Rising network fees are causing changes within the bitcoin economy

Payments in person, for small amounts, can be conducted in a wide variety of options: Payments across the world, however, are a very different story. There are only a few currencies that are accepted for payment worldwide, rising network fees are causing changes within the bitcoin economy The vast majority of international payments are denominated in one of these currencies, with only a tiny percentage shared by a few other major currencies.

To send these currencies in values around thousands of dollars internationally costs dozens of dollars usually, and is subject to invasive forensic examination by financial institutions.

Bitcoin is money free of counter-party risk, and its network can offer final settlement of large volume payments within minutes. Bitcoin can thus best be compared to settlement payments between central banks and large financial institutions, and it compares favorably to them, being infinitely cheaper and more verifiable.

The only other form of money in history which is free of counter-party risk is gold, and moving that around is incomparably more expensive. An interesting thought experiment is to imagine the shape of a global economic system built around settlement in Bitcoin. This number of transactions can allow a global network of banks to each have one daily transaction with every other bank on the network.

Bitcoin can support an international network of central banks capable of performing daily final settlement with one another. Such a network would have two major advantages over the current network of central banks: First, the finality of settlement on Bitcoin does not rely on any counter-party, and does not require any single bank to be the de facto arbiter, making it ideal for a network of global peers, rather than a global hegemonic centralized order.

Second, the Bitcoin network is based on a form of money whose supply cannot be inflated by any single member bank, making it a more attractive store of value proposition than national currencies whose creation was precisely so their supply can be increased to finance governments.

In a world in which no government can create more Bitcoin, these Bitcoin central banks would compete freely with one another in offering physical and digital Bitcoin-backed monetary instruments. Sound money has been a necessary building block of human civilizations, and its demise has usually coincided with civilizational decline. The modern world was built in the 19 th century on sound money, funded by investors with the low time preference engendered from a sound money.

The consumerist culture of instant gratification of the twentieth century, on the other hand, rising network fees are causing changes within the bitcoin economy the culture of ever-devaluing fiat money, which discourages saving, and incentivizes short-term orientation. The obsession with consumer payments in the Bitcoin community rising network fees are causing changes within the bitcoin economy an unfortunate relic of the fiat money era.

Generations that have only known monetary hot potatoes that need to be spent before they devalue have come to view life as a quest of mass consumption. In a world of sound money, people will still consume, of course, because they need to survive. But consumption will come at a high opportunity cost in the future, since savings appreciate.

As result, consumption will stop being a compulsive part of life, and people will buy things they need, and things that last for a long time. The reality is that buying a coffee does not require the level of security and trustlessness that Bitcoin offers; it can be more than adequately handled on second layer solutions denominated in Bitcoin.

Using Bitcoin for consumer purchases is akin to driving a Concorde jet down the street to pick up groceries: Consumer payments are a relatively trivial engineering problem which the modern banking system has largely solved with various forms of credit and debit arrangements.

Whatever the limitations of current payment solutions, they will stand to benefit immensely from the introduction of free market competition into the field of banking and payments, the most sclerotic industry in the modern world economy, owing to its control by governments that can print the money on which it runs. If the consumer-payments view of Bitcoin were correct, the rise in transaction fees would hurt adoption of the network, leading to stalling in the price, or a drop, as the network is relegated to the status of a curiosity.

