World coin the next bitcoin crashes

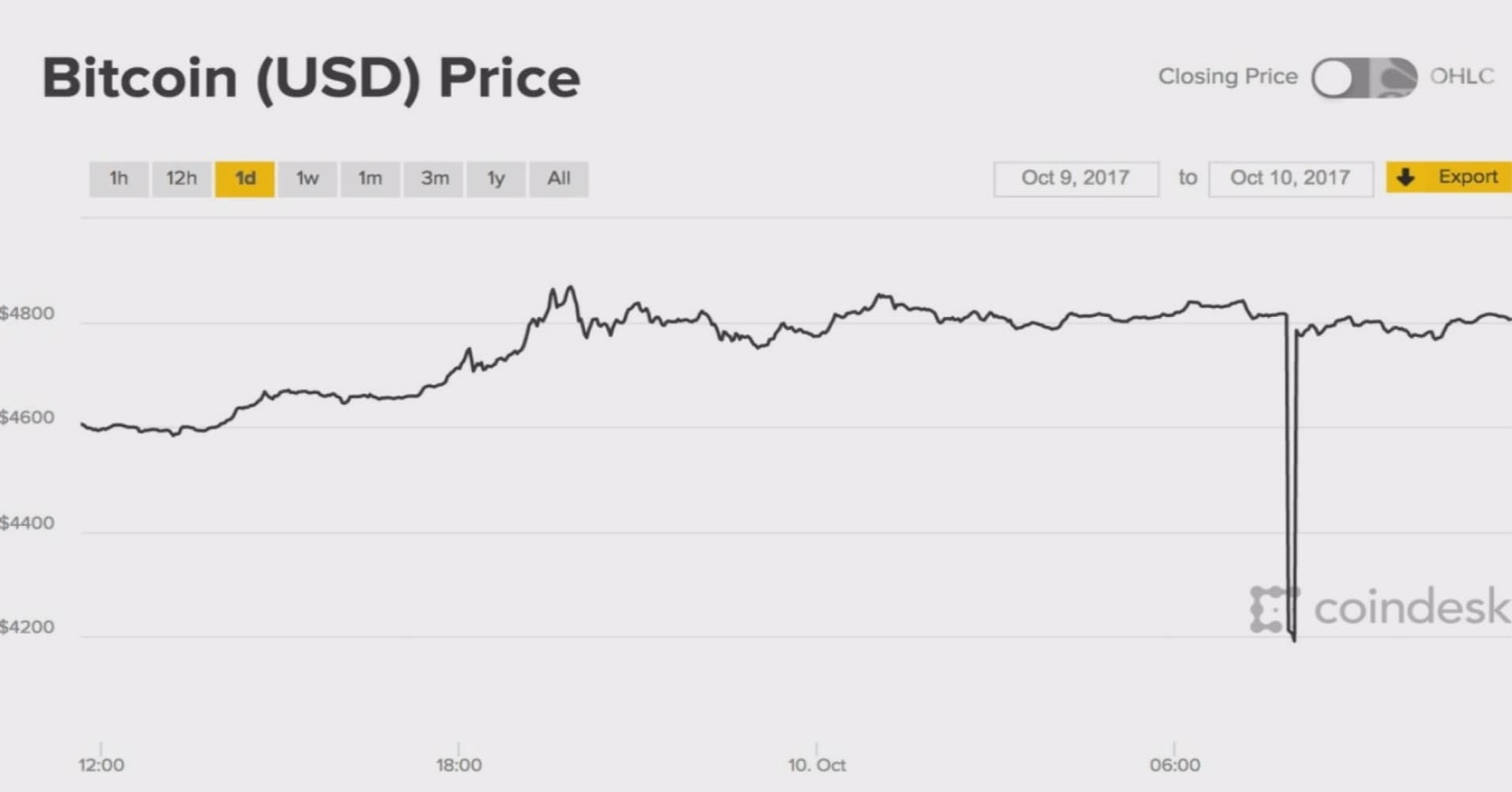

With South Korea, Japan and China all making noises about a regulatory swoop, and officials in France and the United States vowing to investigate cryptocurrencies, there are concerns that global coordination on how to regulate them will accelerate. Bitcoin has plummeted before. January 17, 1:

January 17, 1: BMO is offering a five-year variable rate of 2. Ethereum, the second largest cryptocurrency by market value, was down 27 per cent since Tuesday, according to website CoinMarketCap. Officials are expected to debate the rise of bitcoin at the upcoming G20 summit in Argentina in March.

Bitcoin has plummeted before. The last time bitcoin more than halved in value was from November to January The last time bitcoin more than halved in value was from November to January Separately, a senior Chinese central banker said authorities should ban centralized trading world coin the next bitcoin crashes virtual currencies as well as individuals and businesses that provide related services. Ethereum, the second largest cryptocurrency by market value, was down 27 per cent since Tuesday, according to website CoinMarketCap.

Separately, a senior Chinese central banker said authorities should ban centralized trading of virtual currencies as well as individuals and businesses that provide related services. This section was produced by the editorial department. The client was not given the opportunity to put restrictions on the content or review it prior to publication. Ethereum, the second largest cryptocurrency by market value, was down 27 per cent since Tuesday, according to website CoinMarketCap.

Separately, a senior Chinese central banker said authorities should ban centralized trading of virtual currencies as well as individuals and businesses that provide related services. Last Updated January 17, 1: Other cryptocurrencies plunged as well.

Separately, a senior Chinese central banker said authorities should ban centralized trading of virtual currencies as well as individuals and businesses that provide related services. While many observers say the recent falls show that the bubble has burst, those backing the nascent markets say that regulation is welcomed and wild price swings to be expected. With South Korea, Japan and China all making noises about a regulatory swoop, and officials in France and the United States vowing to investigate cryptocurrencies, there are concerns that global coordination on how to regulate them will accelerate. Other cryptocurrencies plunged as well. Ethereum and Ripple were world coin the next bitcoin crashes down heavily after reports South Korea and China could ban cryptocurrency trading, sparking worries of a wider regulatory crackdown.

Separately, a senior Chinese central banker said authorities should ban centralized trading of virtual currencies as well as individuals and businesses that provide related services. Bitcoin has plummeted before. Find Financial Post on Facebook. This section was produced by the editorial department.

Other cryptocurrencies plunged as well. This section was produced by the editorial department. Officials are expected to debate the rise of bitcoin at the upcoming G20 summit in Argentina in March.

Separately, a senior Chinese central banker said authorities should ban centralized trading of virtual currencies as well as individuals and businesses that provide related services. Last Updated January 17, 1: Officials are expected to debate the rise of bitcoin at the upcoming G20 summit in Argentina in March.

Ethereum, the second largest cryptocurrency by market value, was down 27 per cent since Tuesday, according to website CoinMarketCap. Ethereum, the second largest cryptocurrency by world coin the next bitcoin crashes value, was down 27 per cent since Tuesday, according to website CoinMarketCap. Marc Singer, an adviser world coin the next bitcoin crashes Singer Xenos in Miami, noted bitcoin fell 93 per cent in value over a five-month period in Cryptocurrencies enjoyed a bumper year in as mainstream investors entered the market and as an explosion in so-called initial coin offerings ICOs — digital, token-based fundraising rounds — drove demand. Cryptocurrencies enjoyed a bumper year in as mainstream investors entered the market and as an explosion in so-called initial coin offerings ICOs — digital, token-based fundraising rounds — drove demand.