Treasury market liquidity risk

This measure is important because low trading volumes may indicate that high transaction costs have deterred investors from making trades, a phenomenon that transaction cost measures would clearly miss because they are calculated from actual trades. The trading volumes depicted in the figure show no obvious signs of a current problem with market liquidity. On balance, the evidence presented in these two figures seems to suggest that market liquidity has not deteriorated in recent years--subject, of course, to the caveat I just discussed about the possibility that our measures of bid-ask spreads could be distorted by the increasing role of investors as suppliers rather than demanders of liquidity.

As an aside, the market liquidity figures shown are only for the corporate bond market, but we see similar patterns in the equity and Treasury markets. Policy Issues Related to Market Liquidity While the evidence for changes in market liquidity does not point clearly to a reduction, I have highlighted some recent research that indicates the possibility that market liquidity has fallen.

To date, observed changes in liquidity do not suggest that shifts in liquidity are having a notable effect on the cost of trading. Nonetheless, the potential for liquidity to evaporate in times of stress deserves careful scrutiny--along with broader risks to financial stability associated with changes in markets. One area where policy concerns have arisen is related to the potential for fire sales in bond markets, which could compound the risks associated with leverage in the financial sector.

Bond markets have grown considerably, and market-based finance has intensified over the past years, making market liquidity even more important. As shown in figure 5 , assets under management in investment-grade and high-yield corporate bond mutual funds the solid blue area have hovered around 25 to 30 percent of the amount of outstanding corporate bonds in recent years, up from about 15 percent before the crisis.

Reduced market liquidity might exacerbate fire sale risks from leverage at financial institutions or from first-mover advantage at mutual funds.

Leveraged institutions are more sensitive to changes in asset prices. Adverse movements in asset prices, margin calls, and higher haircuts may force them to sell assets to obtain cash and delever, affecting other market participants through declining asset prices and increased margin calls. In addition, leverage may closely interact with liquidity risk at mutual funds. Open-end mutual funds are characterized by the so-called first-mover advantage: Investors can redeem daily from the funds that hold assets that are less liquid, while liquidation costs are borne by investors remaining in the fund.

If a decline in bond prices leads to sizable fund withdrawals, the first-mover advantage could accelerate redemptions and second-round price declines. In addition, investors may perceive leveraged funds that experience stress as riskier, possibly becoming more inclined to redeem from these funds. This situation could be worse than in the past if market liquidity deteriorates and dealers are less willing to buy and hold bonds in inventory to cushion the price decline induced by fire sales.

However, thanks to recent regulation and supervisory changes, including higher capital requirements and stress tests, leverage at the largest intermediaries is much reduced relative to pre-crisis norms--and, as a result, vulnerabilities from potential fire sale risks are less significant. From this perspective, a small reduction in liquidity from regulatory changes--even if present, which is not obvious--may be a reasonable price to pay for greater safety.

I will now place changes in liquidity into the broader context of financial stability. Tradeoff between Liquidity and Regulations to Achieve a Safer Financial System It is possible that regulations aimed at correcting vulnerabilities in the financial system--like the Supplementary Leverage Ratio, together with other factors--have altered the business model of dealer firms and, thus, liquidity.

While the evidence for a reduction in market liquidity is far from clear, let us for the moment accept this possibility and consider the potential effects on financial stability.

Regulatory changes, even those that may have reduced market liquidity, likely have enhanced financial stability on balance. Recent evidence indeed points in favor of enhanced financial stability.

Regulatory capital ratios for banks and insurance companies remain high, which, as previously mentioned, would mitigate fire sales and their effect on the solvency and functioning of these institutions.

Leverage at intermediaries is much reduced relative to pre-crisis norms, and gross leverage at hedge funds, based on the partial information available, has not changed much in recent years. Research from economists at the Federal Reserve Bank of New York shows that the decline in leverage, among other factors, has substantially reduced potential fire sale externalities in the banking and broker-dealer sectors.

Regulatory changes are in train for the asset management industry, whose vulnerabilities have been under examination by the Financial Stability Oversight Council and the Financial Stability Board.

Conclusion Overall, liquidity is adequate by most measures, in most markets, and most of the time. Nevertheless, the market structure is changing, and trades in certain situations and in certain market segments might have become more costly. Also, flash events may be more frequent today, and the dynamics of a system with frequent flash events are likely to become complicated. Moreover, some regulatory changes are only now being phased in. In light of these changes and the evolving structure of financial markets, it will be important to monitor and continue to analyze the state of market liquidity.

As we monitor, we should continue to emphasize how the evolution of market liquidity interacts with broader changes to affect the efficient allocation of capital and financial stability. And we should always bear in mind the possibility that new financial developments could change the dynamics of market responses to unanticipated economic developments.

Choi, Jaewon, and Yesol Huh Duarte, Fernando, and Thomas M. Financial Stability Board Financial Stability Oversight Council Trebbi, Francesco, and Kairong Xiao National Bureau of Economic Research. Securities and Exchange Commission, and U. Commodity Futures Trading Commission Securities and Exchange Commission a. In this speech, I am discussing market liquidity, not funding liquidity.