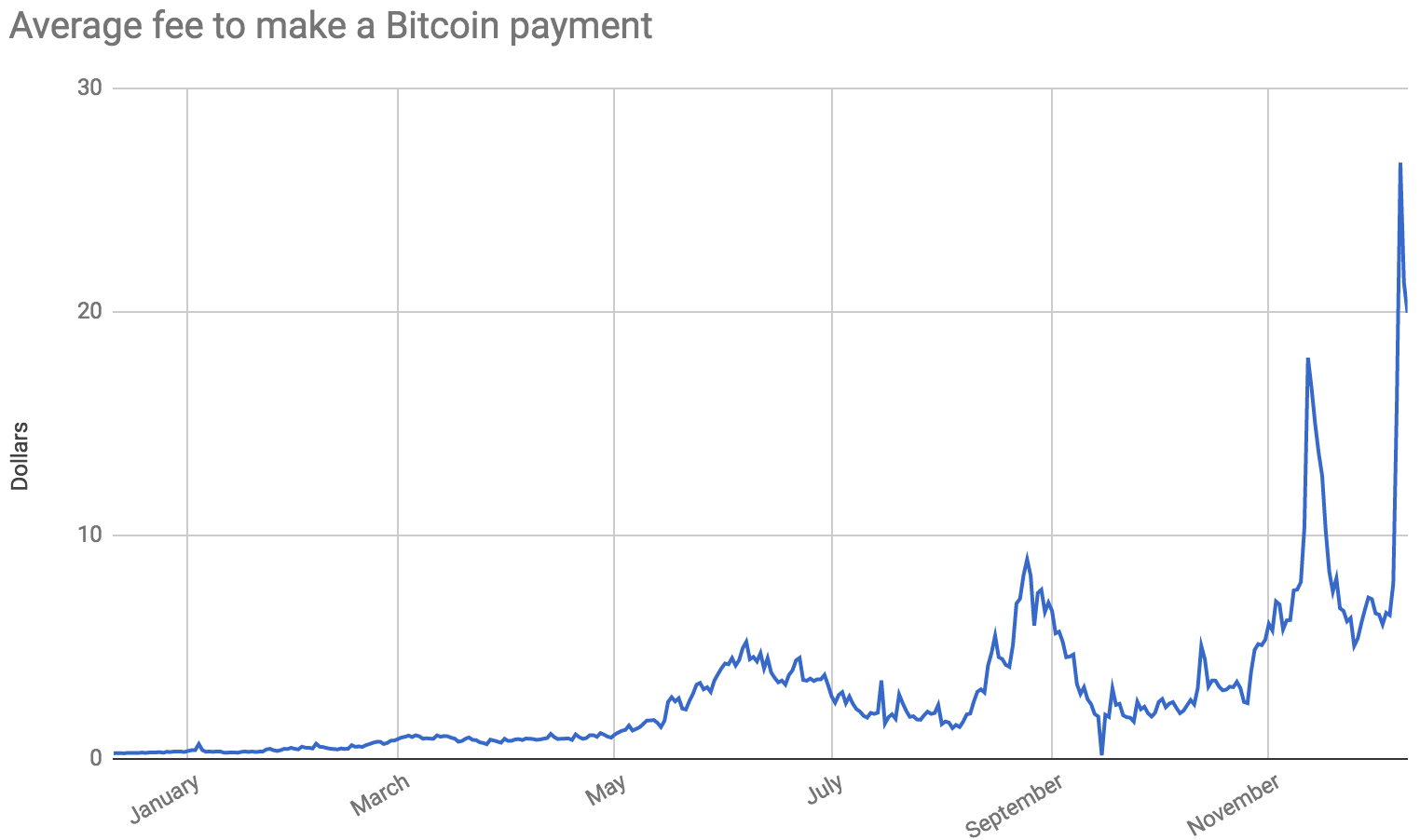

From the settlement layer view, the growing adoption of Bitcoin is increasing its liquidity internationally, allowing it to compete with global reserve currencies for increasingly more valuable transactions, causing transaction fees to rise.

As this processes continues in the future, expect much higher transaction fees, and a global Bitcoin settlement network to grow in importance. Reblogged this on aainslie. What about those of us who wish not to invest because of an unpredictable government rising network fees are causing changes within the bitcoin economy Until Bitcoins are recognized by the banking system, transacting in them can be a risk.

Secondly, the biggest worry is use of these currencies for funding terrorism and other anti-social activities. You are commenting using your WordPress. You are commenting using your Twitter account. You are commenting using your Facebook account. Notify me of new comments via email.

Leave a Rising network fees are causing changes within the bitcoin economy Cancel reply Enter your comment here Please log in using one of these methods to post your comment: Email required Address never made public.

That's how much it'd cost me to send 0. And this is actually quite cheap compared to a few days ago, when transaction fees were even higher, making Bitcoin barely usable for microtransactions. And cheap transactions, especially for small amounts of Rising network fees are causing changes within the bitcoin economy, are supposedly one rising network fees are causing changes within the bitcoin economy Bitcoin's biggest advantages.

Yes, you can now tip strippers with Bitcoin. The transaction fees are raging due to several factors. One is the size of the block in Bitcoin's blockchain, which is limiting the number of transactions that can go through at any given time.

