Proof of resource bitcoin price

Requiring a POW token from users would inhibit frivolous or excessive use of the service, sparing the service's underlying resources, such as bandwidth to the Internetcomputation, disk space, electricity and administrative overhead. In the early days proof of resource bitcoin price Bitcoin, anyone could find a new block using their computer's CPU. Where can I get help? Ethereum Ethereum Classic KodakCoin.

In proof of resource bitcoin price case of Bitcoin, this can be measured by its growing base of users, merchants, and startups. Many early adopters spent large numbers of bitcoins quite a few times before they became valuable or bought only small amounts and didn't make huge gains. With such solutions and incentives, it is possible that Bitcoin will mature and develop to a degree where price volatility will become limited. Additionally, new bitcoins will continue to be issued for decades to come.

However, it is accurate to say that a complete set of good practices and intuitive security solutions is needed to give users better protection of their money, and to reduce the general risk of theft and loss. Known-solution protocols tend to have slightly lower variance than unbounded probabilistic protocols, because the variance of a rectangular distribution is lower than the variance of a Poisson distribution with the same mean. This is how Proof of resource bitcoin price works for most users.

Bitcoins can be divided up proof of resource bitcoin price 8 decimal places 0. You can find more information and help on the resources and community pages or on the Wiki FAQ. Work is underway to lift current limitations, and future requirements are well known. What are the advantages of Bitcoin? Instead, the fee is relative to the number of bytes in the transaction, so using multisig or spending multiple previously-received amounts may cost more than simpler transactions.

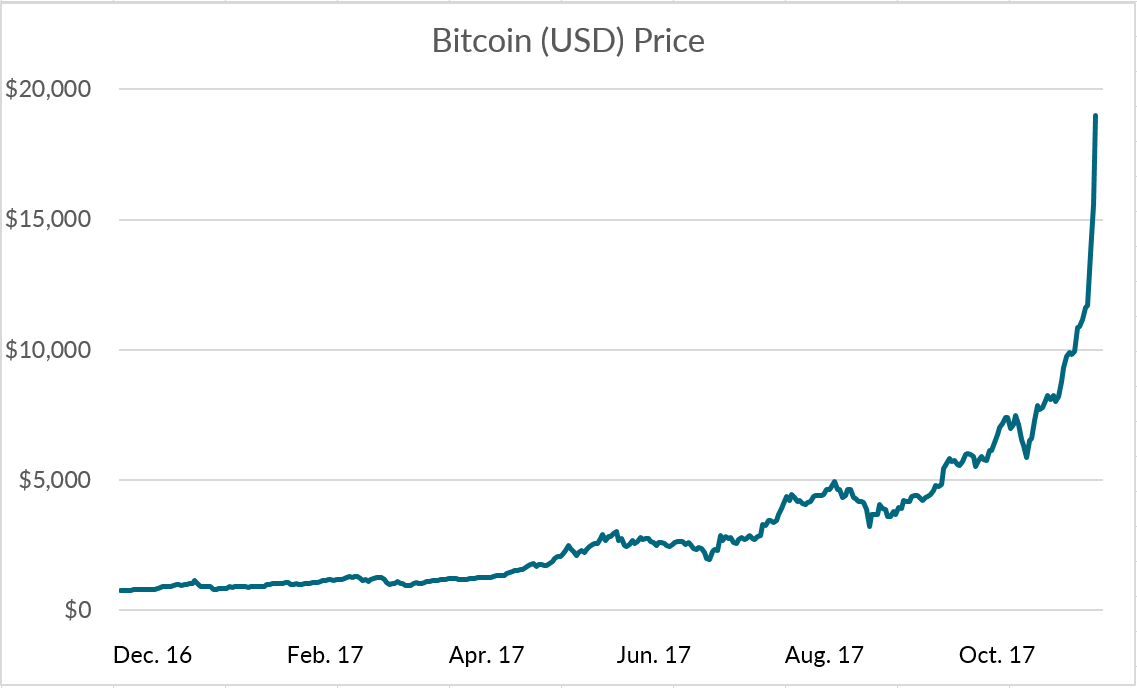

For now, Bitcoin remains by far the most popular decentralized virtual currency, proof of resource bitcoin price there can be no guarantee that it will retain that position. As per the current specification, double spending is not possible on the same block chain, and neither is spending bitcoins without a valid signature. It is more accurate to say Bitcoin is intended to inflate in its early years, and become stable in its later years. Reasons for changes in sentiment may include a loss of confidence in Bitcoin, a large difference between value and price not based on the fundamentals of the Bitcoin economy, increased press coverage stimulating speculative demand, fear of uncertainty, and old-fashioned irrational exuberance and proof of resource bitcoin price.

Behind the scenes, the Bitcoin network is sharing a public ledger proof of resource bitcoin price the "block chain". Why do people trust Bitcoin? Since the source code for Finney's RPOW software was published under a BSD -like licenseany sufficiently knowledgeable programmer could, by inspecting the code, verify that the proof of resource bitcoin price and, by extension, the RPOW server never issued a new token except in exchange for a spent token of equal value. To make it easier to enter a recipient's address, many wallets can obtain the address by scanning a QR code or touching two phones together with NFC technology.

This process is referred to as "mining" as an analogy to gold mining because it is also a temporary mechanism used to issue new bitcoins. Bitcoin use proof of resource bitcoin price also be made difficult by restrictive regulations, in which case it is hard to determine what percentage of users would keep using the technology. Spending energy to secure and operate a payment system is hardly a waste. For bitcoin's price to stabilize, a large scale economy needs to develop with more businesses and users.