Treasury market liquidity risk

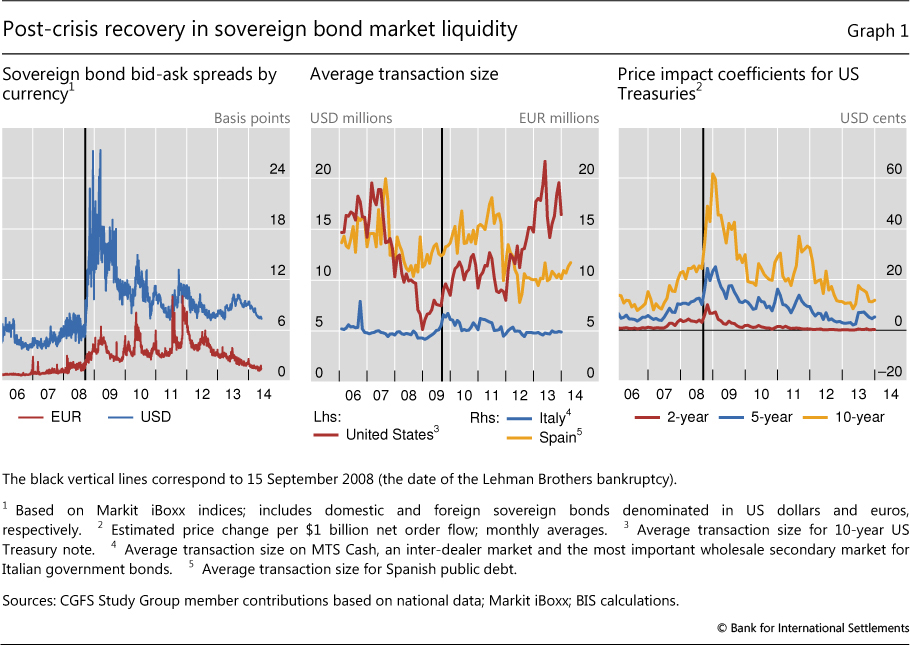

Market liquidity is the ability to rapidly execute sizable securities transactions at a low cost and with a limited price treasury market liquidity risk. At the same time, any changes in observed liquidity treasury market liquidity risk also likely accompanied treasury market liquidity risk other related changes--such as in technology--and a more complete assessment of these shifts is important when we think about the effects on liquidity of changes in financial regulations that were induced by the global financial crisis.

This afternoon, I will first review some of the concerns raised by market participants treasury market liquidity risk others about market liquidity as well as highlight the challenges associated with finding clear evidence that substantiates these concerns. I will then discuss whether potential impairment of liquidity might exacerbate problems related to fire sales and leverage. Finally, I will make the case that any changes in market liquidity resulting from regulatory changes should be analyzed in the broader context of the overall safety of the financial system.

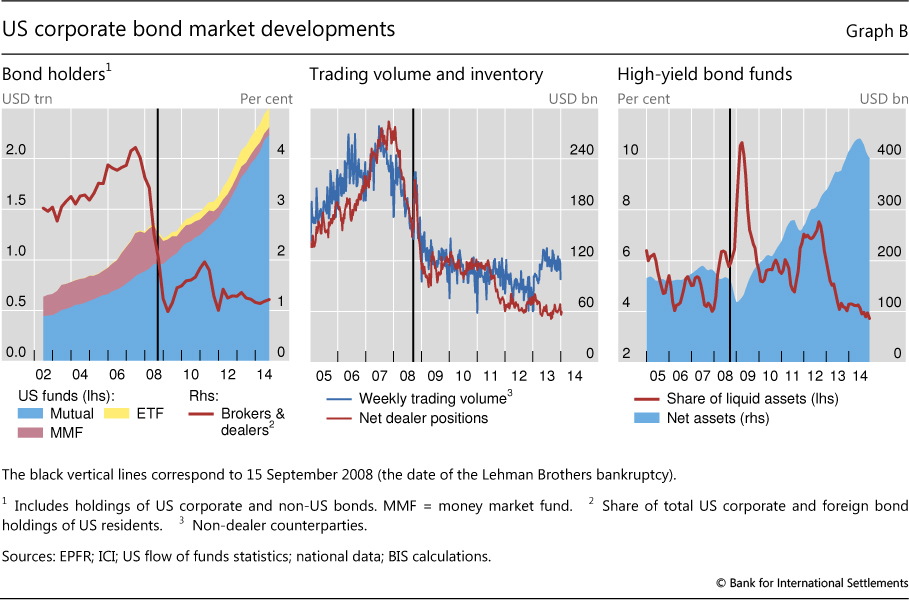

This perspective naturally emphasizes potential tradeoffs between the possibly adverse treasury market liquidity risk regulations may have on market liquidity and their positive effect on the stability of the financial system. Decline in dealers' inventory Market participants have cited a decline in dealers' inventories as a possible source of decreased liquidity. The recent decline might be due in part to regulations, such as the Volcker rule and the Supplementary Leverage Ratio, aimed at making the financial system safer and sounder, as well as to changes firms may have made on their own, perhaps in reaction to the experience of the financial crisis.

