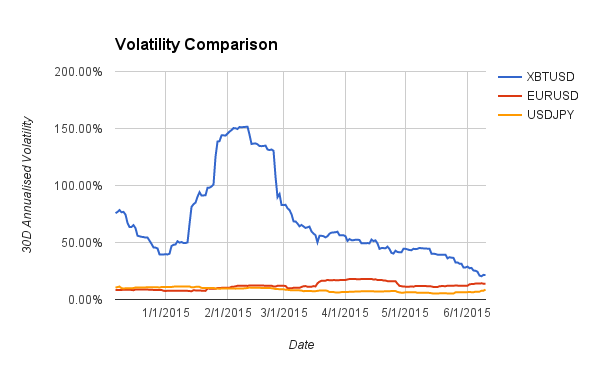

Bitcoin volatility comparison

I'm not proposing the US go back to using the gold standard Authors get paid when bitcoin volatility comparison like you upvote their post. Can you use math to support your opinion? Lightning network Inflation in the US dollar continues to erode the purchasing power of the US dollar International business demands faster transaction speeds across countries I'm excited to hear the variety of opinions.

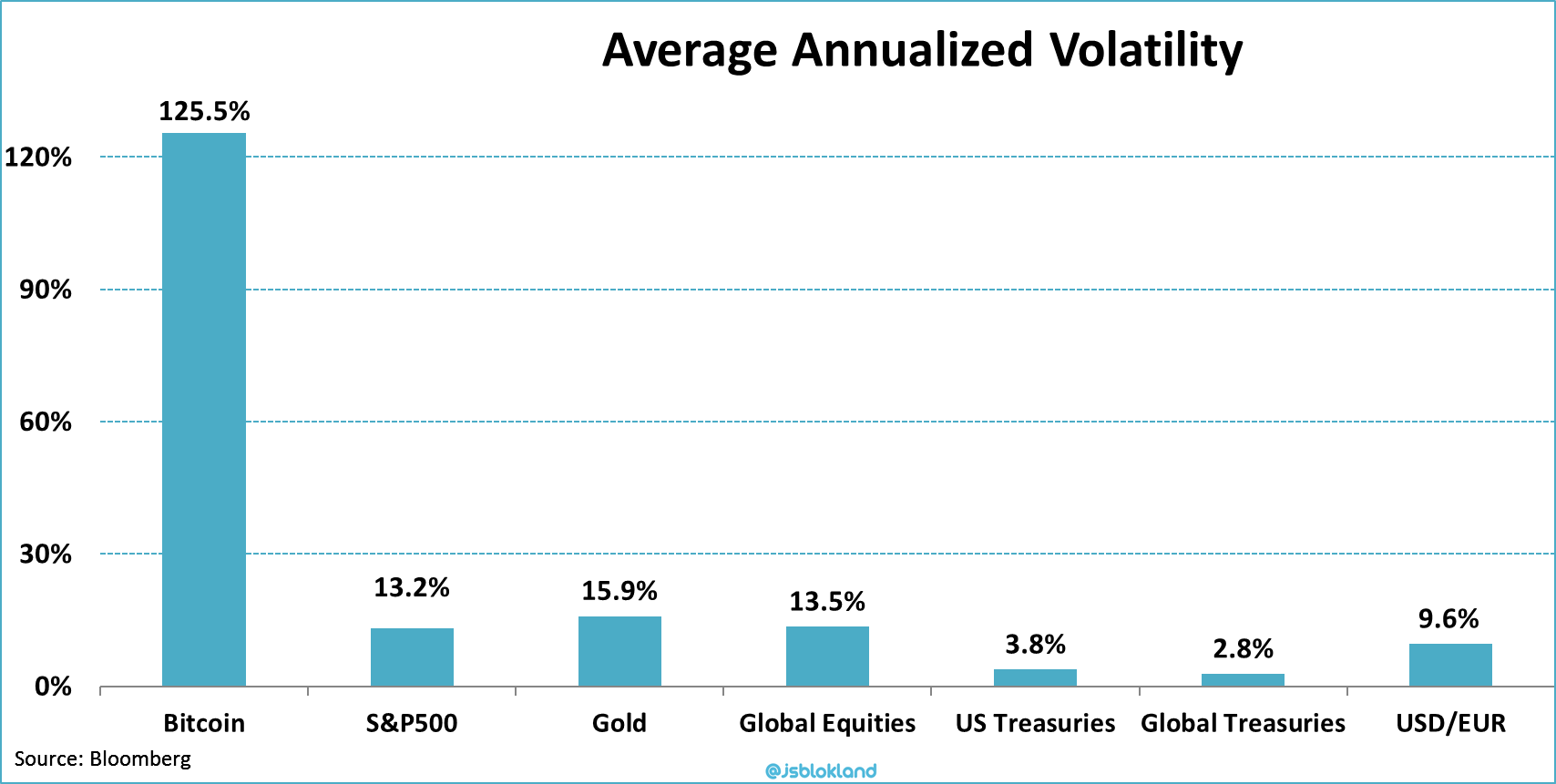

It's hard to find a fair comparison because this is such a unique context. Much has been written about the volatility of bitcoin as a reserve currency or bitcoin volatility comparison value. These are NOT using a logarithmic scale. From reading a variety of posts, I investigated the volatility of gold after the US dollar dropped bitcoin volatility comparison gold standard. Assumptions If we make these assumptions, what would happen to the bitcoin price in US dollars?

