative was launched in December The project is led by the Linux Foundation and involves both major financial institutions and large technology firms.

The idea is to provide an environment to identify and address important features for a cross-industry post trade distributed ledger working group list standard for distributed ledgers.

R3 is a New York based start-up which leads a consortium partnership with over 40 of the world's largest banks. It aims to provide a forum for the creation of common standards for the use of DLT in finance and create blockchain applications. Unlike the other two initiatives, R3 is a commercial venture. A more detailed overview of industry initiatives is available here financial news.

SWIFT and central securities depositories join forces to post trade distributed ledger working group list the value of standards in distributed ledger technology for securities markets, post trade distributed ledger working group list as proxy voting and digital assets. Brussels, 16 January — SWIFT and seven central securities depositories CSDs have signed a Memorandum of Understanding MOU to work together to demonstrate how distributed ledger technology could be implemented in post-trade scenarios, such as corporate actions processing, including voting and proxy-voting.

The group will investigate the types of new products that can be built using it, and how existing standards such as ISO can support it. Additional CSDs are expected to join in the coming weeks. Today, securities processing, particularly in areas requiring multi-party contact, involve extremely cumbersome manual processes that can carry significant inherent cost and risk. There is clear value in re-using established business definitions and facilitating interoperability amongst DLT implementations, which this project will demonstrate.

The promise of the technology on paper is great, but it is currently missing a key component around standardisation. Other aspects of the MOU include fostering collaboration amongst the CSD community in DLT research and development, helping define the role of financial market infrastructure providers in markets based on distributed ledgers and; identifying, defining and developing additional use cases for DLT in a CSD environment and the post trade distributed ledger working group list landscape, such as services for different kinds of DLT-based digital assets.

In addition, the group will focus on creating and adapting common standards and principles for the use of DLT post trade distributed ledger working group list CSDs and the financial industry, and promoting the adoption of those standards and principles to other parties, including regulators. The framework will identify key definitions, classifications, services and post trade service provider roles.

Findings from the use case on digital assets are expected to be published in Q2. As the industry evolves, DLT-specific standards such as ISOwill provide a great foundation, in terms of both existing business content and approach. The Exchange will open channels of constructive dialogue with various stakeholders to identify the common principals, standards and business rules needed for the successful implementation of DLT in post trade operations, with the aim of enhancing the speed and security of capital market transactions.

This group of institutions —representative of the world market of securities depositories and industry providers - contributes engineers and analysts, which are experts in the business, standards and technology.

Together, they will use DLT to find solutions that will finally facilitate interoperability between global operators of securities markets. Based on our experience, blockchain, smart contracts, and other FinTech solutions may significantly upgrade the quality of services provided to our existing and potential clients. In this context, international cooperation based on the win-win principle will considerably increase the efficiency of such findings and contribute to industry development in general.

We provide our community with a platform for messaging and standards for communicating, and we offer products and services to facilitate access and integration, identification, analysis and regulatory compliance. Our messaging platform, products and services connect more than 11, banking and securities organisations, market infrastructures and corporate customers in more than countries and territories.

While SWIFT does not hold funds or manage accounts on behalf of customers, we enable our global community of users to communicate securely, exchanging standardised financial messages in a reliable way, thereby supporting global and local financial flows, as well as trade and commerce all around the world. As their trusted provider, we relentlessly pursue operational excellence; we support our community in addressing cyber threats; and we continually seek ways to lower costs, reduce risks and eliminate operational inefficiencies.

SWIFT also brings the financial community together — at global, regional and local levels — to shape market practice, define standards and debate issues of mutual interest or concern. For more information, visit www. Please see below commentary from the participating CSDs: Blockchain solutions for payments seem about a dime a dozen.