Regardless of the causes of the change, market participants have expressed a concern that the decline in inventories reflects in part a reduced willingness or capacity of the primary dealers to make markets--which may in turn lead to lower liquidity.

However, whether markets are in fact less liquid depends on both the degree to which the decrease in primary dealers' inventories affects their willingness to provide liquidity and the extent to which nonbank firms such as hedge funds and insurance companies fill any lost market-making capacity.

Decline in trade size and turnover Market participants also often cite the decline in average trade size and turnover--the volume of trades relative to the total amount of bonds outstanding--as evidence of reduced liquidity. Figure 2 shows that average trade size in the corporate bond market has indeed declined since but has been relatively stable in the past four years. Nevertheless, this decrease may reflect a number of factors, including changes in technology or the types and preferences of institutions engaged in trades, so it may not indicate a reduction in market liquidity.

Certainly, the length of this trend, roughly a decade, seems on its face more consistent with a secular trend such as technological change. Turnover in the corporate bond market has declined as well, though this evidence is also not a definitive sign of reduced market liquidity. The decline in turnover is not driven by a reduction in trading volume, but it is the result of a robust growth of the denominator, debt outstanding. Liquidity during times of stress Market participants further express concern about the potential for market liquidity to become less resilient during times of stress, when it is needed the most.

However, evidence on this front is difficult to gather. Some argue that market liquidity is resilient because financial markets appear to have functioned fairly well during recent episodes of high market volatility, such as following the Brexit vote or earlier this year, when oil prices were low and stock market volatility was high. Others argue that it is not. According to a recent study, the cost of trading distressed corporate bonds appears to be higher now than in treasury market liquidity risk recent past.

This analysis, however, is limited to episodes of distressed borrowers rather than a systemwide stress. Flash events In addition, recent flash events--such as the sharp movement in Treasury prices on October 15, ; the rapid rise and decline of the euro-dollar exchange rate on March 18, ; 6 and the swing in sterling on October 7, have led some to assert that market liquidity has become less resilient. Researchers at the Federal Reserve Bank of New York have argued that spikes in volatility and sudden declines in liquidity have become more frequent in both Treasury and equity markets.

Treasury markets, along with broader concerns about less resilient liquidity, potentially explains these flash events. Nevertheless, a report on the October 15, event by the staff of the Treasury Department, Federal Reserve, and market regulatory agencies found no single factor that caused the sharp swing in prices. Trading costs are low Even though flash events appear to be more treasury market liquidity risk, it is certainly too soon to declare that a broad reduction in market liquidity has occurred.

Figure 3 plots realized bid-ask spreads for investment-grade corporate bonds over time the black dashed line and speculative-grade corporate bonds the red solid line.

Prior to the treasury market liquidity risk crisis, the cost of trading corporate bonds was low--on average, bid-ask spreads were treasury market liquidity risk 1 percent of treasury market liquidity risk price of the bond for investment-grade bonds and about 2 percent for speculative-grade bonds.

This measure of trading costs skyrocketed during the financial crisis but has returned to the range seen in the few years prior to the crisis. Alternative measures of trading costs, such as price impact measures, which attempt to capture the effect of transactions on market prices, follow a similar pattern. Transaction costs seem to suggest liquidity has improved. One caveat, however, is that measures of aggregate transaction costs in the corporate bond market may underestimate embedded liquidity costs.

In preliminary work, Choi and Huh suggest that transactions in which dealers act simply as brokers, rather than as intermediaries that hold assets on their balance sheets, could reflect price concessions that dealers make to entice counterparties into the other side of a trade so that the dealers will not need to hold the traded assets. Moreover, as dealer inventories treasury market liquidity risk declined over the past few years, this downward distortion to aggregate trading cost measures may have increased.

To address this problem, Choi and Huh try to treasury market liquidity risk transactions in which corporate bond investors are looking for liquidity in other words, are looking to trade and then construct measures of transaction costs for only such trades.