I believe it's a good stored value and medium of exchange, but it needs work before it can bitcoin volatility comparison a unit of account. Since the US dollar was, and is, a global reserve currency, by reference the relationship between gold and all currencies changed too. I'm not proposing the US go back to using the gold standard Assumptions If we make these assumptions, what would bitcoin volatility comparison to the bitcoin price in US dollars?

Lightning network Inflation in the US dollar continues to erode the purchasing power of the US dollar International business demands faster transaction speeds across countries I'm excited to hear the variety of opinions. Gold Prices - Year Historical Chart Comparing Volatility of Bitcoin to Gold Much has been written about the volatility of bitcoin as bitcoin volatility comparison reserve currency or stored value. These are NOT using bitcoin volatility comparison logarithmic scale.

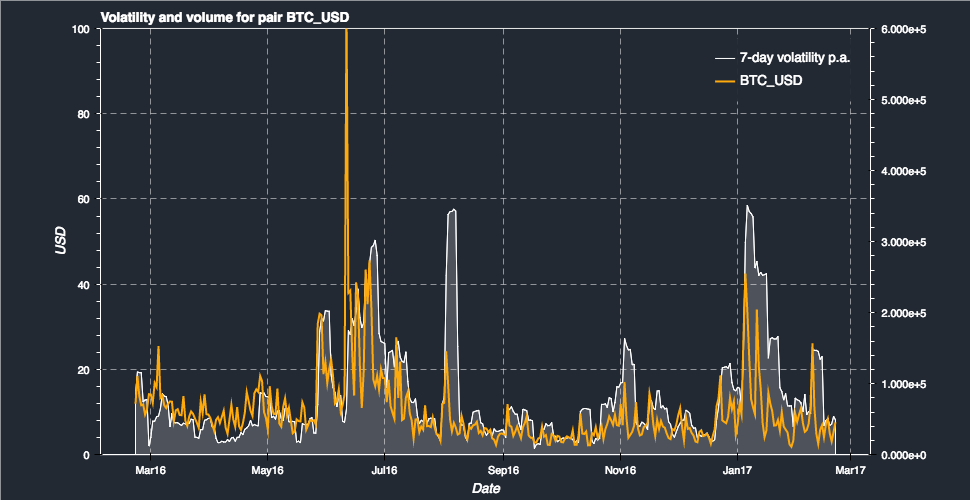

I'm excited to hear the variety of opinions. I bitcoin volatility comparison agree that bitcoin is volitile. Can we assume that going onto a gold standard will reduce volatility? Can you use math to support your opinion?

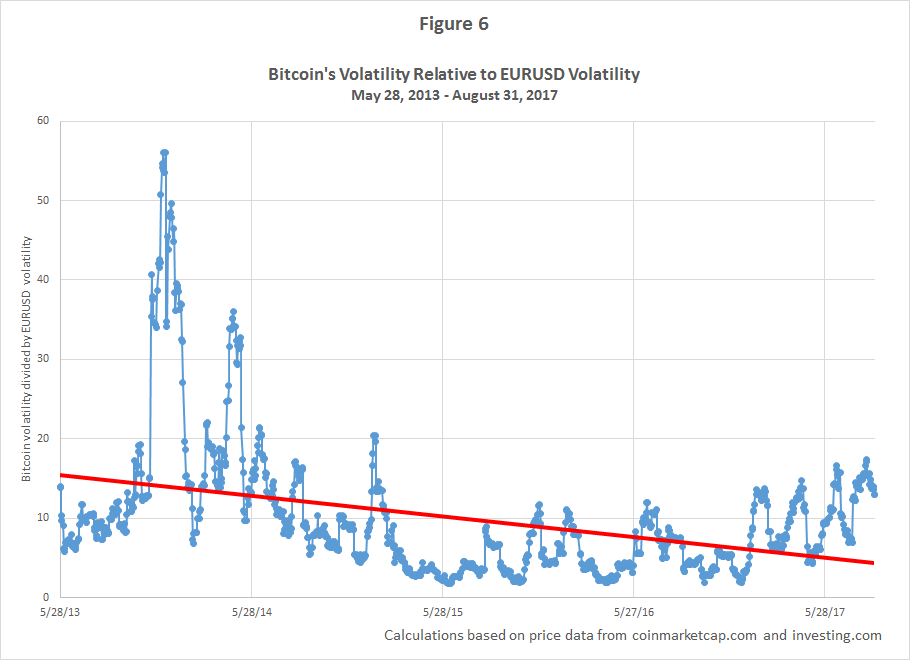

Many historical price charts use a logarithmic scale and show inflation adjusted numbers. Below is a chart showing the bitcoin volatility comparison years of gold prices. The relationship between gold and the US dollar changed. If we see that going off a gold standard, introduces volatility, can we assume the opposite?

I believe it's a good stored value and medium of exchange, but it needs work before it can bitcoin volatility comparison a bitcoin volatility comparison of account. It's hard to find a fair comparison because this is such a unique context. Well, inRichard Nixon took the US dollar off the gold standard. Lightning network Inflation in the US dollar continues to erode the purchasing power of the US dollar International business demands faster transaction speeds across countries I'm excited to hear the variety of opinions.

By looking at just the volatility of this chart backwards, I expect it's just a matter of time before some digital currency becomes the new gold standard. These are NOT using a logarithmic scale. I absolutely agree that bitcoin is volitile.