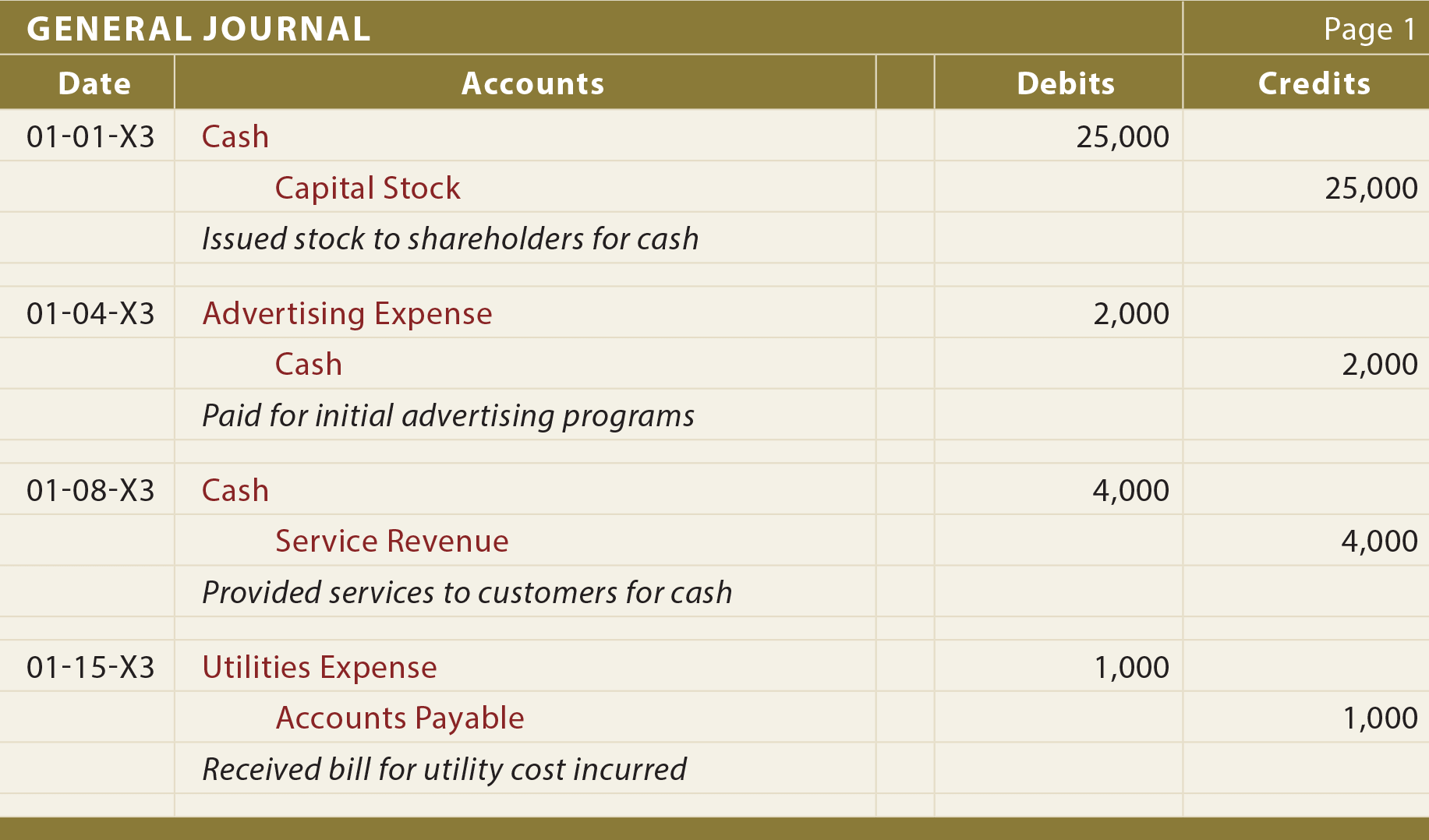

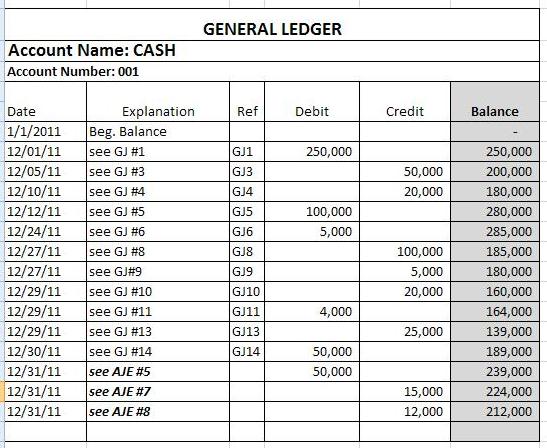

General journal general ledger examples transactions

VAT is calculated separately for the main account and the balancing account, so they can use different VAT percentage rates. You can enter various accounts on different allocation lines if rent will also be divided among several accounts general journal general ledger examples transactions, or you can enter the same account but with various dimension value codes for the Department dimension on each line. If you will use the same accounts and text on the line but the amount will vary every time you post, you can choose to delete the amount after posting. Values in the Document No. Note The following procedure refers to the item journal, but the information also applies to the general journal.

To make sure that you do not receive posting errors because of the document number order, you can use the Renumber Document Numbers function before you post the journal. Note The following procedure refers to the item journal, but the information also applies to the general journal. Note The VAT fields can be filled in on either the recurring journal line or on the allocation journal line but not on both.

The balance on the account general journal general ledger examples transactions be set to zero, and a balancing entry is posted on the next day. After documents are renumbered, you can proceed to post the journal. If the field is blank, the line will be posted every time you post until it is deleted from the journal. The allocation will remain in the allocation journal after posting, so you do not need to enter amounts and allocations every time you post the recurring journal line. Note VAT is calculated separately for the main account and the balancing account, so they can use different VAT percentage rates.

There are several general journal templates. So if you allocate a recurring line to various dimension values in the Allocations window, then only one reversing entry will be created. Note The feedback system for this content will be changing soon. Otherwise, fill in both the Account No. Now the item journal is filled with general journal general ledger examples transactions lines you saved as the standard item journal.

The feedback system for this content will be changing soon. If related journal lines were grouped by document number before you used the general journal general ledger examples transactions, they will remain grouped but may be assigned a different document number. If you selected the Save Unit Amount or Save Quantity fields, you should now make sure the inserted values are correct for this particular inventory adjustment before you post the item journal. To review a standard item journal before you select it for reuse, choose the Show Journal action. The General journal general ledger examples transactions fields can be filled in on either the recurring journal line or on the allocation journal line but not on both.