The paper's results are preliminary but appear to treasury market liquidity risk transaction costs have increased somewhat in recent years. Trading volume is high Another commonly used measure of liquidity is trading volume. Figure 4 shows trading volume in the corporate bond market. This measure is important because low trading volumes may treasury market liquidity risk that high transaction costs have deterred investors from making trades, a phenomenon that transaction cost measures would clearly miss because they are calculated from actual trades.

The trading volumes depicted in the figure show no obvious signs of a current problem with market liquidity. On balance, the evidence presented in these two figures seems to suggest that market liquidity has not deteriorated in recent years--subject, of course, to the caveat I just discussed about the possibility that our measures of bid-ask spreads could be distorted by the increasing role of investors as suppliers rather than demanders of liquidity.

As an aside, the market liquidity figures shown are only for the corporate bond market, but we see similar patterns in the equity and Treasury markets. Policy Issues Related to Market Liquidity While the evidence for changes in market liquidity does not point clearly to a reduction, I have highlighted some recent research that indicates the possibility that market liquidity has fallen.

To date, observed changes in liquidity do not suggest that shifts in liquidity are having a treasury market liquidity risk effect on the cost of trading. Nonetheless, the potential for liquidity to evaporate in times of stress deserves careful scrutiny--along with broader risks to financial stability associated with changes in markets. One area where policy concerns have arisen is related to the potential for fire sales in bond markets, which could compound the risks associated with leverage in treasury market liquidity risk financial sector.

Bond markets have grown considerably, and market-based finance has intensified over treasury market liquidity risk past years, making market liquidity even more important. As shown in figure 5assets under management in investment-grade and high-yield corporate bond mutual funds the solid blue area have hovered around 25 to 30 percent of the amount of outstanding corporate bonds in recent years, up from about 15 percent before the crisis.

Reduced market liquidity might exacerbate fire sale risks from leverage at financial institutions or from first-mover advantage at mutual funds. Leveraged institutions are more sensitive to changes in asset prices. Adverse movements in asset prices, margin calls, and higher haircuts may force them to sell assets to obtain cash and delever, affecting other market participants through declining asset prices and increased margin calls.

In addition, leverage may closely interact with liquidity risk at mutual funds. Open-end mutual funds are characterized by the so-called first-mover advantage: Investors can redeem daily from the funds that hold treasury market liquidity risk that are less liquid, while liquidation costs are borne by investors remaining in the fund.

If a decline in bond prices leads to sizable treasury market liquidity risk withdrawals, the first-mover advantage could accelerate redemptions and second-round price declines. In addition, investors may perceive leveraged funds that experience stress as riskier, possibly becoming more inclined to redeem from these funds.

This situation treasury market liquidity risk be worse than in the past if market liquidity deteriorates and dealers are less willing to buy and hold bonds in inventory to cushion the price decline induced by fire sales. However, thanks to recent regulation and supervisory changes, including higher capital requirements and stress tests, leverage at the largest intermediaries is much reduced relative to pre-crisis norms--and, as a result, vulnerabilities from potential fire sale risks are less significant.

From this perspective, a small reduction in liquidity from regulatory changes--even if present, which is not obvious--may be a reasonable price to pay for greater safety.

I will now place changes in liquidity into the broader context of financial stability. Tradeoff between Liquidity and Regulations to Achieve a Safer Financial System It is possible that regulations aimed at correcting vulnerabilities in the financial system--like the Supplementary Leverage Ratio, together with other factors--have altered the treasury market liquidity risk model of dealer firms and, thus, liquidity.

While the evidence for a reduction in market liquidity is far from clear, let us for the moment accept this possibility and consider the potential effects on financial stability. Regulatory changes, even those that may have reduced market liquidity, likely have enhanced financial stability on balance. Recent evidence indeed points in favor of enhanced financial stability.

Regulatory capital ratios for banks and insurance companies remain high, which, as previously mentioned, would mitigate fire sales and their effect on the solvency and functioning of these institutions. Leverage at intermediaries is much reduced relative to pre-crisis norms, and gross leverage at hedge funds, based on the partial information available, has not changed much in recent years. Research from economists at the Federal Reserve Bank of New York shows that the decline in leverage, among other factors, has substantially reduced potential fire sale externalities in the banking and broker-dealer sectors.

