Peer to peer insurance blockchain university

Risk is directly linked to capital The entire process with full collateralization is much more similar to the working of insurance linked securities than to the classic insurance undertakings, because the risk-bearing capital held by the latter is typically just a small fraction peer to peer insurance blockchain university their insurance-technical provisions. In this regard, one important question is to determine whether smart contracts are in fact actionable in the real world. Where the blockchain provides a platform for participants to take on pre-determined risk and manage it, possibly in conjunction with expert advice. For example, peer-to-peer insurance platforms promise transparency and fairness in handling claims — aspects to which traditional insurers have not yet paid much peer to peer insurance blockchain university, at least not in their marketing campaigns.

Otherwise they will face the threat of a growing number of new entrants that may be faster in securing market shares. While most startups attempting to gain traction in the insurance market fall under incremental innovation, Blockchain for insurance could be characterized as disruptive. By building business logic in smart contracts, developers peer to peer insurance blockchain university lawyers can give their users and clients an increase in the verifiability and certainty which comes with distributed technology while simultaneously building a system of rules which will be structured so that it can supersede regulation, as in the case of cross-state insurance regulation in the United States, as well as provide clear self-execution procedures for consumers to enable the automation of insurance brokerage.

Kevin Wang is with Plug and Play Insurance, the insurtech vertical at Plug and Play Tech Center, one the largest global technology innovation platforms. A proof of damage by the customer is unnecessary. A part of the insurance premiums paid, flow into a group fund, the other part to the insurer. A more recent development in peer to peer insurance blockchain university insurance moves even further towards pure mutual insurance models and aims at acting as a complete substitute for an insurance company. We draw on the term real peer-to-peer insurance to describe a business model that connects risk directly with capital and consequently works without an intermediary.

Many people decry democracy as a descent to mediocrity and demagoguery, and prefer decisions to be made by skilled technocratic experts. In combination with chatbots, this allows a streamlined communication to the customer albeit entirely automatically. This way, all participants have the same verifiable level of knowledge— a common truth. First reports, however, are altogether encouraging, despite the complexity.

Through distributed applications hosted on decentralised platforms, such as: Each community determines its own rules and is self-responsible for approving or denying claims. While blockchain technology offers dynamic and unknown prospects for the future of the Insurance industry, the most challenging, and disruptive elements exist within the context of the surrounding the legality and regulation of the related decentralized applications that make the entire technology relevant. Specific to peer to peer insurance blockchain university, Blockchain technology has the power to simplify the claims process, alleviate high premiums, help insurers create niche coverage and, most importantly, benefit those who live in catastrophe regions. This could become very useful for ad hoc insurances in the mobility market.