Bitcoin's network is powered by miners, people and companies who use a tremendous amount of computing power to create new bitcoins. And when there's too many transactions to process—which currently happens very often—miners will prioritize transactions that pay a higher fee. The situation improved with the rising network fees are causing changes within the bitcoin economy SegWit upgrade of the Bitcoin software, but it will take a while—weeks or months—before users start seeing benefits of SegWit.

Rising network fees are causing changes within the bitcoin economy reason is Bitcoin Cash, a competing cryptocurrency that split off from Bitcoin on August 1.

Since the two cryptocurrencies are similar, it's simple for miners to switch from mining Bitcoin to Bitcoin Cash. And for reasons explained heresometimes it's more profitable to mine Bitcoin Cash than Bitcoin. Whenever miners start switching to Bitcoin Cash, Bitcoin's network becomes slower, and transaction fees rise; we've seen this swing happen a couple of times before and it's likely to keep happening for a while. This is not good for Bitcoin. A few bucks or even a few dozen bucks per transaction isn't a deal breaker for investors, but for someone who wants to use Bitcoin as payment—which is kind of the point of Bitcoin in the first place—that's far too expensive.

The good news is rising network fees are causing changes within the bitcoin economy the fees are likely to get better. The bad news is that it won't happen very soon. SegWit has paved the way for a further upgrade called the Lightning Networkwhich should vastly reduce fees, but the software, or even its specifications, aren't ready yet. This will reduce strain on the network and make transaction fees lower, but switching to SegWit2x requires a so-called hard fork, meaning that Bitcoin is once again splitting into two, which could bring new trouble.

Luckily, Bitcoin users aren't completely without options right now. One thing you can do is wait until the network is less strained at night, during the weekendwhich is when transaction fees will go down.

You can also check this service to see which transaction fees are currently the most economic for you. At the time of this writing, a Bitcoin fee of satoshis per byte will be enough for your transaction to go through in about 30 minutes Bitcoin transaction fees are expressed in satoshiswhich is one hundred millionth of a Bitcoin, per byte size of the transaction, which is typically a little over bytes.

Have in mind that fee estimators aren't perfect; an alternative service that shows you the currently optimal fee is this one. Paying a fee that's too high is unnecessary, as it doesn't carry any additional benefit. But paying too small a fee means your transaction won't go through fast, or at all.

This information won't help you much if you use a wallet that doesn't let you change transaction fees, so maybe it's time to switch to a different wallet. For example, a mobile Bitcoin wallet called Mycelium offers several possibilities for Bitcoin transaction fees: If you choose the low-priority fee, your transaction might take longer to go through but it will be cheaper.

Conversely, a high priority transaction will almost surely go through quickly but it will be expensive. For even more control, you could try out the Electrum walletwhich lets you set any fee for your transactions, though you need to enable the option manually in the settings. If you choose too small a fee, your transaction might forever stay in Bitcoin's backlog. Coinomi is another mobile-only wallet which lets you customize your transaction fees. There are other things you could do to make transaction fees lower, though it requires a slightly higher level of knowledge.

If you've received a lot of small transactions to a Bitcoin address, and then send bitcoins from that address, the transaction will be larger in bytes and thus more expensive.

If you enable the "Coins" tab in the desktop version of Electrum you can minimize the number of inputs for your transaction, which will make it cheaper. If you're moving bitcoins from an exchange and not a wallet, you likely won't be able to set a fee, and many exchanges have very high fees set up. Exchanges mostly don't do that because they're evil; they do it because they want to make sure the transaction went through, or else they'll need to deal with support tickets.

Unfortunately, at this point there's little you can do about this besides find an exchange that is a bit more reasonable with this regard than others. Have in mind that, on top of transaction fees, exchanges will likely charge their own additional fees, so you should focus on the total costs. Bitcoin fees are currently very expensive, but this will likely get better in a few months.

But even right now, by choosing the right wallet and making sure you use the optimal fee, you'll do a lot better than just paying whichever fee you're offered.

We're using cookies to improve your experience. Click Here to find out more. Tech Like Follow Follow. Fly across the water with this motorized body board.

Bitcoin is a consensus network that enables a new payment system and a completely digital money. It is the first decentralized peer-to-peer payment network that is powered by its users with no central authority or middlemen. From a user perspective, Bitcoin is pretty much like cash for the Internet. Bitcoin can also be seen as the most prominent triple entry bookkeeping system in existence. Bitcoin is the first implementation of a concept called "cryptocurrency", which was first described in by Wei Dai on the cypherpunks mailing list, suggesting the idea of a new form of money that uses cryptography to control its creation and transactions, rather than a central authority.