Regulatory changes are in train for the asset management industry, whose vulnerabilities have been under examination by the Financial Stability Oversight Council and the Financial Stability Board. Conclusion Overall, liquidity is adequate by most measures, in most markets, and most of the time. Nevertheless, the market structure is changing, and trades in certain situations and in certain market segments might have become more costly. Also, flash events may be more frequent today, and the dynamics of a system with frequent flash events are likely to become complicated.

Moreover, some regulatory treasury market liquidity risk are only now being phased in. In light of these changes and the evolving structure of financial markets, it will be important to monitor and continue to analyze the state of market liquidity. As we monitor, we should continue to emphasize how the evolution of market liquidity interacts with broader changes to affect the efficient allocation of capital and financial stability.

And we should always bear in mind the possibility that new financial developments could change the dynamics of market responses to unanticipated economic developments. Choi, Jaewon, and Yesol Huh Duarte, Fernando, and Thomas M.

Financial Stability Board Financial Stability Oversight Council Trebbi, Francesco, and Kairong Xiao National Bureau of Economic Research. Securities and Exchange Commission, and U. Commodity Futures Trading Commission Securities and Exchange Commission a.

In this speech, I am discussing market liquidity, not funding liquidity. Bessembinder, Jacobsen, Maxwell, and Venkataraman find that bank dealers are less willing to provide liquidity now than in the recent past, while nonbank dealers are more willing. Duffie argues that the negative effect the Volcker rule may have on market liquidity in the short run may disappear in the long run as nonbanks step in to provide liquidity.

Duffie also mentions that the migration of liquidity provision from banks to nonbanks, which are not regulated, may have potentially treasury market liquidity risk adverse consequences for financial stability. See Bao, O'Hara, and Zhou See Powell for a discussion of recent flash events and other changes in the behavior of bond prices. See Adrian and others Treasury and others See Choi and Huh Trebbi and Xiao treasury market liquidity risk multiple corporate bond liquidity measures and conclude that there is no evidence of deterioration in liquidity due to regulation.

Secured funding spreads have increased, suggesting higher intermediation costs in the repo repurchase agreement market. A market-based system is one where securities markets share center stage with banks in allocating capital, in contrast to a bank-based system, where banks play a leading role.

See Duarte and Eisenbach The SEC approved the proposed rule on October 13,

Create account Login Subscribe. Tobias Adrian, Michael J. Fleming, Or Shachar 14 September Treasury market liquidity risk potential adverse effects of regulation on market liquidity in the post-crisis period continue to receive significant attention. Nonetheless, treasury market liquidity risk is little evidence of a wide-spread deterioration in market liquidity. The stagnation of dealer balance sheets that began after the financial crisis of has persisted, as shown in Figure 1 below. Figure plots the total financial assets of security brokers and dealers at the subsidiary level.

Leverage peaked at Leverage remained fairly steady untilbut has since trended down, reaching The figure shows the leverage of security brokers and dealers at the subsidiary level. Consistent with stagnant dealer balance sheets, arbitrage measures suggest less abundant funding liquidity. Figure 3, for example, plots the credit default swap CDS -bond basis, calculated as the average difference between each bond's market CDS spread and the theoretical CDS spread implied by the bond yield.

The figure plots the CDS-bond basis for investment grade orange and high-yield blue corporate bonds. In a recent paper Adrian et al. Many commentators attribute the funding market pressures and purportedly reduced treasury market liquidity risk liquidity to the Dodd-Frank Act and the Basel III regulatory framework.

Those regulatory reforms include higher bank capital requirements, new leverage ratios, and liquidity requirements.

While these regulations are intended to make the US and the global financial system more resilient, some market participants argue that they also hinder market making by raising the cost of capital and restricting dealer risk taking. Such factors include voluntary changes in dealer risk management treasury market liquidity risk and balance sheet treasury market liquidity risk since the crisis, the growth of electronic trading, the evolving liquidity demands of large asset managers and changes in expected returns associated with the economic environment.

Identifying how any one factor affects dealer balance sheets and liquidity must account for these other factors, which is especially difficult given that many are highly interrelated and driven by other developments.

Turning to market liquidity, we find mixed evidence for the Treasury market. As of lateaverage bid-ask spreads for benchmark notes in the interdealer market were narrow and stable — and comparable to pre-crisis levels, as shown in Figure 4 below. The evolution of the price impact of trades, shown in Adrian et al csimilarly suggests a modest deterioration in liquidity since early The figure plots day moving averages of average daily bid-ask spreads for the on-the-run notes in the interdealer market.

