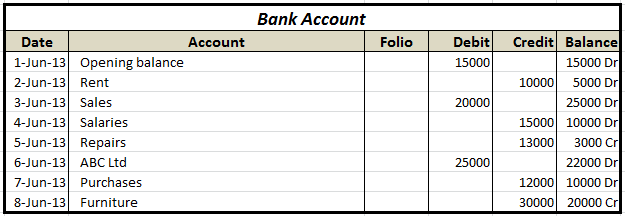

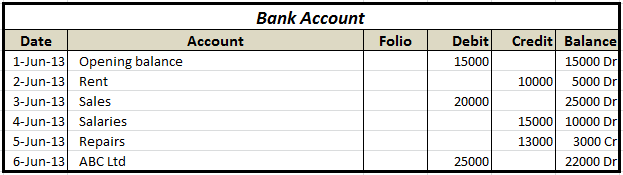

A running balance is maintained in the ledger after each transaction is posted

When you revalue balance sheet accounts, the From date is ignored. The unrealized gain or loss transactions that are created during the revaluation process are system-generated. If you are using those modules, the outstanding transactions should be revalued using the foreign currency revaluation in those modules.

Each accounting entry will post to the unrealized gain or loss and the main account being revalued. Note The feedback system for this content will be changing soon. After the foreign currency revaluation process is complete, a record will be created to track the history of each run. For example, one accounting convention requires assets and liabilities to be revalued at the current exchange rate, fixed assets at the historical exchange rate, and profit and loss accounts at the monthly average.

A separate record will be created for each legal entity and posting layer. The From date and To date values define the date interval for calculating the foreign currency balance that will be revalued. The preview in General ledger is different from the simulation in the AR and AP foreign currency revaluation. Because the AR and AP foreign currency revaluation create accounting entries in General ledger, the accounts receivable and accounts payable main accounts should be excluded from the General ledger foreign currency revaluation.

If no accounts are defined, the accounts from the Ledger page are used. Old comments will not be carried over. The simulation in AR and AP is a report, but general ledger has a preview which can be posted, without having to run the revaluation process again. Realized gain and realized loss accounts are used when settling AR and AP transactions, and unrealized gain and unrealized loss accounts are used for revaluing open transactions and general ledger main accounts.

A new foreign currency revaluation historical record will be created to maintain the historical audit trail of when the revaluation occurred or was reversed. If content within a comment thread is important to you, please save a copy. Set Preview before posting to Yes if you would like to review the result of the General ledger revaluation.

Select the legal entities for which you want to run the revaluation process. The General ledger foreign currency revaluation can be used to revalue the balance sheet and profit and loss accounts. The Date of rate can be used to define the date for which the exchange rate should default. Select which main accounts to revalue:

The accounting currency will be included in the list, but nothing will be revalued if the accounting currency is selected. The results of the preview can be exported to Microsoft Excel to retain the history of how the amounts were calculated. Realized gain and realized loss accounts are used when settling AR and AP transactions, and unrealized gain and unrealized loss accounts are used for revaluing open transactions and general ledger main accounts.

If the main account should be revalued in General ledger, select Foreign currency revaluation. The results of the preview can be exported to Microsoft Excel to retain the history of how the amounts were calculated. You can reverse the results of the revaluation out of date order, but you may need to also reverse a more current revaluation to ensure the correct balances for each revalued main account. The revaluation process can be run for one or more legal entities. When you revalue profit and loss accounts, the sum of all transactions that occur within the date interval are revalued.

The Date of rate can be used to define the date for which the exchange rate should default. If you want to further restrict the range of main accounts, use the Records to include tab to define a range of main accounts, or individual main accounts. Specify the Exchange rate type. Instead, the balance to be revalued is determined by going from the beginning of the fiscal year until the To date.