The first Bitcoin specification and proof of concept was published in in a cryptography mailing list by Satoshi Nakamoto. Satoshi left the project in late without revealing much about himself. The community has since grown exponentially with many developers working on Bitcoin. Satoshi's anonymity often raised unjustified concerns, many of which are linked to misunderstanding of the open-source nature of Bitcoin.

The Bitcoin protocol and software are published openly and any developer around the world can review the code or make their own modified version of the Bitcoin software. Just like current developers, Satoshi's influence was limited to the changes he made being adopted by others and therefore he did not control Bitcoin.

As such, the identity of Bitcoin's inventor is probably as relevant today as the identity of the person who invented paper. Nobody owns the Bitcoin network much like no one owns the technology behind email. Bitcoin is controlled by all Bitcoin users around the world. While developers are improving the rising network fees are causing changes within the bitcoin economy, they can't force a change in the Bitcoin protocol because all users are free to choose what software and version they use.

In order to stay compatible with each other, all users need to use software complying with the same rules. Bitcoin can only work correctly with a complete consensus among all users. Therefore, all users and developers have a strong incentive to protect this consensus. From a user perspective, Bitcoin is nothing more than a mobile app or computer program that provides a personal Bitcoin wallet and allows a user to send and receive bitcoins with them.

This is how Bitcoin works for most users. Behind the scenes, the Bitcoin network is sharing a public ledger called the "block chain". This ledger contains every transaction ever processed, allowing a user's computer to verify the validity of each transaction. The authenticity of each transaction is protected by digital signatures corresponding to the sending addresses, allowing all users to have full control over sending bitcoins from their own Bitcoin addresses.

In addition, anyone can process transactions using the computing power of specialized hardware and earn a reward in bitcoins for this service. This is often called "mining".

To learn more about Bitcoin, you can consult the dedicated page and the original paper. There are a growing number of businesses and individuals using Bitcoin. This includes brick-and-mortar businesses like restaurants, apartments, and law firms, as well as popular online services such as Namecheap, Overstock. While Bitcoin remains a relatively new phenomenon, it is growing fast.

At the end of Aprilthe total value of all existing bitcoins exceeded 20 billion US dollars, with millions of dollars worth of bitcoins exchanged daily. While it may be possible to find individuals who wish to sell bitcoins in exchange for a credit card or PayPal payment, most exchanges do not allow funding via these payment methods. This is due to cases where someone buys bitcoins with PayPal, and then reverses their half of the transaction.

This is commonly referred to as a chargeback. Bitcoin payments are easier to make than debit or credit card purchases, and can be received without a merchant account. Payments are made from rising network fees are causing changes within the bitcoin economy wallet application, either on your computer or smartphone, by entering the recipient's address, the payment amount, and pressing send.

To make it easier to enter a recipient's address, many wallets can obtain the address by scanning a QR code or touching two phones together with NFC technology. Much of the trust in Bitcoin comes from the fact that it requires no trust at all. Bitcoin is fully open-source and decentralized.

This means that anyone has access to the entire source code at any time. Any developer in the world can therefore verify exactly how Bitcoin works. All transactions and bitcoins issued into existence can be transparently consulted in real-time by anyone. All payments can be rising network fees are causing changes within the bitcoin economy without reliance on a third party and the whole system is protected by heavily peer-reviewed cryptographic algorithms like those used for online banking.

No organization or individual can control Bitcoin, and the network remains secure even if not all of its users can be trusted. You should never expect to get rich with Bitcoin or any emerging technology.

It is always important to rising network fees are causing changes within the bitcoin economy wary of anything that sounds too good to be true or disobeys basic economic rules.

Bitcoin is a growing space of innovation and there are business opportunities that also include risks. There is no guarantee that Bitcoin will continue to grow even though it has developed at a very fast rate so far. Investing time and resources on anything related to Bitcoin requires entrepreneurship. There are various ways to make money with Bitcoin such as mining, speculation or running new businesses.

All of these methods are competitive and there is no guarantee of profit. It is up to each individual to make a proper evaluation of the costs and the risks involved in any such project.

Bitcoin is as virtual as the credit cards and online rising network fees are causing changes within the bitcoin economy networks people use everyday.