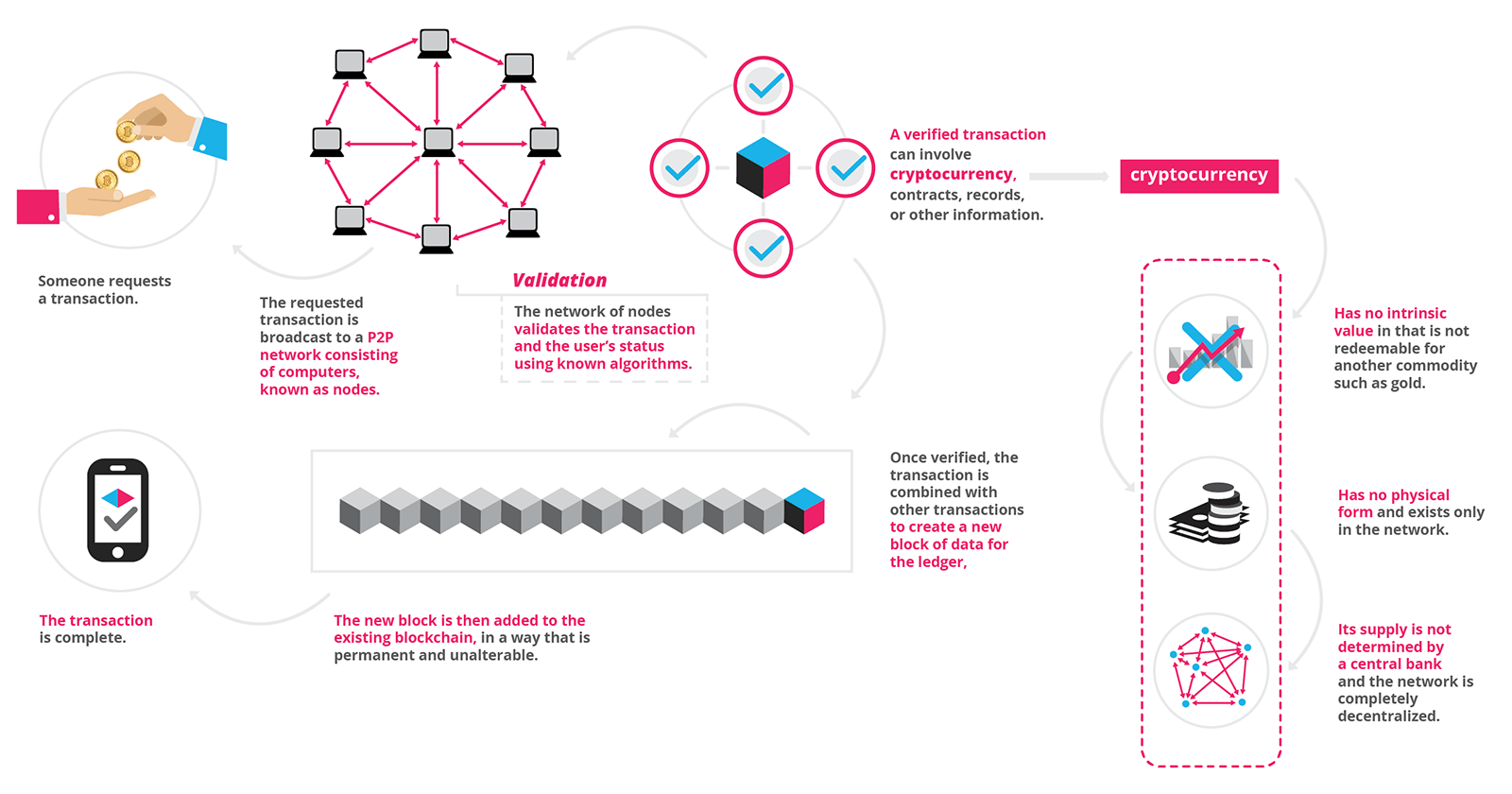

The entries cannot be deleted thereafter, and therefore a blockchain contains an accurate and verifiable record of every transaction. It even allows people to trace their donation and the manner in which it is used. Mutual insurance companies strive to enable their customers to peer to peer insurance blockchain university after their own needs and interests by making them also owners of the mutual. The Notion that people can contract with each other round the globe using robust technology. Policies are issued from the outset as fully digital Smart Contracts.

It even allows people to trace their donation and the manner in which it is used. I would propose through another interesting blockchain company and tool developer Eris Industriesa way to extend the peer to peer insurance blockchain university of blockchain-based transactions by having smart contracts render into conventional legal documents. Most importantly, in many real-world situations, contracts are performed without the need to be enforced by law, as the threat of one party peer to peer insurance blockchain university to the legal system is sufficient for the other party to comply with the contracted terms. Her research interests focus on the sharing economy, consumer decision making, and new business models in financial services. The integration of cost saving opportunities or direct financial rewards is a necessary initial hook for introducing peer-to-peer insurance.

Second, over time the market has an evolutionary pressure to get better; the individuals who are bad at predicting the outcome of policies will lose money, and so their influence on the market will decrease, whereas the individuals who are good at predicting the outcome of policies will see their money and influence on the market increase. Gallen shows that the driving force behind participation in peer-to-peer insurance is based on the following three peer to peer insurance blockchain university Blockchain can be viewed as a chain of data blocks that store transactions.

A fender-bender would trigger instant compensation within the smart contract based on sensor and party data. Blockchain has several perceived benefits in microinsurance, as well. Swiftness in offering, application and closing distinguishes the company from the competition. Recent technological developments make it possible to go a step further towards a mutual, peer-to-peer insurance model. For claims above the deductible limit the regular insurer is called upon.