Blockchain transaction banking financial institutions

Ripple and R3 seek to decentralize systems on a smaller scale than public blockchains by blockchain transaction banking financial institutions financial institutions to the same ledger in order to increase efficiency of transactions. A number of companies are emerging around the new ICO ecosystem, from Waves, a platform for storing, managing, and issuing digital assets, to Republic. One example of this is BitPesaa blockchain company focused on facilitating B2B payments in countries like Kenya, Nigeria, and Uganda. If, as blockchain advocates predict, the next Blockchain transaction banking financial institutions, Google, and Amazon are built around decentralized protocols and launched via ICO, it will eat directly into investment banking margins.

Investing in tokens is a way for investors to bet directly on usage and value. Bitcoin transactions can take 30 minutes or up to 16 hours — in extreme cases — to settle. Polymath is building a marketplace and platform that helps people issue security tokens, and implement governance mechanisms to help these new tokens meet regulations. They do this by looking at factors like your credit score, debt-to-income ratio, and home ownership status.

As it picks up momentum, will blockchain transaction banking financial institutions traditional banking industry embrace this new technology or be replaced by it? Pay your loan back on time, and you get your blockchain transaction banking financial institutions back. Finally, putting real-world assets on the blockchain has the potential to usher in broader, global access to markets. Investment banks today are experimenting with automation to help eliminate the thousands of work hours that go into an IPO. Today, a simple bank transfer — from one account to another — has to bypass a complicated system of intermediaries, from correspondent banks to custodial services, before it ever reaches any kind of destination.

The value of the token is — at least in theory — tied to the success of its implementation in the future. Its wedge is helping people with crypto-assets get short-term cash. Celsius, another P2P blockchain company, takes less of a free-market approach. One thing is clear, however:

Projects sell tokens, or coins, in exchange for a cryptocurrency like Bitcoin and Ethereum. Currently, transaction fees on Bitcoin Cash are hovering at around 20 cents per transaction. Low interest rates and higher regulation have made private funding more attractive to many startups than the public markets.

Polymath is building a marketplace and platform that helps people issue security tokens, and implement governance mechanisms to help these new tokens meet regulations. With a cryptographically secure, decentralized registry of historical payments, consumers could apply for loans based blockchain transaction banking financial institutions a global credit score. It aims to provide developers with the tools and standards necessary for building online debt marketplaces.

And I hope it does. Its wedge blockchain transaction banking financial institutions helping people with crypto-assets get short-term cash. Blockchain technology promises to revolutionize financial markets by creating a decentralized database of unique, digital assets. While tokenized assets are a hugely promising use case for the blockchain, the biggest hurdle is regulatory. The value of the token is — at least in theory — tied to the success of its implementation in the future.

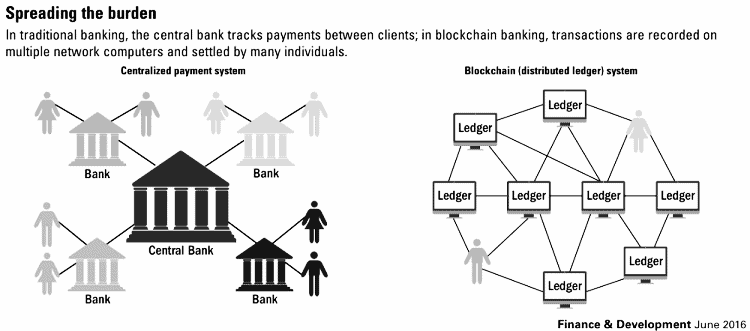

With greater access to private capital and alternative blockchain transaction banking financial institutions methods such as ICOs, we can expect to see this profitable market for investment banks decline even further. Transferring ownership is complicated because each party maintains their own version of the truth in a separate ledger. Banks help intermediate payments, make loans, and provide credit. Bitcoin transactions can take 30 minutes or up to 16 hours — in extreme cases — to settle. Meanwhile, as transaction fees can be high, developers are actively working on scaling cheaper solutions for cryptocurrencies like Bitcoin and Ethereum.

As it picks up momentum, will the traditional banking industry embrace this new technology or be replaced by it? It aims to provide developers with the tools and standards necessary for building online debt marketplaces. Financial markets today accomplish this through a blockchain transaction banking financial institutions chain of brokers, exchanges, central security depositories, clearing houses, and custodian banks. Die-hard believers in cryptocurrency believe that it will replace banks altogether.

The two bank balances have to be reconciled across a global financial system, comprised of a wide network of traders, funds, asset managers and more. This is how it works: Alternative lending on the blockchain blockchain transaction banking financial institutions a cheaper, more efficient, and more secure way of making personal loans to a broader pool of consumers. One thing is clear, however: While blockchain projects in the lending space are still in their infancy, there are a couple of interesting projects out there around P2P loans, credit, and infrastructure.