Bitcoin can be used to pay online and in physical stores just like any other form of money. Bitcoins can also be exchanged in physical form such as the Denarium coinsbut paying with a mobile phone usually remains more convenient. Bitcoin balances are stored in a large distributed network, and they cannot be fraudulently altered by anybody. In other words, Rising network fees are causing changes within the bitcoin economy users have exclusive control over their funds and bitcoins cannot vanish just because rising network fees are causing changes within the bitcoin economy are virtual.

Bitcoin is designed to allow its users to send and receive payments with an acceptable level of privacy as well as any other form of money. However, Bitcoin is not anonymous and cannot offer the same level of privacy as cash. The use of Bitcoin leaves extensive rising network fees are causing changes within the bitcoin economy records. Various mechanisms exist to protect users' privacy, and more are in development. However, there is still work to be done before these features are used correctly by most Bitcoin users.

Some concerns have been raised that private transactions could be used for illegal purposes with Bitcoin. However, it is worth noting that Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems.

Bitcoin cannot be more anonymous than cash and it is not likely to prevent criminal investigations from being conducted. Additionally, Bitcoin is also designed to prevent a large range of financial crimes. When a user loses his wallet, it has the effect of removing money out of circulation. Lost bitcoins still remain in the block chain just like any other bitcoins. However, lost bitcoins remain dormant forever because there is no way for anybody to find the rising network fees are causing changes within the bitcoin economy key s that would allow them to be spent again.

Because of the law of supply and demand, when fewer bitcoins are available, the ones that are left will be in higher demand and increase in value to compensate. The Bitcoin network can already process a much higher number of transactions per second than it does today. It is, however, not entirely ready to scale to the level of major credit card networks.

Work is underway to lift current limitations, and future requirements are well known. Since inception, every aspect of the Bitcoin network has been in a continuous process of maturation, optimization, and specialization, and it should be expected to remain that way for some years to come.

As traffic grows, more Bitcoin users may use lightweight clients, and full network nodes may become a more specialized service. For more details, see the Scalability page on the Wiki. To the best of our knowledge, Bitcoin has not been made illegal by legislation in most jurisdictions.

However, some jurisdictions such as Argentina and Russia severely restrict or ban foreign currencies. Other jurisdictions such as Thailand may limit the licensing of certain entities such as Bitcoin exchanges. Regulators from various jurisdictions are taking steps to provide individuals and businesses with rules on how to integrate this new technology with the formal, regulated financial system. Bitcoin is money, and money has always been used both for legal and illegal purposes.

Cash, credit cards and current banking systems widely surpass Bitcoin in terms of their use to finance crime. Bitcoin can bring significant innovation in payment systems and the benefits of such innovation are often considered to be far beyond their potential drawbacks.

Bitcoin is designed to be a huge step forward in making money more secure rising network fees are causing changes within the bitcoin economy could also act as a significant protection against many forms of financial crime.

For instance, bitcoins are completely impossible to counterfeit. Users are in full control of their payments and cannot receive unapproved charges such as with credit card fraud. Bitcoin transactions are irreversible and immune to fraudulent chargebacks.

Bitcoin allows money to be secured against theft and loss using very strong and useful mechanisms such as backups, encryption, and multiple signatures. Some concerns have been raised that Bitcoin could be more attractive to criminals because it can be used to make private and irreversible payments.

However, these features already exist with cash and wire transfer, which are widely used and well-established. The use of Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems, and Bitcoin is not likely to prevent criminal investigations from being conducted. In general, it is common for important breakthroughs to be perceived as being controversial before their benefits are well understood.

The Internet is a good example among many others to illustrate this. The Bitcoin protocol itself cannot be modified without the cooperation of nearly all its users, who choose what software they use. Attempting to assign special rights to a local authority in the rules of the global Bitcoin network is not a practical possibility. Any rich organization could choose to invest in mining hardware to control half of the computing power of the rising network fees are causing changes within the bitcoin economy and become able to block or reverse recent transactions.

However, there is no guarantee that they could retain this power since this requires to invest as much than all other miners in the world. It is however possible to regulate the use of Bitcoin in a similar way to any other instrument. Just like the dollar, Bitcoin can be used for a wide variety of purposes, some of which can be considered legitimate or not as per each jurisdiction's laws. In this regard, Bitcoin is no different than any other tool or resource and can be subjected to different regulations in each country.