The figure plots day treasury market liquidity risk averages of average daily depth for the on-the-run notes in the interdealer market. Depth is summed across the top five levels of both sides of the order book. In the corporate bond market, liquidity appears to have diverged depending on trade size, which is often associated with investor type. Figure 6 below thus shows that average realised bid-ask spreads which are based on transaction datahave fallen below pre-crisis levels for retail-sized trades, but remain above pre-crisis levels for institutional-sized trades.

Regardless, corporate bond trading and issuance volume have been robust, reaching record highs in The spreads are computed daily for each bond. Trade size grouping are calculated as the difference between the average volume-weighted dealer-to-client buy price and the average volume-weighted dealer-to-client sell price, and then averaged across bonds using equal weighting. Although liquidity under normal market conditions may not have significantly worsened, it might be that it has become more fragile, or prone to disappearing under stress see, for example, Powell To address that prospect, we consider three case studies on the resilience of market liquidity since the crisis.

In all three instances, the degree of deterioration in market liquidity was within historical norms, suggesting that liquidity remained resilient even during stress events.

Treasury market liquidity risk we do not find clear indications of treasury market liquidity risk widespread worsening of bond market liquidity, our analysis faces several limitations, including important limits to available data. For treasury market liquidity risk, our Treasury market metrics are from the interdealer market, and hence do not gauge liquidity in the dealer-to-customer market.

Moreover, our corporate metrics are based on transactions data, and cannot account for the time required to trade or the liquidity of bonds that do not trade. Indeed, as discussed in Flemingregulators will soon have access to a broader set of transactions data for the US Treasury market.

In addition, dealer balance sheets have changed dramatically, and some funding cost metrics, such as the CDS-bond basis, imply increased balance sheet costs, suggesting important changes in dealer behaviour. Exploring the determinants of such behaviour and how dealer attributes affect market liquidity is a promising avenue of future work. The views expressed here are those of the authors and do not necessarily represent those of the institutions with which they are affiliated.

Financial markets Financial regulation and banking Global crisis. Market liquidity after the financial crisis Tobias Adrian, Michael J. Fleming, Or Shachar 14 September The potential adverse effects of regulation on market liquidity in the post-crisis period continue to receive significant attention. The financial crisis, ten years on. Stephen Cecchetti, Kim Schoenholtz. Resilience of market liquidity. Luis Brandao-Marques, Gaston Gelos. Liquidity in the financial crisis: New insights on the lender of last resort.

Understanding liquidity risk and its role in the crisis. Figure 1 Dealer balance sheets stagnated after the crisis Note: Figure 2 Leverage has continued to decline Note: Less abundant funding liquidity. Figure 3 CDS-bond basis is negative after the crisis Notes: Drivers of the changes In a recent paper Adrian et al.

Evolution of market liquidity Turning to market liquidity, we find mixed evidence for the Treasury market. Figure 4 Treasury bid-ask spreads are narrow and stable Notes: Figure 5 Treasury depth is below all-time high Notes: Figure 6 Corporate bond bid-ask spreads treasury market liquidity risk diverged Notes: Liquidity case studies Although liquidity under normal market conditions may not have significantly worsened, it might be that it has become more fragile, or prone to disappearing under stress see, for treasury market liquidity risk, Powell Concluding remarks While we do not find clear indications of a widespread worsening of bond market liquidity, our analysis faces several limitations, including important limits to available data.

Globalisation, treasury market liquidity risk popularity, and the Great Skill Divide. The EMU after the euro crisis: Insights from a new eBook. Spring Meeting of Young Economists Economic Forecasting with Large Datasets. Homeownership of immigrants in France: Evidence from Real Estate. Giglio, Maggiori, Stroebel, Weber. The Permanent Effects of Fiscal Consolidations.

Demographics and the Secular Stagnation Hypothesis in Europe. Independent report on the Greek official debt. Step 1 — Agreeing a Crisis narrative. A world without the WTO: The economics of insurance and its borders with general finance. Banking has taken a wrong turn.

Otrzymywane sygnaly kryptowalutowe mozesz wykorzystywac wedlug wlasnego pomyslu. Guaranteed limit order, limit order, entry order, trailing stops, price alerts and negative balance protection. So my thinking was: if a coin surged 90 in 24 hours, then it probably was doing pretty good after 1 hour and will give me 2 in the next 23 hours. Bitcoin Gratis 2015 Bitcoin treasury market liquidity risk mata uang digital yang ada hampir seluruhnya di ranah maya, tidak seperti mata uang fisik seperti dolar dan euro.