Bessembinder, Jacobsen, Maxwell, and Venkataraman find that bank dealers are less willing to provide liquidity now than in the recent past, while nonbank dealers are more willing. Duffie argues that the negative effect the Volcker rule may have on market liquidity in the short run may disappear in the long run as nonbanks step in to provide liquidity.

Duffie also mentions that the migration of liquidity provision from banks to nonbanks, which are not regulated, may have potentially important adverse consequences for financial stability. See Bao, O'Hara, and Zhou See Powell for a discussion of recent flash events and other changes in the behavior of bond prices. See Adrian and others Treasury and others See Choi and Huh Trebbi and Xiao analyze multiple corporate bond liquidity measures and conclude that there is no evidence of deterioration in liquidity due to regulation.

Secured funding spreads have increased, suggesting higher intermediation costs in the repo repurchase agreement market. A market-based system is one where securities markets share center stage with banks in allocating capital, in contrast to a bank-based system, where banks play a leading role.

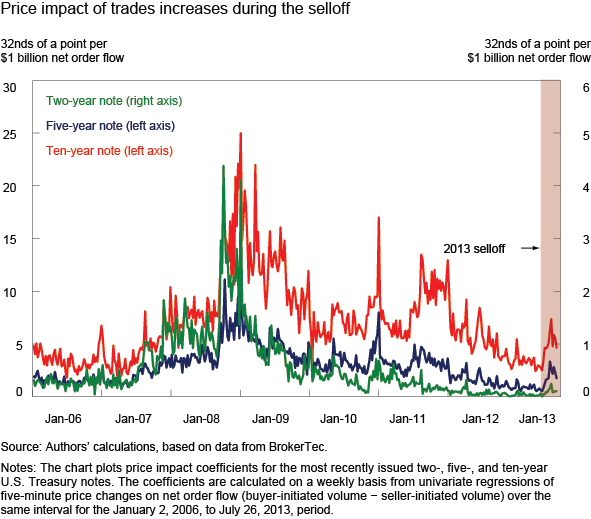

See Duarte and Eisenbach Although liquidity under normal market conditions may not have significantly worsened, it might be that it has become more fragile, or prone to disappearing under stress see, for example, Powell To address that prospect, we consider three case studies on the resilience of market liquidity since the crisis.

In all three instances, the degree of deterioration in market liquidity was within historical norms, suggesting that liquidity remained resilient even during stress events.

While we do not find clear indications of a widespread worsening of bond market liquidity, our analysis faces several limitations, including important limits to available data.

For example, our Treasury market metrics are from the interdealer market, and hence do not gauge liquidity in the dealer-to-customer market. Moreover, our corporate metrics are based on transactions data, and cannot account for the time required to trade or the liquidity of bonds that do not trade. Indeed, as discussed in Fleming , regulators will soon have access to a broader set of transactions data for the US Treasury market. In addition, dealer balance sheets have changed dramatically, and some funding cost metrics, such as the CDS-bond basis, imply increased balance sheet costs, suggesting important changes in dealer behaviour.

Exploring the determinants of such behaviour and how dealer attributes affect market liquidity is a promising avenue of future work.

The views expressed here are those of the authors and do not necessarily represent those of the institutions with which they are affiliated. Financial markets Financial regulation and banking Global crisis.

Market liquidity after the financial crisis Tobias Adrian, Michael J. Fleming, Or Shachar 14 September The potential adverse effects of regulation on market liquidity in the post-crisis period continue to receive significant attention.

The financial crisis, ten years on. Stephen Cecchetti, Kim Schoenholtz. Resilience of market liquidity. Luis Brandao-Marques, Gaston Gelos. Liquidity in the financial crisis: New insights on the lender of last resort.

Understanding liquidity risk and its role in the crisis. Figure 1 Dealer balance sheets stagnated after the crisis Note: Figure 2 Leverage has continued to decline Note: Less abundant funding liquidity. Figure 3 CDS-bond basis is negative after the crisis Notes: Drivers of the changes In a recent paper Adrian et al. Evolution of market liquidity Turning to market liquidity, we find mixed evidence for the Treasury market.

Figure 4 Treasury bid-ask spreads are narrow and stable Notes: Figure 5 Treasury depth is below all-time high Notes: Figure 6 Corporate bond bid-ask spreads have diverged Notes: Liquidity case studies Although liquidity under normal market conditions may not have significantly worsened, it might be that it has become more fragile, or prone to disappearing under stress see, for example, Powell Concluding remarks While we do not find clear indications of a widespread worsening of bond market liquidity, our analysis faces several limitations, including important limits to available data.

Globalisation, government popularity, and the Great Skill Divide. The EMU after the euro crisis: Insights from a new eBook. Spring Meeting of Young Economists Economic Forecasting with Large Datasets. Homeownership of immigrants in France: Evidence from Real Estate.